President Biden campaigned on achieving a carbon-free power grid by 2035. He does not appear to be backing down from this goal. On March 31, the White House announced the American Jobs Plan, which proposes spending nearly $2.3 trillion on infrastructure and job creation. It calls for tax incentives, federal purchases of clean energy solutions and significant research and development on clean energy initiatives. Here, we’ll look at the components of the plan that might affect the power sector.

Tax incentives for renewable energy

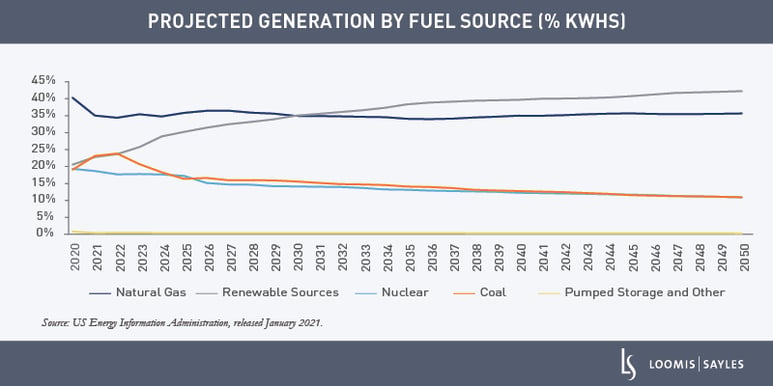

Over the last three years, the regulated utility sector has seen a dramatic acceleration in renewable energy development at the expense of coal generation. We believe this trend would accelerate further under the American Jobs Plan, which proposes a ten-year extension of both investment and production tax credits for renewable energy (onshore/offshore wind and solar). One of the long-standing complaints among renewable energy developers has been the lack of a long-term renewable energy investment program in the United States. For more than a decade, renewable incentives have been extended for short intervals (typically one to three years) making the formation of long-term development goals challenging. We believe extending these tax credits for another ten years would help renewable energy developers implement long-term plans.

Tax incentives for energy storage

In an attempt to address the intermittency issue associated with the transition from traditional baseload power sources to renewable energy sources, the American Jobs Plan would allow stand-alone storage to qualify for a tax credit. Today, storage only qualifies for a tax credit if it is paired with a renewable generation project. The tax credit would stimulate the development of storage, which is currently uneconomic on a standalone basis. For example, the price of a lithium-ion battery pack was $137/kWh in 2020, about twice the forward on-peak ERCOT[i] price of $66.29 for the month of July 2021.[ii] This price differential makes it difficult for stand-alone batteries to compete on a merchant basis. Bloomberg New Energy Finance forecasts the price of a battery pack will fall to $58/kWh by 2030, at which time we would expect storage to become competitive on a stand-alone basis, all else equal.[iii]

Converting tax credits to cash

Under the American Jobs Plan, tax credits could be converted to cash. Traditionally, utilities, which have minimal tax liabilities, have brought in tax equity partners. These partners provide the equity for renewable energy projects in exchange for renewable energy tax incentives. There has been some concern in the sector about the depth of the tax equity market and the potential for saturation. The plan addresses this concern, attempting to correct it before it becomes an issue.

Transmission improvement

If the tax incentives in the American Jobs Plan pass, we believe significant investment in transmission will be needed to accommodate the expected influx of renewable energy. Many companies have cited transmission capacity as a major headwind to meaningful renewable energy development.

It’s unclear if the plan will allocate any funding to transmission development. Though spending details have yet to be released, the White House has indicated its intent to offer investment tax credits to incentivize transmission development and add at least 20 gigawatts of transmission to support its ambitious goals. We would expect any funding in this area to directly benefit utilities with large exposure to transmission.

Permitting has been another major obstacle to renewable energy development, and the Biden administration has announced it will give the Department of Energy greater authority to alleviate this issue.

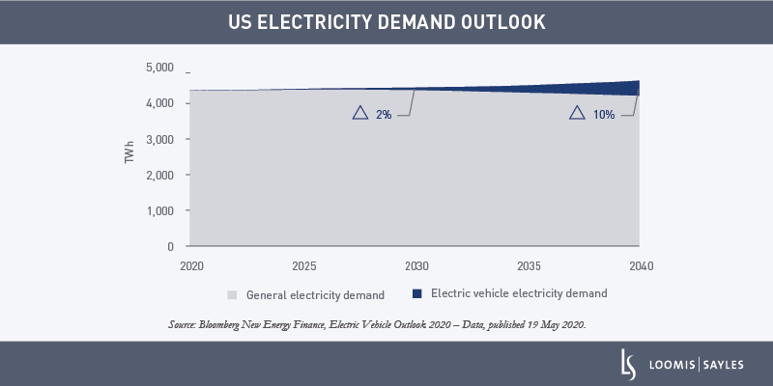

Powering a potential increase in electric vehicles

The plan also proposes a $174 billion investment in the electric vehicle market. Though the plan lacks many critical details, it proposes electrifying the federal fleet, providing incremental incentives to consumers for electric vehicle purchases, and accelerating the development of charging stations. We believe this would benefit regulated utilities because it would require incremental investment in generation and/or transmission, further increasing utilities’ rate base.

Higher corporate taxes

To pay for the American Jobs Plan, the White House has proposed increasing the corporate tax rate to 28% from 21%. While this may seem contradictory on the surface, we believe regulated utilities would benefit under a higher tax rate because they could charge customers based on the proposed statutory tax rate of 28% while their effective tax rate would likely be significantly lower. Standard & Poor’s expects a higher tax rate would lead to a 100-basis-point improvement in the funds from operations/debt ratio across the regulated utilities sector.[iv] Alternatively, integrated power producers and unregulated utilities would likely see a negative impact from a higher corporate tax rate in our view.

Robust investment opportunities may warrant a cautious approach to credit

The American Jobs Plan will likely see modifications before crossing the finish line, but we expect it to provide robust investment opportunity potential for the power sector for years to come. Under the current proposal, we think regulated utilities could be relative winners while power companies with unregulated operations could see their credit profiles negatively impacted. Given that balance sheets in the power sector are already under pressure, we are cautious about the impact of incremental investment opportunities on credit. It’s important to remember that clean energy incentives may be accretive for equity investors, but not necessarily for creditors.

WRITTEN BY:

[i] ERCOT is an acronym for the Electric Reliability Council of Texas.

[ii] Bloomberg New Energy Finance, “2020 Lithium-Ion Battery Price Survey,” 16 December 2020.

[iii] Bloomberg New Energy Finance, “2020 Lithium-Ion Battery Price Survey,” 16 December 2020.

[iv] Standard & Poor’s, “North American Regulated Utilities’ Negative Outlook Could See Modest Improvement,” 20 January 2021.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.