Single family construction presents a puzzle: with the economy in the seventh year of expansion, why has home construction remained near depression levels? Construction is not depressed due to lack of demand from consumers – it is being held back by supply-side constraints in land, labor and financing which have not recovered from the 2008 housing crisis. That demand remains robust can be gleaned from strong increases in house prices. But we dug deeper, looking at states with strongest population and economic growth and found that even there, supply remains depressed.

In an environment of constrained supply, we expect to see continued home price appreciation and slow but steady growth in construction. Here’s why:

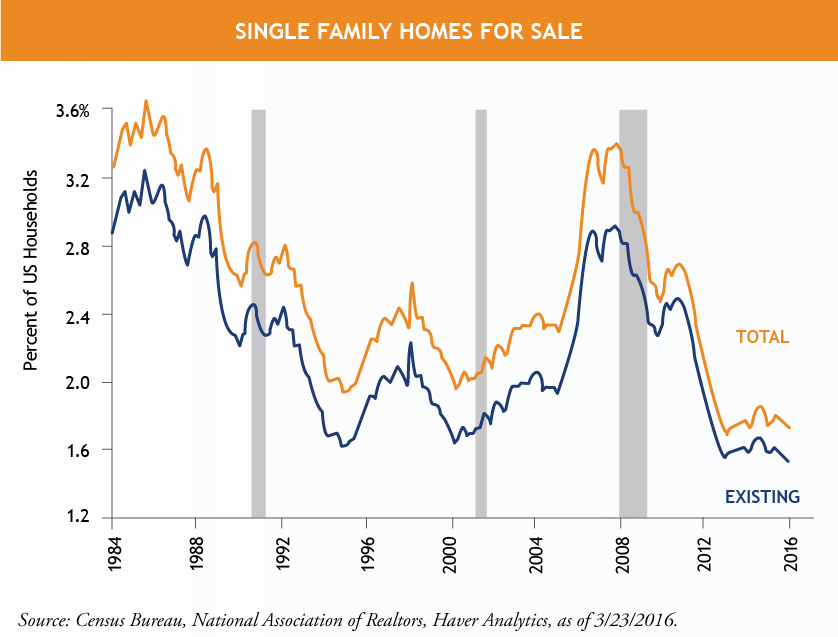

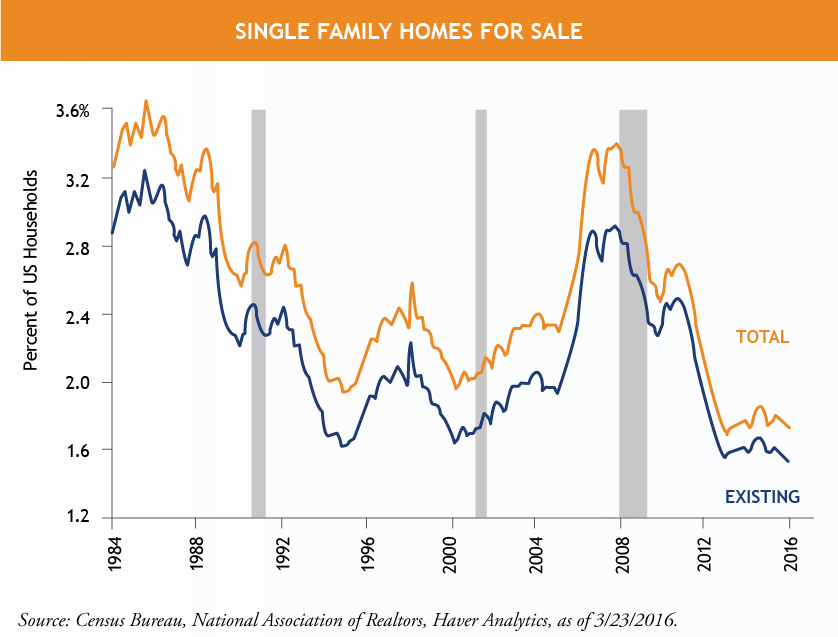

1. Inventory of single-family homes remains near all-time lows

Inventory of homes for sale, both existing and new, remains at historically low levels, despite the growing number of households. When measured as a percent of households, housing inventories are at the lowest levels since data started to be tracked in 1984. Such a low level of inventory should lead to more construction, but construction has remained weak.

