The advance estimate of Q2 real GDP is scheduled to be announced July 28 (the day after the FOMC meeting). Even after likely revisions, I put the odds over 50% that there were declines in real GDP in Q1 and Q2. If these two quarters did decline, would that mean the US economy is already in recession? I say "no."

Setting the table - Business cycle dating is as much art as science

The National Bureau for Economic Research (NBER) set up the Business Cycle Dating Committee (BCDC) to identify the peaks and troughs that frame economic recessions and expansions, thus maintaining a chronology of US business cycles.1 It can take the committee a long time to announce the peak or trough of a cycle because it waits long enough to recognize a turn in the cycle versus noisy fluctuations. For example, the BCDC did not announce the start of the 2007-2009 recession until December 2008 (one year in), and it did not announce the end of the 2020 recession (in April 2020) until July 2021.

If we were to wait for an official announcement of a recession, the recession could by then be mostly over. That does no one any good.

Appetizer – Don’t look for GDP in the salad

Members of the business press sometimes like to say that a recession is a decline of real GDP lasting at least two consecutive quarters. I would disagree.

To determine a recessionary period, the BCDC emphasizes economy-wide measures of economic activity and looks at the criteria of depth, diffusion and duration. It uses a range of monthly and seasonally-adjusted measures of aggregate real economic activity—not including real GDP—to determine peaks and troughs of the business cycle.2 The BCDC focuses mainly on monthly chronology, which requires consideration of monthly indicators. GDP is only available quarterly.

In recent decades, it appears the BCDC has put the greatest weight on real personal income less transfers and nonfarm payrolls. It uses no fixed rule about how to weigh the various indicators in its decisions.

Entrée – Can’t ignore healthy selections

Will the NBER eventually declare a recession? Based on monthly data available so far, I have to say "no." If it did, the NBER would have to explain its decision in light of favorable readings in nonfarm payrolls, household employment, real personal income less transfers, real manufacturing and trade sales, industrial production and real personal consumption expenditures.3

