As of March 2025, approximately 70% of euro area household savings were held as bank deposits.[1] The European Commission (EC) identified these assets as untapped investment capital that, when invested more broadly, could increase wealth and stimulate the European economy.

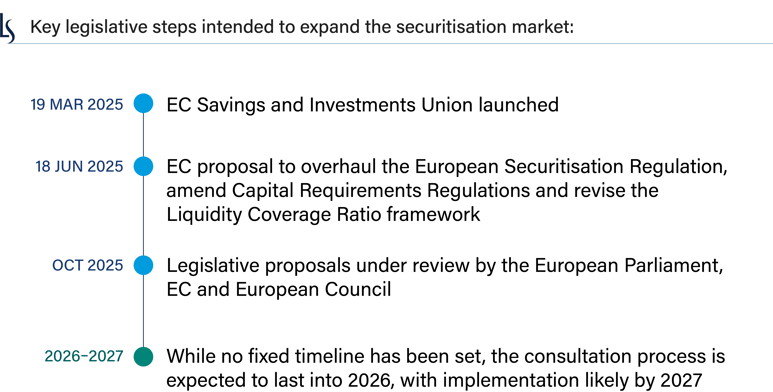

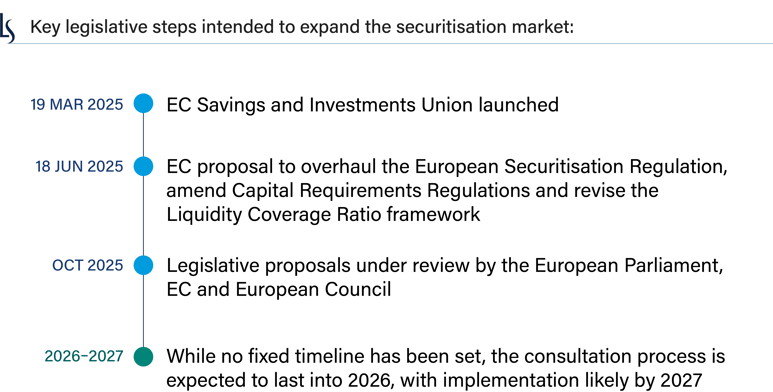

As part of this focus, the EC has introduced legislation to revitalise the European securitisation market. Steps to support its strategy include lower capital charges for banks under Capital Requirements Regulation and insurers under Solvency II, streamlined due diligence, and expanded eligibility for securitisations as liquid assets.

We believe these changes have the potential to unlock significant investments and spur growth in the European Union and United Kingdom asset-backed security markets. To learn more, see: A Welcome Revival: How EU Reforms Aim to Boost Securitisation & Implications for Insurer Demand.

If enacted, these long-awaited reforms will foster increased issuance in the securitisation market and present investors with opportunities to enhance their asset allocations in an asset class that can have compelling risk and return potential.

WRITTEN BY:

Sébastien André, Mortgage and Structured Finance Portfolio Manager, Euro ABS

Alexandre Boulinguez, Mortgage and Structured Finance Portfolio Manager, Euro ABS

David Rittner, CFA, Mortgage and Structured Finance Investment Strategist

[1] European Commission, Savings and investments union: better financial opportunities for EU citizens and businesses, 19 March 2025.

8492142.1.1

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.