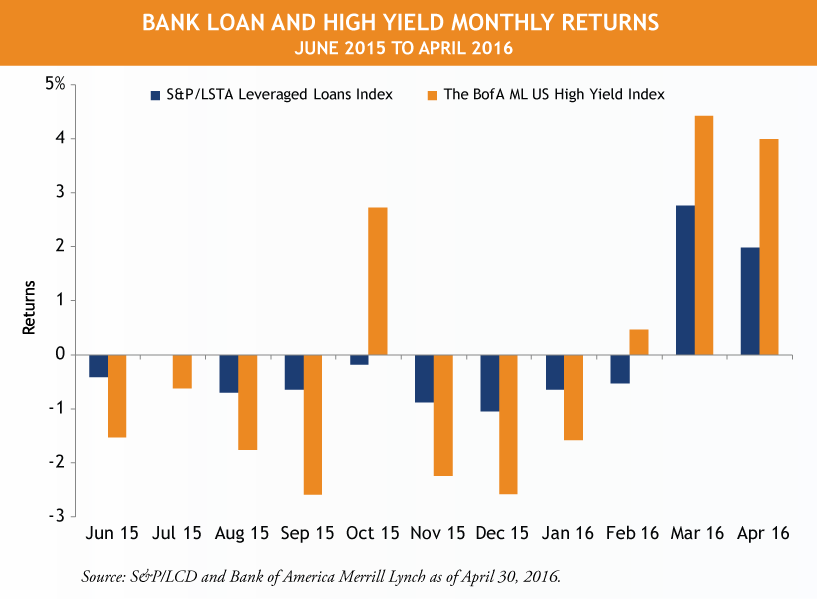

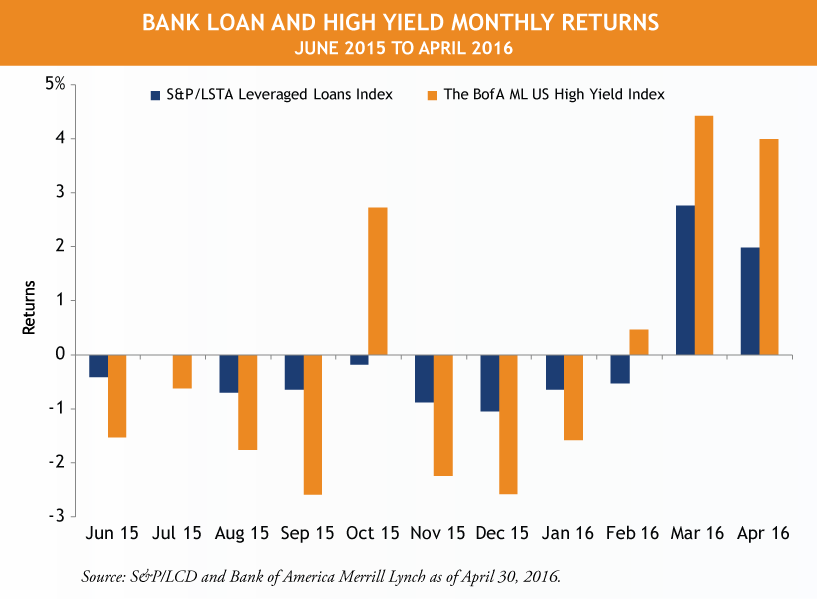

One of the phrases our bank loan team loves to use is “whatever happens in the high yield market, happens in the bank loan market, only less.”

Why is this statement typically true? Because many of the companies that issue bank loans also issue high yield bonds. A typical corporate capital structure has about 40% floating rate bank debt, 40% fixed high yield bonds, and 20% equity. So when investor sentiment is dominating market action, it makes sense that both the bank loan and high yield markets would be affected in a similar way. However, since bank loans are senior in the capital structure and secured by the assets of the company, movements caused by negative market sentiment actually hurt the bank loan market less. These bank loan traits tend to help protect investors from outsize market movements.

This “only less” sentiment was reinforced during the recent “take risk off the table” period we saw between June 2015 and February 2016. When returns in both the bank loan and high yield spaces turned negative, bank loan returns were less negative than the high yield market. Several months later, when investor sentiment improved, bank loans had less of a bounce back than high yield. Over the same period, the volatility of bank loan returns was less than half that seen in the high yield space.

It stands to reason that investors who are comfortable with the high yield market should also be comfortable with the bank loan market, particularly given the current yield of 6.07% (as of 4/30/16) in the bank loan market versus 7.58% for high yield.

MALR015223

Indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.

The principal risks associated with bank loans are credit quality, market liquidity, default risk and price volatility. While bank loans are secured by collateral and considered senior in the capital structure, the issuing companies are often rated below investment grade and may carry higher risk of default. High yield and lower-rated debt securities have speculative characteristics because of the credit risk of their issuers and may be subject to greater price volatility than higher-rated investments. The secondary market for these securities may lack liquidity which may adversely affect the value of these securities.