Many characteristics make bank loans stand out from their fixed income peers, but here are three key factors we believe everyone should know about bank loan investing:

1. Bank loans do not have interest rate duration.

Bank loan interest payments are typically based on a spread above three-month LIBOR. These payments float with changes in LIBOR. When rates rise, the coupon investors receive rises too. In theory, duration can be calculated for bank loans. However, we have studied the relationship between rate changes and bank loan prices, and there simply is no relationship between them. When rates rise, so does the demand for (and prices of) bank loans.

2. Bank loans tend to be priced fairly most of the time.

While price changes are more common in the distressed bank loan space, in general loans tend to be priced close to par. Bank loans are unlikely to be priced much above or below par because they can be paid off or refinanced at any time and for any reason. While other fixed income markets can at times seem relatively cheap or rich, we think bank loans are usually fair.

3. Bank loans can offer attractive yields while defaults are likely to remain low.

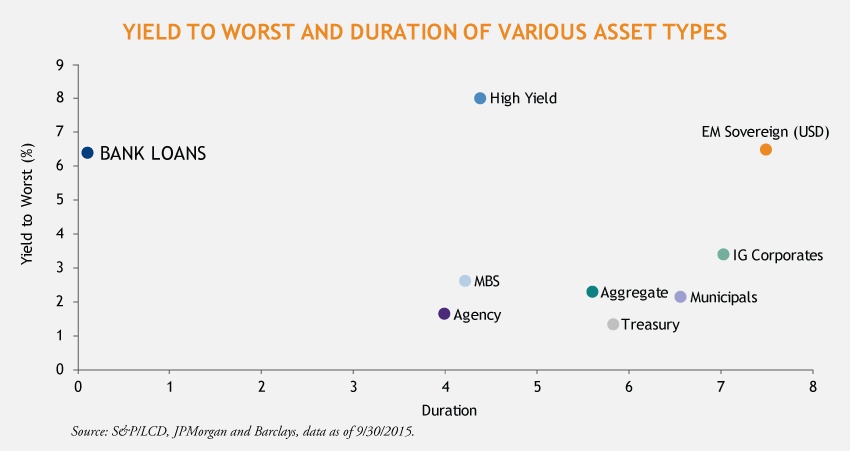

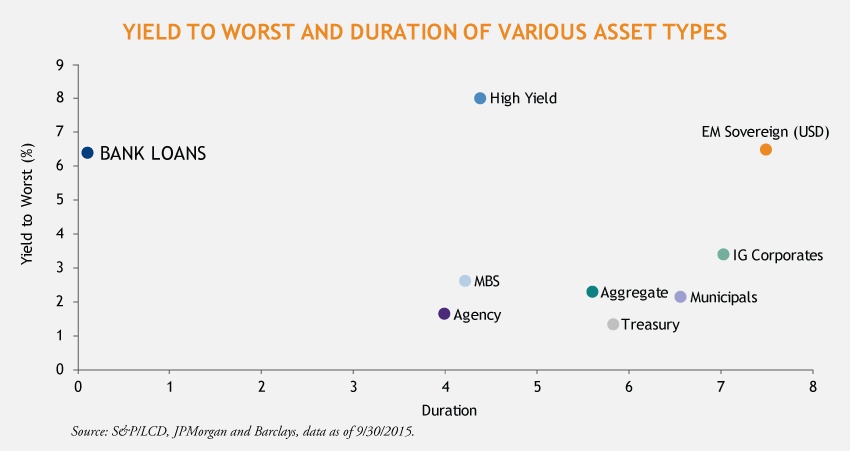

The chart below shows various fixed income asset types by their duration and yield. Bank loans may offer a competitive and generally stable yield that rises with interest rates. Further, there are few bank loan maturities scheduled from now through 2017. This low maturity schedule leads to a default forecast below the asset category’s historical average.

MALR013997

“Yield to Worst and Duration of Various Asset Types” represented using Indexes. Treasury: Barclays US Treasury Index, Agency: Barclays US Agency Index, Aggregate: Barclays US Aggregate Index, MBS: Barclays US MBS Index, Investment Grade Corporates: Barclays US Corporate Index, Municipals: Barclays Municipal Bond Index, High Yield: Barclays US Corporate High Yield Index, EM Sovereign: JPMorgan Emerging Markets Bond Index Plus, Floating Rate Loans: S&P/LSTA Leveraged Loan Index. Indexes are unmanaged and do not incur fees. It is not possible to directly invest in an index. Past performance is no guarantee of future results.