On 6 May, Scotland will hold parliamentary elections that could ramp up the push for a Scottish independence referendum. Support for Scottish independence is substantially stronger than it was before the 2014 referendum, and polling generally indicates a strong likelihood of a pro-independence majority. We believe this event and the prospect of another independence referendum could introduce market volatility. The issue also draws the market’s attention to the general prospect of a country leaving a currency regime—and what that might mean for Europe.

The potential (rocky) path to a referendum

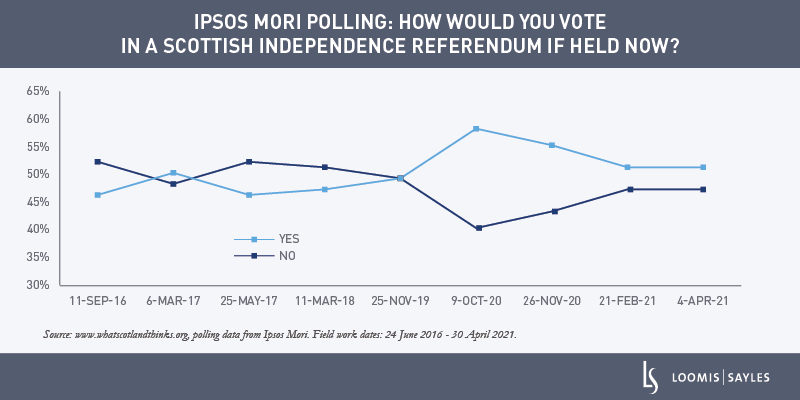

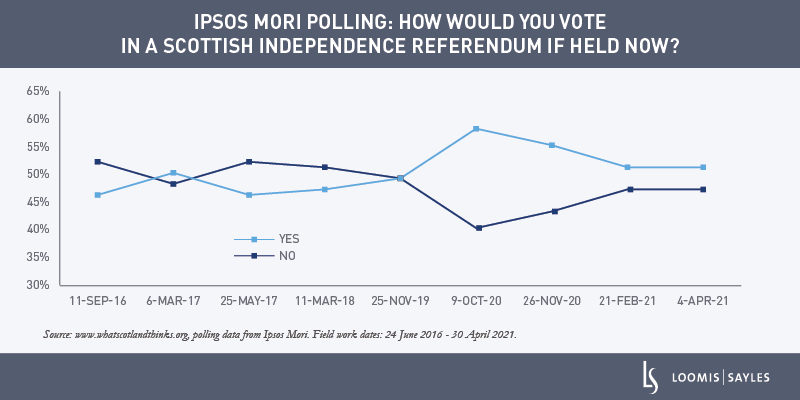

There are three pro-independence parties in Scotland—the Scottish National Party (SNP), the Scottish Greens and Alba. Public support for Scottish independence has consistently polled above 50%. The SNP has said it will legislate to hold a referendum if a pro-independence majority emerges from the election.

The 2014 referendum was held with the assent of the UK government. UK Prime Minister Boris Johnson has said the UK will not assent again. The SNP has suggested it might seek a court challenge to get around this procedure. Another path is to build public pressure to try to get the UK government to assent. Political brinksmanship and legal challenges could introduce significant volatility as the process unfolds.

The SNP wants a referendum within 2.5 years, but the public appears cautious on timing, and the UK—if it negotiates at all—might push for a later vote.

The implications of Scottish independence

Scottish independence is no small issue. It would mean the end of a political union that has existed since 1707—and a highly integrated currency area. For the UK, it has significant geo-strategic implications. It could also raise longer-term questions about the future of Northern Ireland and Wales.

For Scotland, it would have to adopt a new currency regime as an independent country. This would be a complex, multi-year process, made even more complex by a stated desire to pursue EU membership. A successful transition would likely require extensive cooperation with UK institutions over many years.

The case for Scotland’s independence is, in many ways, rooted in a preference for an open society and a globally integrated country. However, if Scotland succeeds in its push for independence, it would create a template for exiting from a currency union. It’s a risk that cannot be dismissed, particularly if politicians elsewhere focus purely on the aspect of a leaving a union without considering the broader aspects of self-governance.

WRITTEN BY:

MALR027235