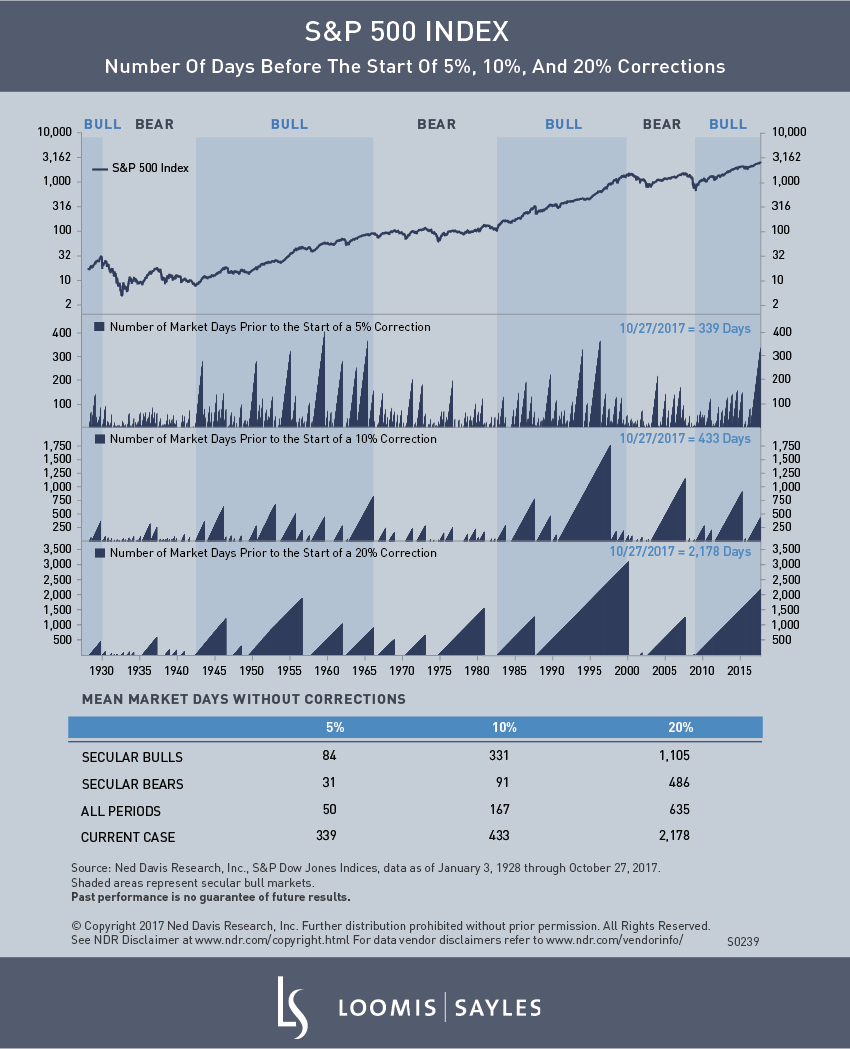

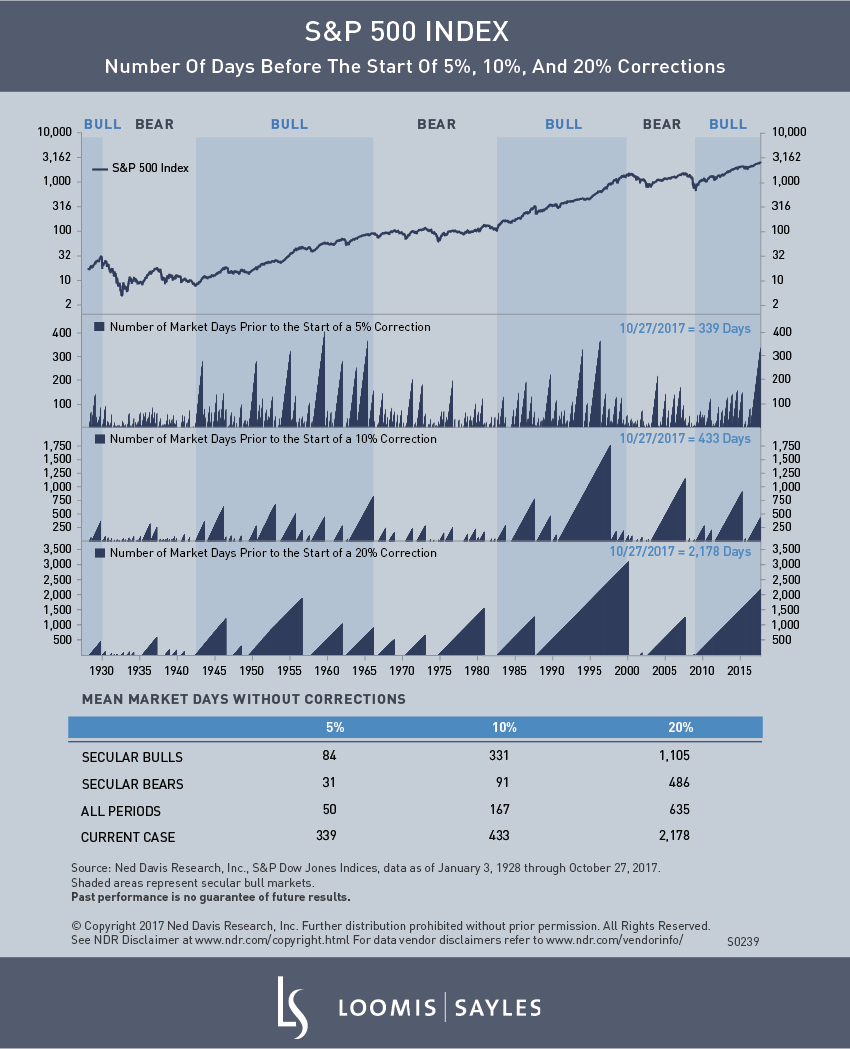

The current equity bull market has been chugging along, enjoying unusually low volatility in recent quarters. The S&P 500® Index is on an extended bull run. The index hasn’t had so much as a 5% correction since February 2016, and it has gone without a 20% or greater pullback since March 2009. The most recent pullback of even 3% concluded on November 4, 2016, just days before the US presidential election.

What’s behind the bull?

- First, we point to low interest rates, not just in the US but worldwide. The 10-year US Treasury yield has not been quoted above 3% since late 2013. Low interest rates make equity valuations appear quite attractive relative to fixed income alternatives.

- Second, consistent global central bank policy has led to a stable backdrop of financial conditions, creating a healthy environment for managers to run companies. This has been the case even with sluggish top-line revenue in the past few years.

- Third, global equity performance has been supported by a strong recovery in corporate earnings worldwide. The S&P 500 is expected to generate operating earnings-per-share growth of close to 10% this year, which would mark the best year of earnings growth since the initial recovery from the financial crisis in 2010-2011. Europe, Japan and emerging markets are all on track for strong earnings this year after a long period of weakness. Based on my analysis, this trend could continue next year as well. Strong earnings growth, together with improving top-line growth, has provided a strong foundation for investor confidence, supporting the low-volatility global equity rally over the past year.

How long can the rally continue?

Economic growth has improved around the world this year, boosting investor confidence in the sustainability of improving business fundamentals. With conditions that typically lead to recession absent, it is possible this low-volatility uptrend could continue for some time. Shocks of one form or another could lead to a short-term pullback, particularly since we have experienced a relatively long period of lower price volatility. Of course, we cannot predict when such events may come along. For now. the combination of improving earnings, relatively predictable central bank policies and investor confidence support a longer-term bull market, temporary price corrections notwithstanding.

MALR021005

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.