From Election Day in November through the end of 2016, financial markets embraced the “Trump Trade,” pricing higher equities, higher interest rates and a stronger US dollar.

So far this year, two legs of the Trump Trade remain intact:

- US equities have continued to march higher as optimism grows for improving corporate profitability.

- Bond yields have retraced some of the post-November gains, but at 2.49% the current US 10-year Treasury yield is still more than 60 basis points higher than the 1.8% seen just before the election.

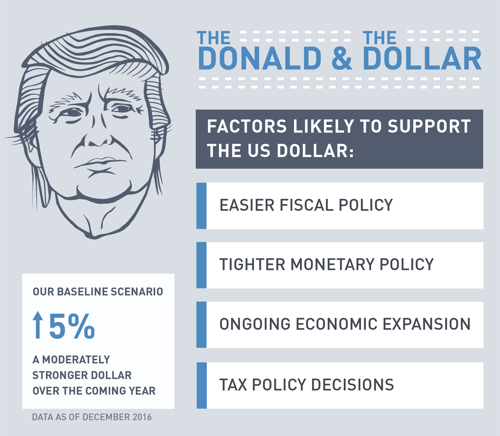

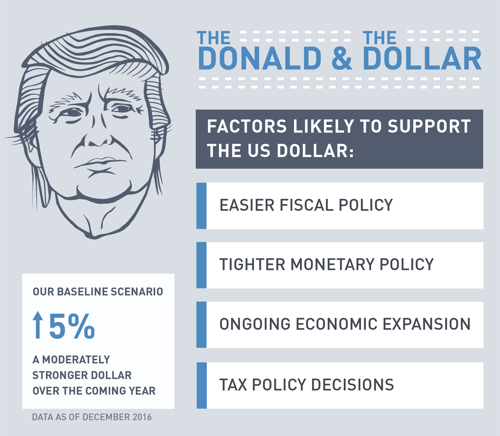

However, the trade weighted dollar has dropped 4%, losing 5-7% against many emerging market and commodity-related currencies. We view the recent depreciation as a correction in the dollar’s primary trend toward appreciation. The dollar is likely to remain supported by easier fiscal policy, tighter monetary policy and the ongoing economic expansion. Most notably, we expect tax policy decisions published over the next month will be the major catalyst for the dollar for 2017.

The proposals put forth by Congress and the new administration are likely to meaningfully overhaul long-standing elements of the US tax code and create a pronounced skew to our dollar outlook. Will tax policies penalize importers and reward exporters and domestic producers? Will taxes discourage US companies from foreign tax shelters? Will policies meaningfully incentivize investment and production in the US?

Our baseline scenario projects a moderately stronger dollar (+5%) over the coming year, with potential for a sharply stronger dollar (+20%) depending on the terms of the tax policies enacted by the new government.

We will have to see how the global economy handles a stronger dollar. A precipitous surge in the dollar could have deleterious effects on US corporations’ profits by denting overseas earnings. It would also likely renew pressure on overseas debtors with outstanding dollar-denominated liabilities, notably in some emerging markets, similar to what we saw during the dollar’s 20% rally in 2014 and 2015.

We are hopeful the markets will have greater visibility around the dollar soon, with the President set to lay out tax plans shortly and the Office of Management and Budget drafting budget plans later in March.

Posted by Laura Sarlo, Senior Sovereign Analyst and Tom Fahey, Senior Global Macro Strategist

MALR016704