The answer to a fundamental question is becoming clearer: US oil production is likely going to be down dramatically in 2016. US shale producers finally got religion. Pressured by credit agency downgrades, investor concerns, bank borrowing revisions, weak capital markets, liquidity fears and low prices, exploration and production (E&P) management teams are implementing draconian capital expenditure cuts. In 2016, these measures are unlikely to reverse much, even if oil prices rise above $40 per barrel.

With hedges rolling off, production in decline, and oil prices in the low $30s, E&Ps have been forced to take drastic measures to help preserve liquidity and stay afloat.

Watch the April 17 OPEC Meeting

We should know more about the deal impact after the April 17 OPEC meeting in Doha. The notable absence of Iran suggests that a resumption of growth by that country isn’t out of the question, and is perhaps likely, as Iran works to grow its market share this year. It’s also critical to watch how Saudi Arabia responds to any increases in Iran’s production, since a commensurate increase in output by Saudi could meaningfully shift the global supply and demand balance for oil.

Drastic Measures

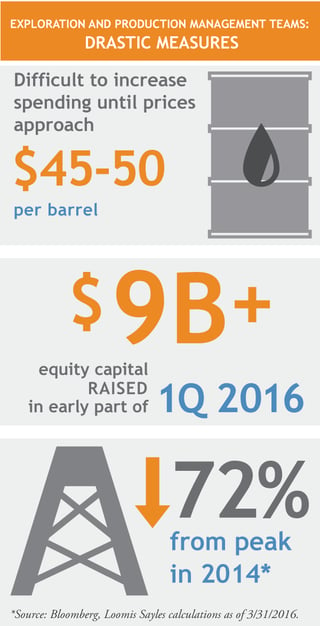

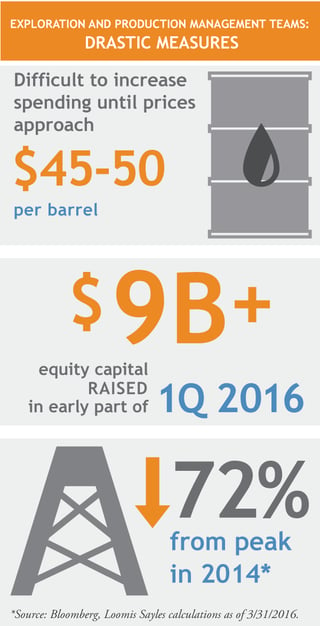

According to our calculations, over $9 billion of equity capital has been raised in the early part of the first quarter by US E&Ps at significant discounts to very depressed market prices for those shares. This reveals the urgency of the situation: that amount is roughly one third of the total equity that we calculate was raised in all of 2015 by the E&P group. In the weeks ahead, more deals are likely to come to market as additional management teams move to de-risk their respective outlooks.

Companies are broadly guiding to restrict spending within operating cash flow. Spending discipline is a critical milestone and tenant of a recovery in energy markets. The US rig count is down almost 75% from its peak in 2014[i] and is slated to fall further as the year progresses and additional rigs roll off of long-term contracts. The result is that US oil production is likely to decline in excess of 700,000 [ii] barrels per day in 2016 which will help balance oversupplied markets.

Leverage ratios for the upstream producers remain elevated going into 2017. The group is facing additional hedge roll-offs next year which suggests it will be difficult for all but the lowest cost and best capitalized producers to increase spending much until prices approach $45-50 per barrel.

Two Major Unknowns

While the trajectory of US production seems defined, there are at least two major unknowns, which I believe will help determine when we get to a more stable market:

Global demand remains soft largely due to new sources of supply and tepid global economic growth. However, gasoline demand remains strong globally, particularly in the US where consumers have displayed elastic demand at low pump prices. The International Energy Agency (IEA) is projecting demand growth of 1.2 million barrels per day in 2016. This is down from 1.6 million barrels per day in 2015, but is still a healthy pace that should help balance markets. Barring a global recession or contagion emerging from the Asian and/or European banking sectors there could be upside to the IEA’s demand projection.

I believe OPEC production is the biggest wild card in the global supply and demand balance. The market has opposing views on how much they will produce due to conflicting media reports and commentary from various spokespersons in OPEC nations. It is our long-held belief that Saudi Arabia is worth listening to and in my view it is more important to watch what they do – rather than listen to what they say. While Russia and Saudi agreed to freeze output at January levels, that deal is still preliminary.

[i] Source: Bloomberg

[ii] Source: Loomis Sayles calculations

MALR014790

Commodity interest and derivative trading involves substantial risk of loss.

Past results are no guarantee of, and not necessarily indicative of, future results.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.