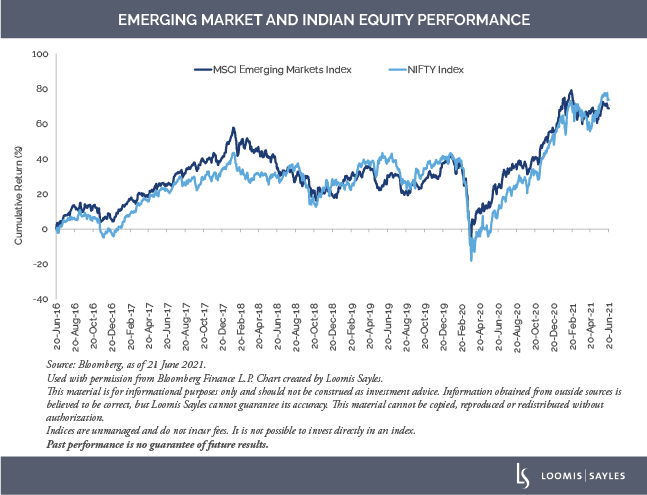

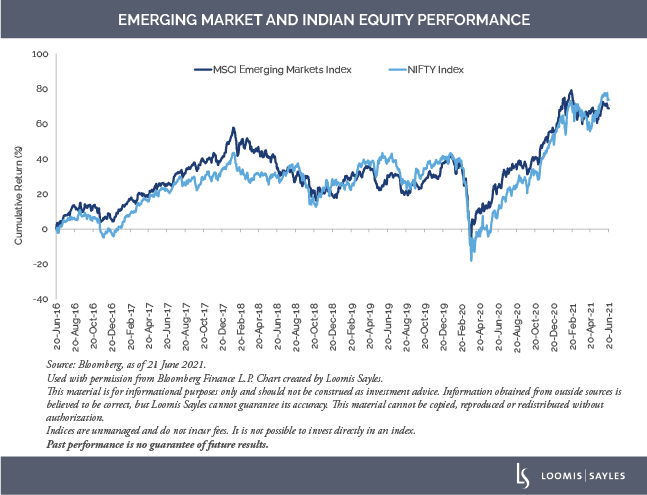

Like most risk assets, emerging market (EM) equities were hit hard by the pandemic, but they’ve made a remarkable rebound. From the low on 23 March 2020 to 18 June 2021, the MSCI Emerging Markets Equity Index gained 80%.[i] The rebound has been widespread and includes some of the worst-hit countries, like India. So what helped EM equities recover so strongly despite the lingering pandemic? I think it’s a combination of new technical, macro and micro drivers that could give this recovery some staying power. I’ll take a closer look at these drivers below.

1) The world is awash in liquidity

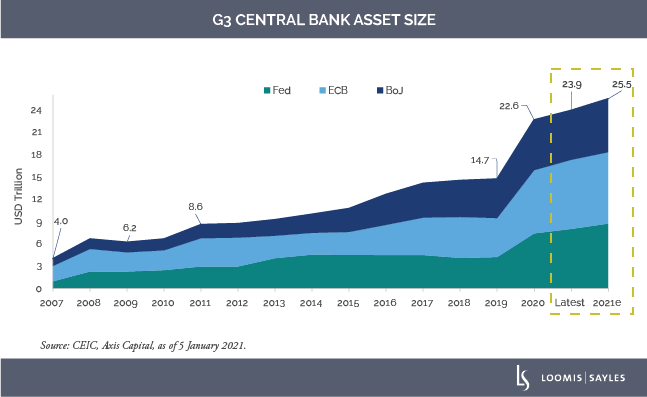

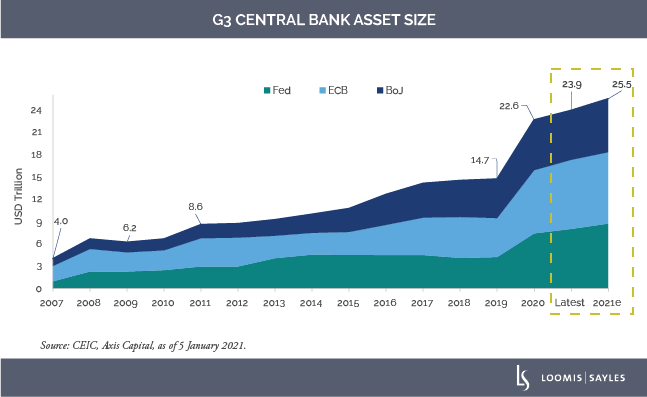

I believe tremendous liquidity has been a main technical driver behind the EM recovery. The sheer size of the added liquidity after the COVID-19 crisis has been enormous. In 2020 alone, the G3 central banks (the Federal Reserve, European Central Bank and Bank of Japan) injected about $8 trillion into the global financial system. They’re expected to continue buying about $250 billion of assets per month through the end of 2021. Compare that to the $2.4 trillion the G3 banks injected in the two years following the global financial crisis.[ii] Looking ahead, I think central banks will take a measured approach in removing this liquidity—a lesson learned from the taper tantrum of 2013. I also think the timing will be later than what markets expect, primarily because there’s still a lot of uncertainty in global markets related to vaccinations, unemployment and the demand recovery.