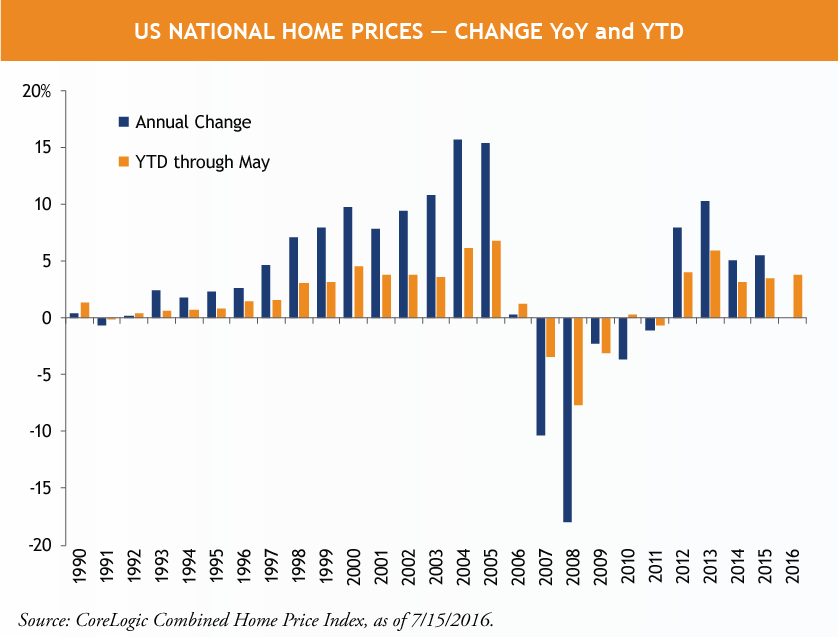

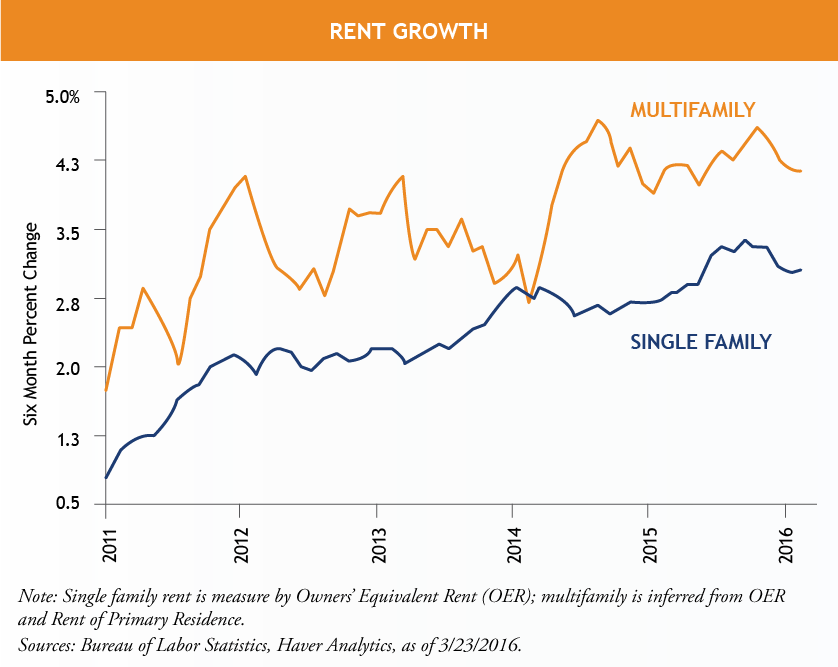

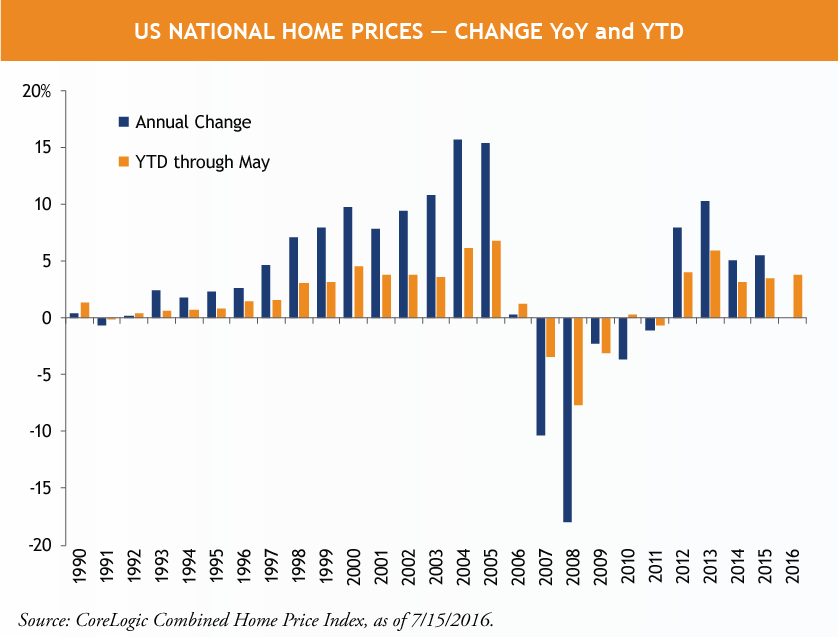

2. House prices and rental prices continue to rise

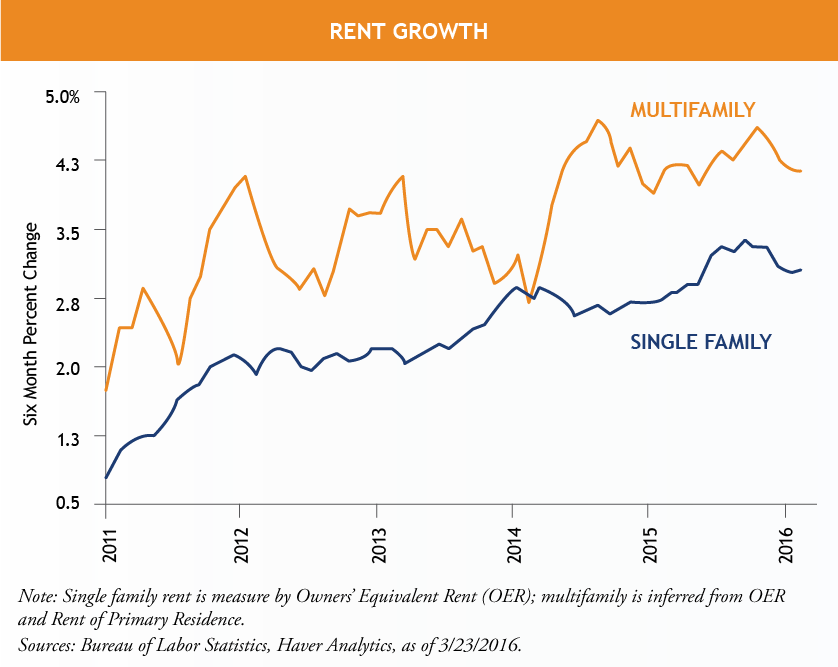

Strong demand for housing can be seen in growth of both rents and house prices. House prices have increased by 3.8% through May. We forecast 5-6% growth for 2016, which is well above inflation.

The growth in rental prices of multifamily housing has occurred faster than in single-family housing, which means apartment rentals are becoming less affordable over time.

