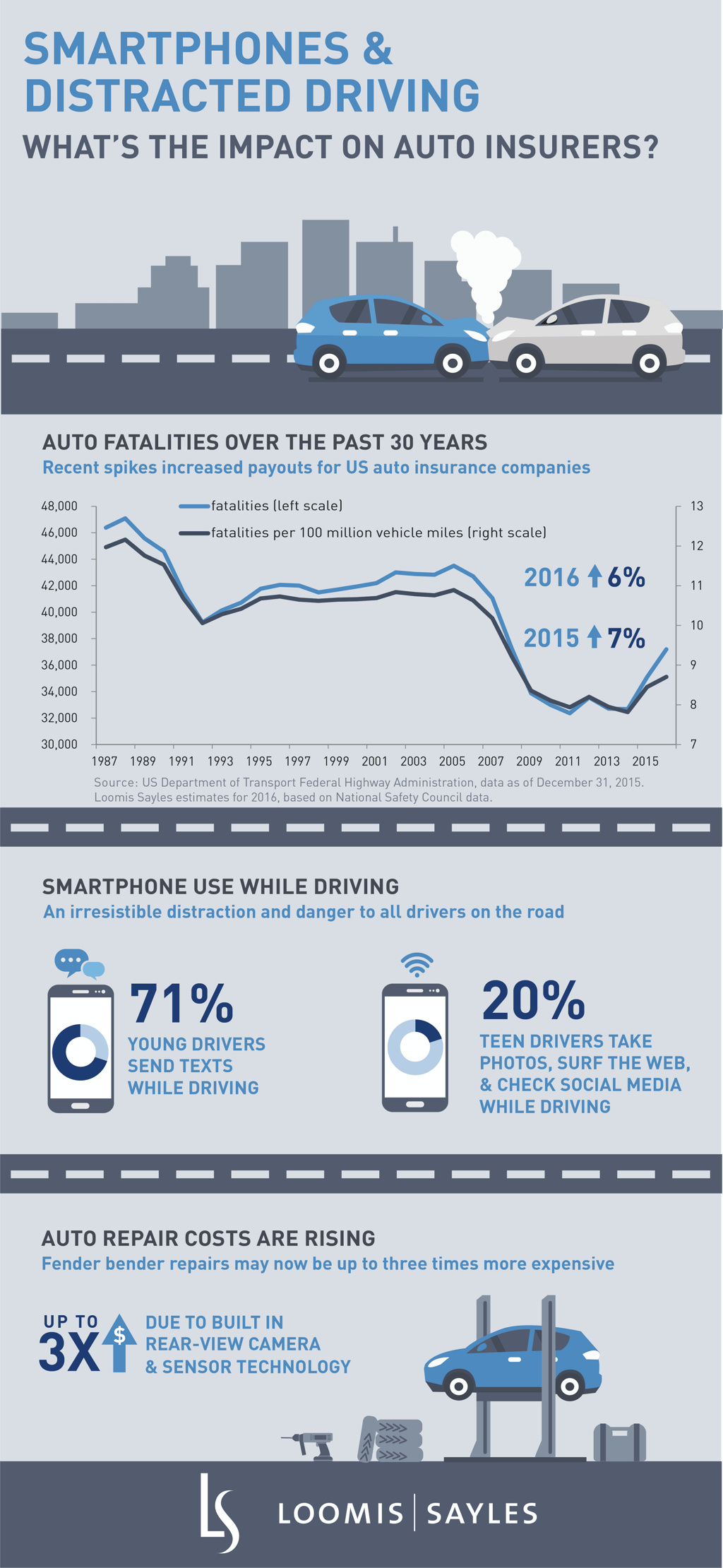

Auto insurers have been caught off-guard. Traffic deaths had been in decline for four decades, as a result of Mothers Against Drunk Driving (MADD), seat belts, crumple zones, anti-lock braking systems, air bags and a string of other safety improvements. Then in the middle of 2015 things changed. Road deaths jumped 7% in 2015, and rose another 6% in 2016.[i]

This has resulted in an unanticipated spike in payouts for US auto insurers. The reason, according to Matt Winter, President of Allstate,[ii] is that the proliferation of smartphones proved an irresistible distraction just as cheap gas prices and a pickup in the US economy resulted in more drivers on the road.

