We remain cautiously optimistic on emerging markets (EM) in 2019 despite a challenging 2018.

Tightening global liquidity is a risk for EM asset prices, but we expect US Federal Reserve (Fed) rate hikes to moderate in 2019 as US growth decelerates. This should benefit EM issuers and improve appetite for risk assets.

We are constructive on the EM local currency space; we view the asset class as supported by the moderating pace of Fed rate hikes, benign global inflation backdrop and the recent uptick in fund flows.

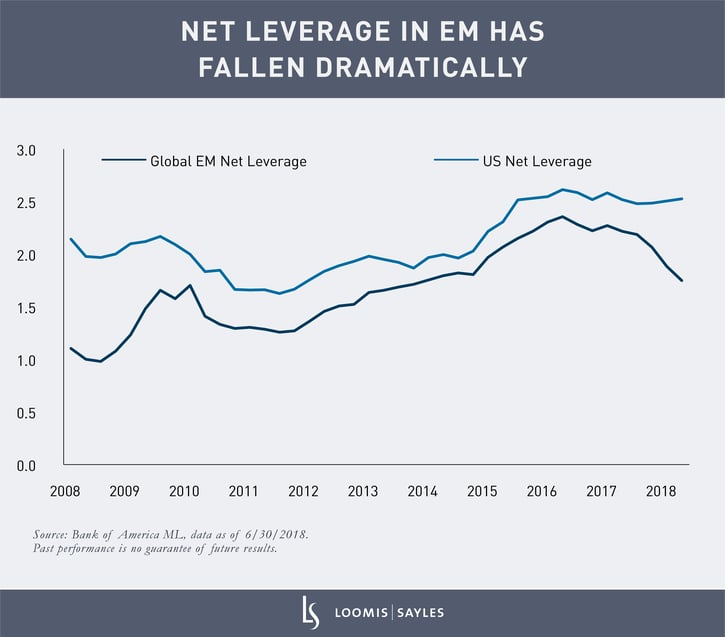

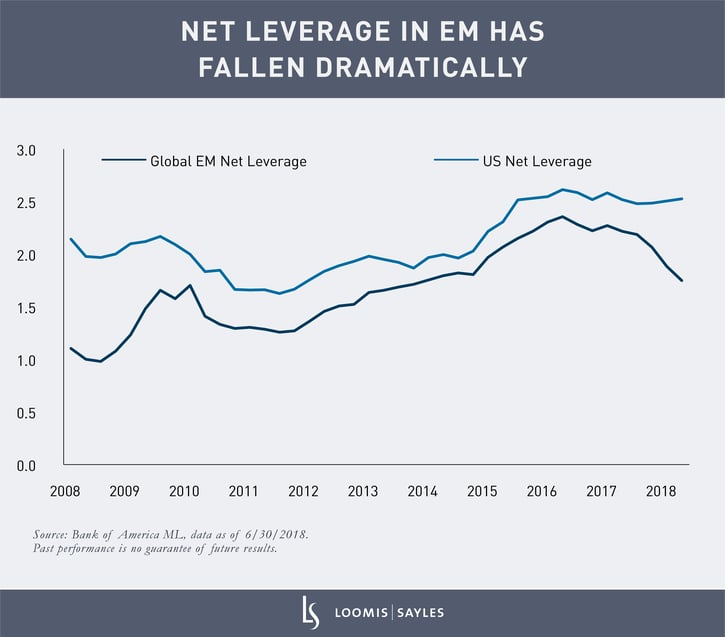

We agree with the consensus estimate of 3.6% global growth for 2019, and see healthy EM corporate balance sheets continuing. We currently prefer short-duration bonds and, in the near term, higher-quality credits with attractive yield potential.

China is committed to long-term deleveraging efforts, but we anticipate short-term policy measures to help offset recent financial stress and the likely economic impact of rising protectionism.

At the end of 2018, Latin America was showing signs of improved growth, with certain economies in the midst of credit repair and recovery. We are mindful of potential policy missteps from new administrations—Mexico and Brazil stand out.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.