The municipal market sold off significantly over the past two weeks. Now that the market seems to have stabilized, we’ll look at what happened and explain why we think the selloff was a valuation correction rather than a market response to actual selling.

Market technicals

Since the market recovery last May, mutual fund flows averaged roughly $1.8 billion in the weeks leading up to the November election. They jumped by a third to nearly $2.4 billion per week in the weeks following the election.[i] This uptick in demand was met by constrained supply.

Yields diverged

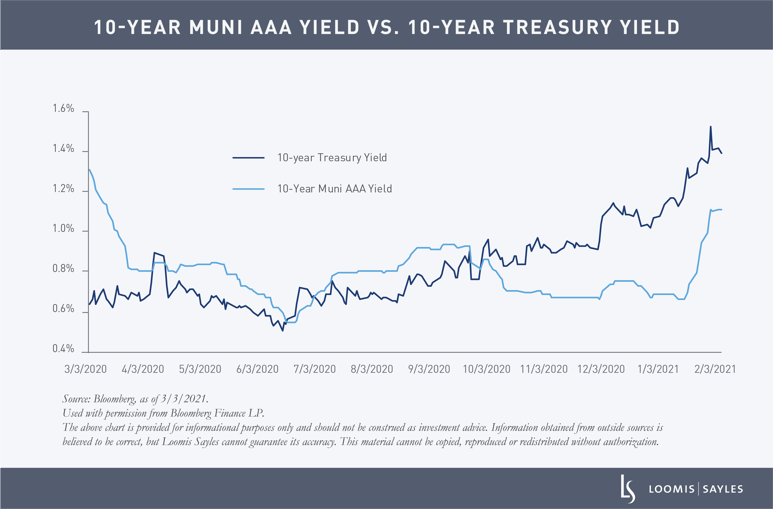

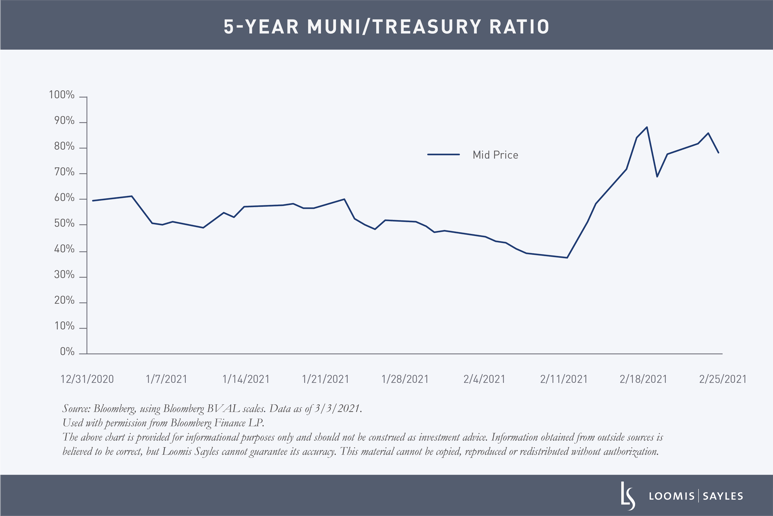

Treasury yields have been steadily increasing since late summer while municipal yields continued to sink to record lows. In fact, by early February 10-year Treasury yields had more than doubled while municipal yields continued to decline. This helped create a significant tightening of valuation ratios for municipals relative to Treasurys. Municipals seemed impervious to outside influences as the market continued to grind lower in yield and tighter in spreads.

But the rubber band snapped in mid-February with the resultant municipal selloff swiftly moving relative valuations back into more normal historical ranges. Between February 9 and February 24, yields rose by more than 40 basis points across most of the curve and the yield curve steepened abruptly.[ii] The AAA municipal curve rose up to levels not seen since mid-May of last year.

What next?

The technical conditions in the municipal market do not appear to have appreciably changed. New issue supply is currently expected to remain on the slack side while state and local governments assess the prospects for the amount and form of additional federal aid that is likely to be forthcoming. And while expectations for a return of tax-exempt advance refunding have been growing, we believe the trend toward taxable issuance is unlikely to shift over the near term.

We think the backup in rates along with the normalization of valuations may provide an opportunity for investors over the near term. While the market could remain subject to the larger trends affecting rate markets generally, municipals are likely to continue to experience a supportive technical backdrop over the medium term. We anticipate a near-term boost from passage of the next round of fiscal relief and a resumption of positive fund flows now that the broader market appears to have stabilized.

[i] Mutual fund flows data from Investment Company Institute, accessed 3/3/2021.

[ii] Source: Bloomberg, accessed 3/3/2021.

MALR026915

Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted. Data and analysis does not represent the actual or expected future performance of any investment strategy, account or individual positions. Accuracy of data is not guaranteed but represents our best judgment and can be derived from a variety of sources.

Market conditions are extremely fluid and change frequently.

Loomis Sayles does not provide tax advice. Please consult with your financial advisor or tax professional.

Past performance is no guarantee of future results.