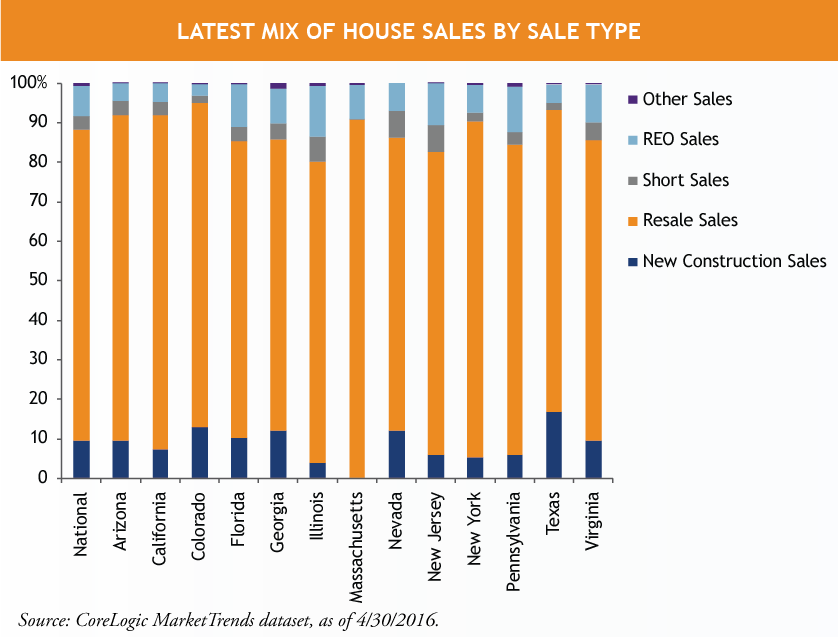

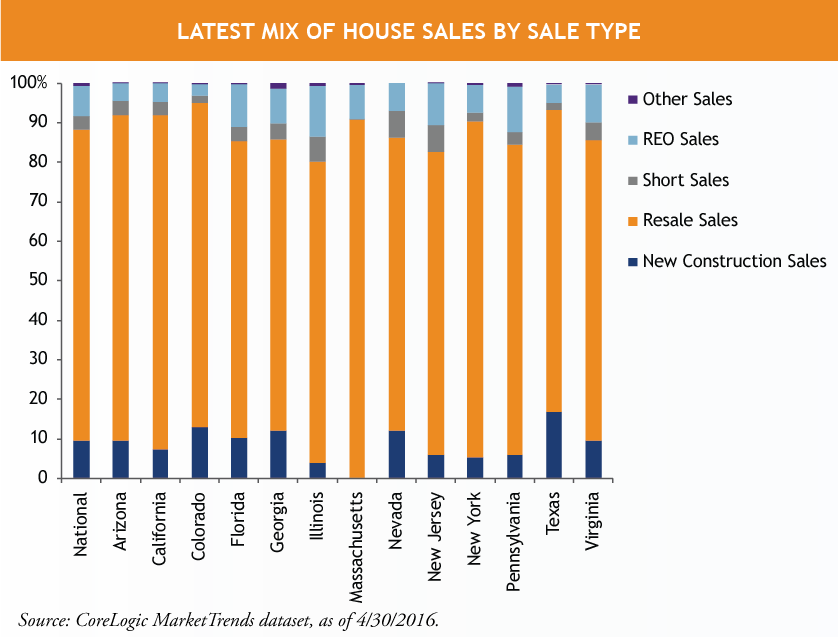

3. New home sales remain small compared to existing home sales

New construction remains 5-15% of sales at the state level, with resales of existing homes the largest category. New construction as percentage of total sales has been as high as 35-40% in Nevada and 30-35% in Florida in the past, but today it is highest in Texas (at 15% of all sales) and below 5% in many Northeastern states.