We’ve also seen many EM central banks injecting liquidity. They’ve been conducting open market operations, buying bonds and providing forward-looking guidance. I believe these liquidity injections should continue over the short to medium term as many EM economies like India and Brazil are still in the throes of the pandemic and their economies still have a significant amount of slack.[iii]

2) External accounts have improved

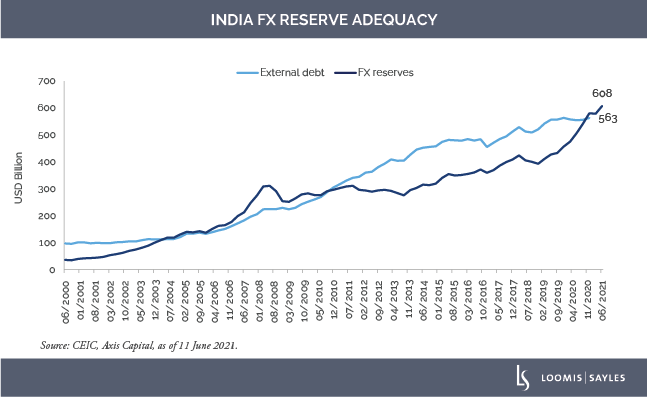

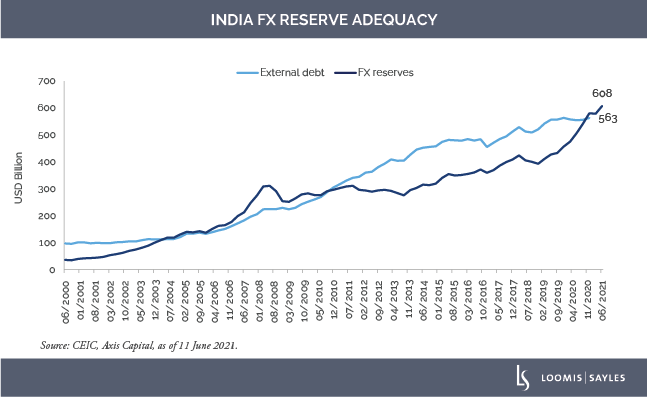

The external accounts of many EM countries have improved from pre-pandemic levels. Take India for example. India had run a current account deficit for ten years, but is now running a surplus due to lower imports and strong exports.[iv] And because India’s major export markets have much stronger vaccination rates and economic recoveries than India does, we expect India’s current account to remain in surplus for some time.

Current account surpluses, in combination with strong positive foreign flows, have helped EM external accounts. Foreign exchange reserves have gone up significantly in many countries. This improvement is important because it helps support the external debt of a country and can attract foreign capital.

Many EM central banks have viewed this improvement as a gift. I believe they will treat their external accounts carefully to avoid another taper tantrum and to continue to attract foreign flows.

3) Balance sheet repair

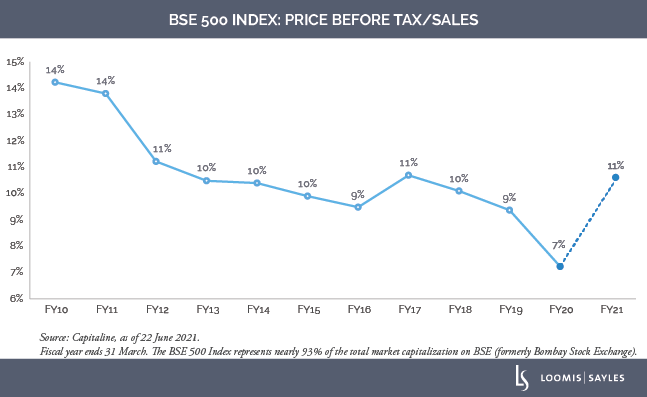

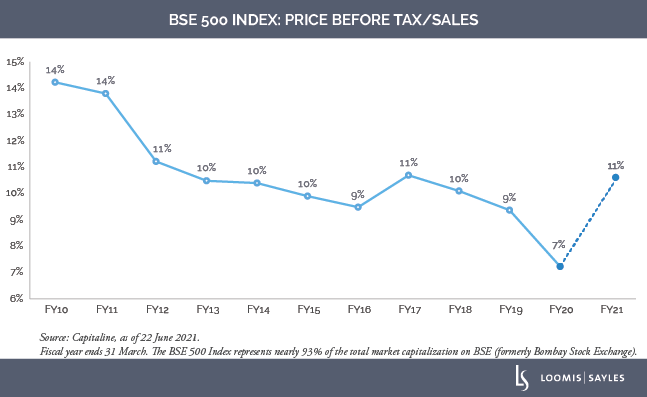

At a micro level, many companies tried to take advantage of cheap, abundant liquidity and the economic slowdown to “fix” themselves. They’ve raised equity to pay down debt, increased margins, reduced expenses and improved operational leverage. The stocks that went up the most post-crisis were largely high-quality and those that we have identified as transitioning-quality stocks that have been repairing their balance sheets and positioning themselves for future growth potential.

A stock picker’s market

EM equities have made a remarkable recovery from the lows of the COVID-19 crisis, but I believe they have room to grow thanks to the conditions described above. Prior to the pandemic, US interest rates and liquidity conditions were a primary driver of US equity performance relative to EM equity performance. Now that financial conditions have improved in EM, I expect relative performance to be driven more by idiosyncratic risks. I believe the EM equity space can offer strong pockets of opportunity for skilled stock pickers.

[i] Source, Bloomberg, from 23 March 2020 to 18 June 2021.

[ii] Sources: US Federal Reserve, European Central Bank and Bank of Japan.

[iii] Slack is a term for unused/underutilized resources in an economy.

[iv] Source: CEIC, IIFL Research, data from 30 June 2010 through 30 June 2021 (estimated).

MALR027422

There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Market conditions are extremely fluid and change frequently.

Past performance is no guarantee of future results.