71% of young drivers admit to sending a text while driving.[iii] That means that they’re not looking where they’re going for five seconds on average. Among teenage drivers, 20% admit to taking pictures, surfing the internet and checking social media while driving.[iv] It’s not just the entertainment device in your pocket that is a problem. Typing your destination into the car navigation system or searching for your favorite songs are also dangerous.

Greater frequency and severity of accidents aren’t the only headaches for auto insurers. The cost of car repairs is also rising, partly due to the new safety features that were supposed to prevent those accidents. The cost of replacing a bumper after a fender bender may have doubled or tripled because of the rear-view camera and sensors that are now typically built into bumpers.[v]

It’s ironic that the rise in accidents is coming at a time when safety features like sensors and automatic braking are becoming more widespread in cars on the road. Maybe drivers are lured into a false sense of security which makes them more likely to reach for their phone when they feel the buzz of a new text?

New technology could affect auto insurers in other ways too. Car-sharing services like Zipcar and ride-hailing apps like Uber and Lyft may reduce car ownership in big cities. Uber CEO Travis Kalanick argued at the World Economic Forum in June 2016 that self-driving cars may result in the end of individual car ownership. “If there was a mobility service that was cheaper than owning a car, more reliable, and you get to sit in the back seat instead of being stressed out in the front seat, why would you own a car?” he said. [vi]

Don't count out auto insurers just yet. Cars won’t be fully autonomous for many years. Recent studies indicate that ride-hailing and car sharing apps are likely to have minimal impact on total new car sales, after taking into account the rapid replacement of shared vehicles.[vii] I expect the recent rise in road accidents to be reversed too, since there is likely to be more focus on teaching awareness of the dangers of distracted driving, and stricter enforcement of laws prohibiting cell phone use while driving.

Auto insurers have been raising policy rates to reflect the recent rise in auto loss costs. Allstate has raised its policy rates by 10% over the last two years[viii] and has changed its underwriting to avoid some of the riskiest drivers. The company expects auto insurance rate increases to moderate, and loss trends to stabilize. Several large auto insurers now offer to monitor your driving, either via a smartphone app or a dongle, with discounts on your insurance if you are driving well. The dongle, which is a small device inserted into your car, can monitor your speed, whether you frequently brake hard (often cited as a sure sign of a bad driver), what time of day you typically drive, and what neighborhood you are in.

Technological change may also provide opportunities for a new kind of personal insurance - for flying cars. Google’s co-founder Larry Page is funding research into flying cars, and Uber last year published a white paper on personal Vertical Take-off and Landing (VTOL) vehicles. Flying cars could be a large new market for auto insurers.

Dubai’s transport authority recently announced that it plans to introduce autonomous single-passenger taxi drones in July of this year. There are reasons to be skeptical about Dubai’s timetable. There is no detail about the safety features of the Ehang 184 quadcopters that they plan to use, and according to news reports, little evidence that they have done much test flying. But even so, the time until widespread availability of flying cars is likely to be measured in years, not decades.

Just don’t send a text when you are flying your car.

MALR016809

[i] National Safety Council, NSC Motor Vehicle Fatality Estimates, as of December 2016.

[ii] Merrill Lynch, US Insurance Conference, February 2017.

[iii] National Highway Traffic Safety Association Distracted Driving, as of March 2017.

[iv] State Farm, Teens, Smartphones and Distracted Driving, October 17, 2016.

[v] The Hartford, Why Complex Cars Cost More to Repair, September 22, 2016.

[vi] World Economic Forum, Annual Meeting of the New Champions, June 27, 2016.

[vii] Center for Automotive Research, The Impact of New Mobility Services on the Automotive Industry, August 2016.

[viii] Allstate,Q4 2016 Earnings Call Presentation, February 2, 2017.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.