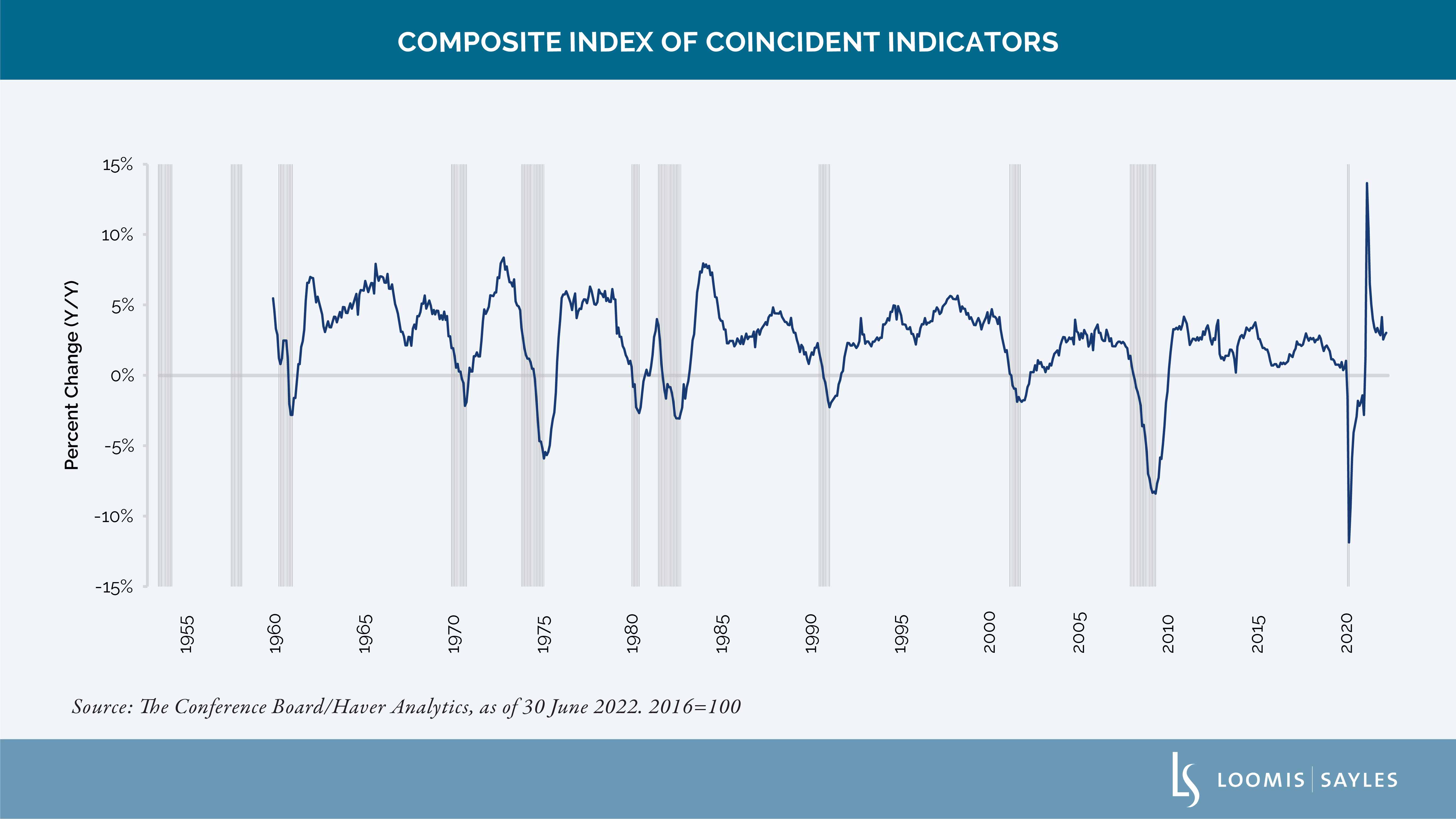

The Conference Board's Index of Coincident Indicators has decreased in every recession since the index started in 1959. This index has not seen a single monthly decline in the data available for the first five months of 2022.

These monthly data could be revised down so much that we discover a recession. But I find that unlikely.

This set of monthly data does not appear consistent with a recession happening in Q1 and Q2 of 2022. But I believe it is more likely that GDP will be revised up.

A recession could still start in the near-term, but I don't think we can say it started earlier this year.

No dessert?

So what happens if, at the end of July, we get an announcement of two consecutive quarters of GDP decline? I believe that:

- For now, the NBER will not declare a recession, and it may put out a press statement on the issue. The decline could be called a "technical recession," but not an official recession.

- The press will make a big deal of the two-quarter drop.

- Ironically, GDP declines might cause a future recession if they take a bite out of consumer and business confidence.

- There will be pressure on the Fed to stop tightening. Members of the FOMC might turn more cautious, concerned that they have already done too much damage.

- It could cause more risk-off pricing in the markets.

- The budget under consideration in Congress, if passed, has large tax increases, which would likely be implemented in January 2023. Concerns about a recession could result in those tax hikes being passed but the implementation delayed. President Biden could ask for more spending.

- With the midterm elections less than four months away, announcements of declining GDP are not likely to help the incumbents.

Potential digestion issues

There are significant risks to consider when weighing the probability of future inflation. If another autumn/winter wave of a new COVID-19 mutation were to occur, it could weaken an already weakened consumer sector.

Russia may escalate its aggression in Ukraine. That scenario could result in further sanctions against Russia or retaliation by Russia. The result could lead to another surge in energy prices and perhaps food prices also. Such shocks could trigger a recession.

The Fed may have such a single-minded focus on inflation that it tightens aggressively even as the economy slows. That could ultimately reduce inflation, but I also believe it could result in a recession.

1In 1978 the National Bureau for Economic Research (NBER), an independent private-sector nonprofit academic organization, set up the Business Cycle Dating Committee (BCDC). NBER.ORG.

2Published by the federal statistical agencies. These include: (1) real personal income less transfers from the Personal Income and Outlays Report, (2) nonfarm payrolls from the Establishment Survey of the Employment Report, (3) employment as measured by the Household Survey of the Employment Report, (4) real personal consumption expenditures from the NIPA reports of the BEA, (5) real manufacturing and trade sales from BEA and (6) industrial production from the Federal Reserve.

3The NBER will note that through May or June of 2022: Nonfarm payrolls rose in every month and is close to a record high. Household employment rose in four out of six months. Real personal income less transfers rose in three of five months, reaching a record high in May. Real manufacturing and trade sales rose in three of the five months. Industrial production rose in four of the five months, reaching a record high in April. Real personal consumption expenditures rose in four of the five months, with a record high in April.

MALR029265

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.