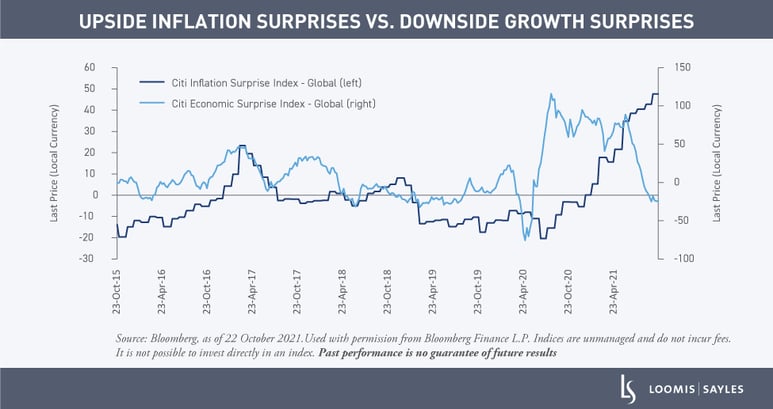

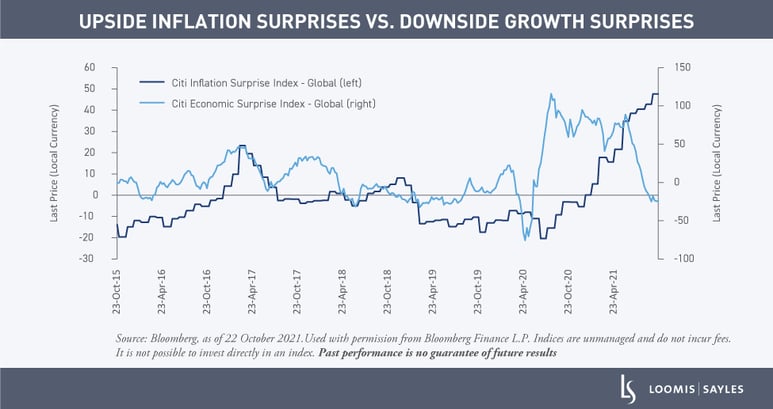

The pandemic triggered economic ripples that have weighed on growth while driving prices higher. In October, the IMF said it expects global economic growth to decline from 5.9% in 2021 to 4.9% in 2022. Unsurprisingly, it cited supply dynamics and COVID-19 variants as contributors to the restrained growth. These same factors also helped foster September’s higher-than-expected, headline inflation.[1]

A slowing economy and higher prices

A slowing economy and higher prices

Does the chart above point to stagflation? No, but it could be transitory “clogflation.” We expect inflation will be transitorily higher as depressed prices normalize and as the prices of supply-constrained sectors surge.

We believe the level of slack in the economy will likely restrain inflation and expect it to return closer to the Fed's target in the second half of 2022—albeit with plenty of monthly volatility.

Risks

Expectations of inflation could rise, turning transitory inflation into sustained inflation. The Fed takes measures of expected inflation very seriously. A "transitory" rise in inflation could get locked into expected inflation. In our view, this could make the Fed's task of keeping inflation under control more difficult.

The rise in expected inflation may be pushing the Fed to start tapering by end of year. We expect a tapering announcement at the November FOMC meeting. We believe a key to both the economic growth and inflation forecast will be how fast the pandemic can be defeated.

[1] Bureau of Labor Statistics, 13 October 2021.

MALR028092