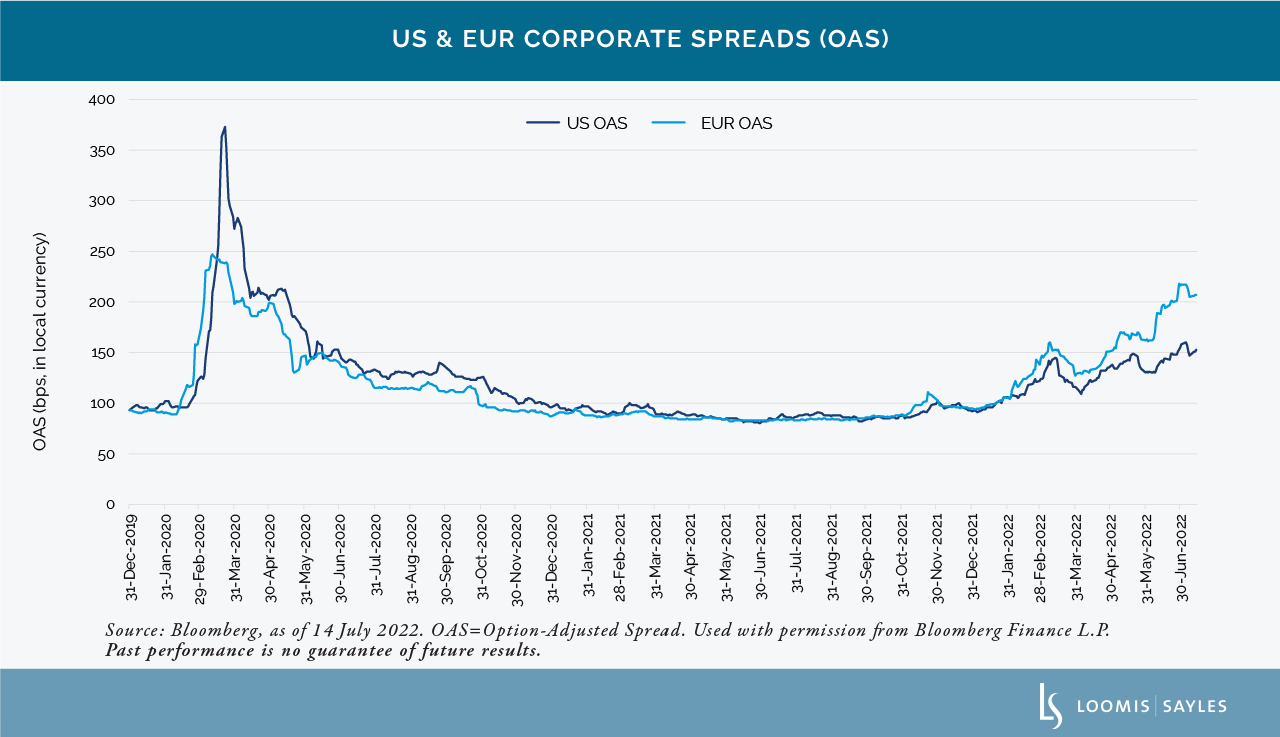

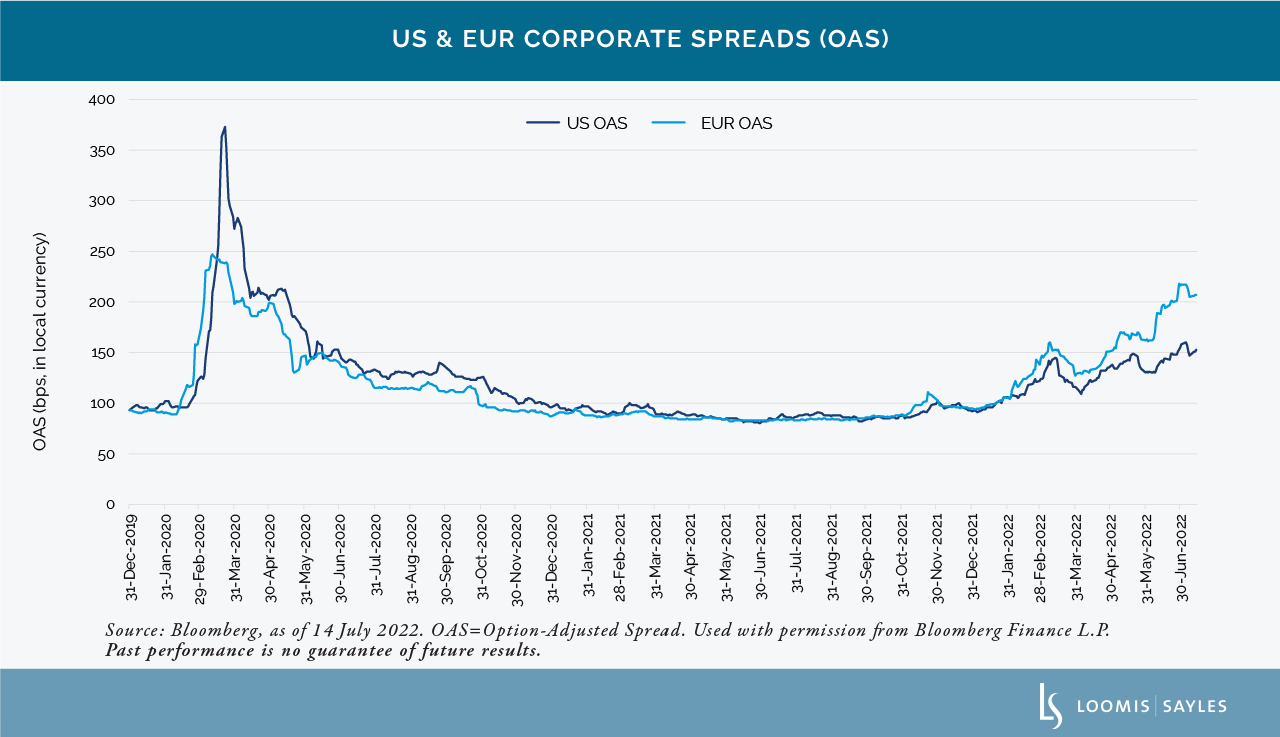

The correlation between US and European corporate bond spreads is historically very high. After a brief decoupling in March 2020—as the European Central Bank (ECB) accelerated a corporate bond purchase program that effectively capped European corporate spreads—US and European corporate bond spreads moved back into lockstep with each other and remained that way through 2021.

The tight correlation between the two asset classes broke down during the first half of 2022 as a confluence of factors pressured European spreads:

- The ECB announced that it would begin withdrawing accommodative policy and stop purchasing corporate bonds.

- Russia invaded Ukraine.

- Worries of natural gas shortages in Europe next winter.

- Fears of a European recession sooner rather than later.

- Renewed EU fragmentation commentary.

We had expected a technical headwind from the withdrawal of ECB bond purchases, but the magnitude of the current differential in EUR/USD spreads has caught our attention. Though we remain quite concerned with the continent’s exposure to Russian-provided natural gas, along with inflationary and recessionary risks, current spread levels have us considering a shift in our thinking. Within our risk budget, we may potentially add to European credit ahead of USD credit in select industries and issuers.

WRITTEN BY:

MALR029284

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.