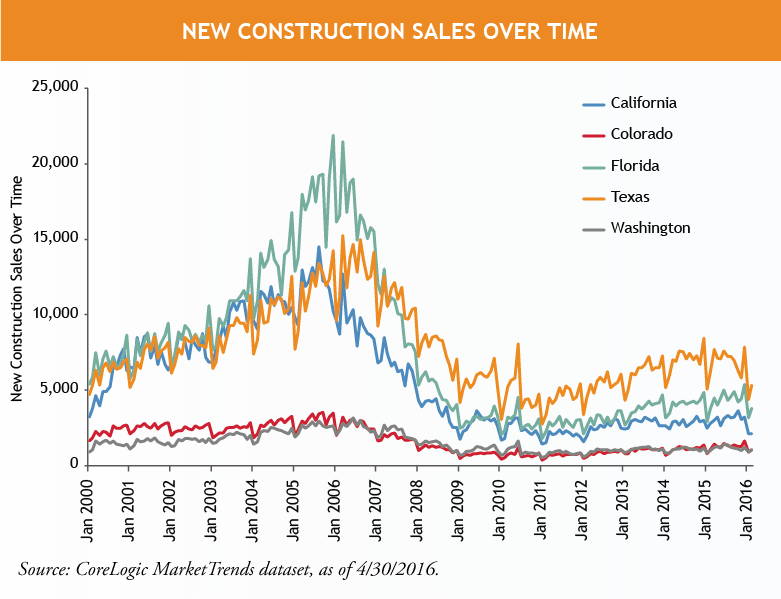

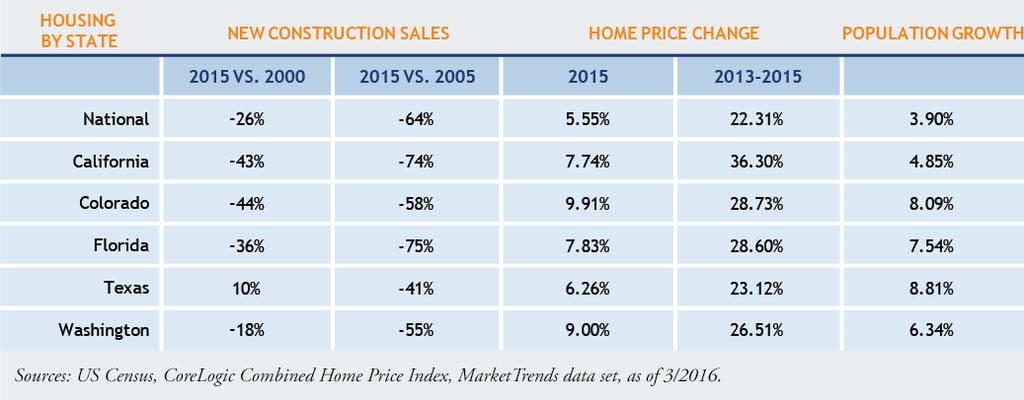

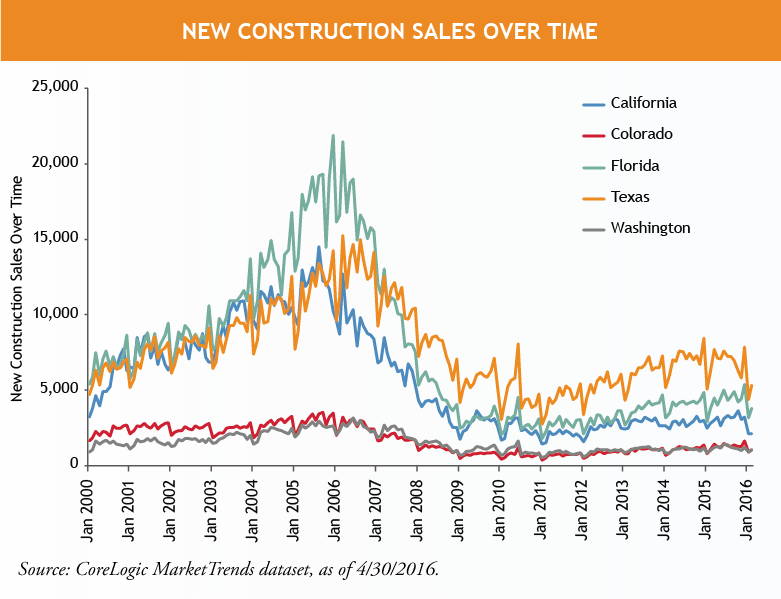

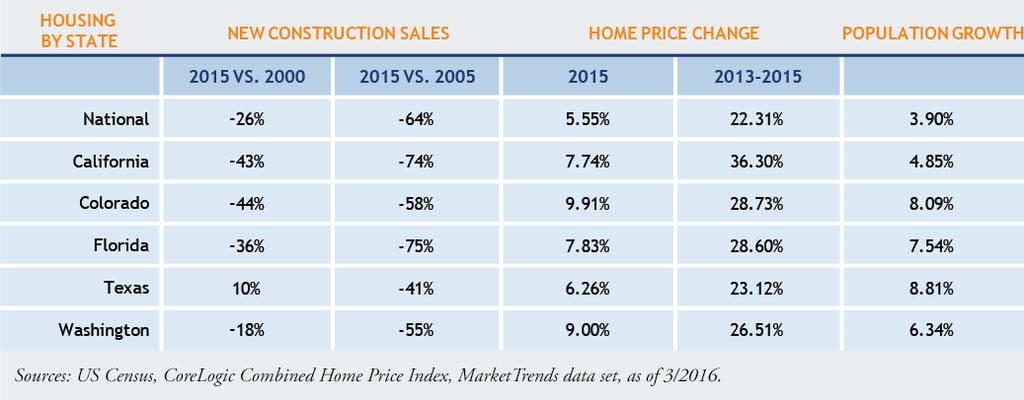

4. Even in states with strong economy, construction recovery is weak

To test if weak demand can account for limited construction, we look at states with the strongest fundamentals, where we know housing demand is strong. We focus on states with strong job and population growth, as well as limited remaining distressed inventory:

- California: 4.9% population growth since 2011

- Colorado: 8.1% population growth since 2011

- Washington: 6.3% population growth since 2011

Even in these states, we have seen weak recovery in construction. In Colorado, for example, the population has been growing and home prices were up 9.9% in 2015 to an all-time high, but the number of new homes sold was 44% lower than 2000 and 58% lower than 2005. California’s economy is also very strong, but California saw 12,000 new home sales per month in 2006, and today that number is around 3,000.

Based on our analysis, we remain bullish about US house prices in an environment of constrained new supply. However, we do not expect a sudden jump in single family construction to suddenly boost the US economy. Rather, single-family construction will continue to grow slowly and contribute a small but stable amount to economic growth for years to come.

MALR15509