Investor fears about inflation and higher rates contributed to periods of selloff in emerging market (EM) equities during the second quarter. However, I think these fears may be overblown. Here, I’ll share why I’m not too worried about inflation, and why interest rate hiking cycles aren’t necessarily bad for EM equities.

Deflating inflation fears

Many EM countries remain in the throes of the COVID-19 pandemic. Demand recovery has been weak, unemployment remains high, and capacity utilization has been low with plenty of economic slack[i] and supply chain bottlenecks. In my view, significant inflation is unlikely in EM, especially over the medium term.

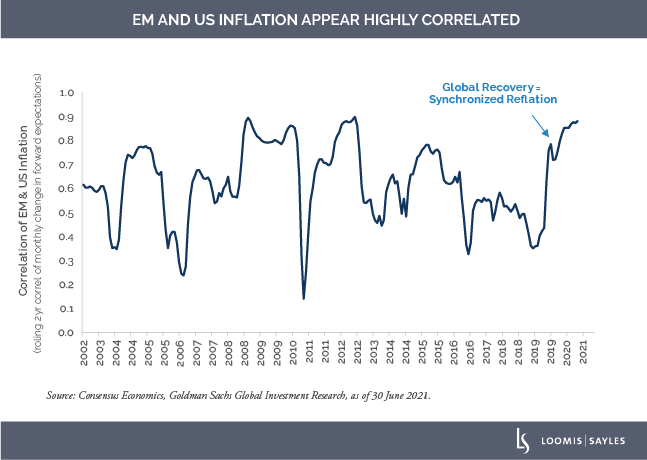

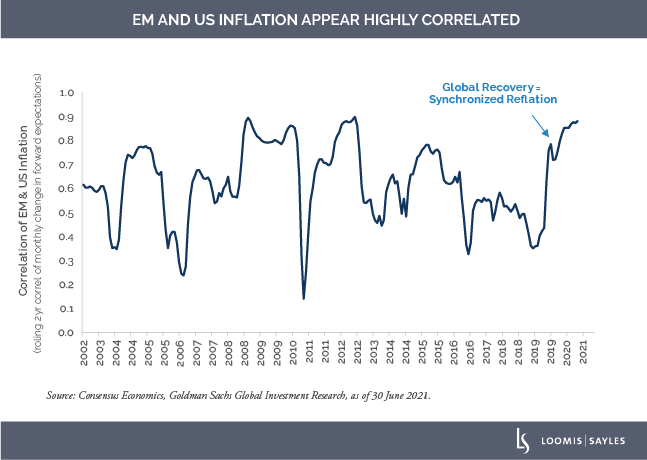

Now let’s consider US inflation. As the chart below shows, short-term EM inflation expectations are typically quite correlated with US inflation expectations, especially during periods of crisis. Currently, the correlation is 0.9, around the highest it has ever been.[ii]

I think most of the inflation pressure in the US will be transitory, though some of it may be permanent. For instance, I believe wage inflation in the low-skills service sector will recede as benefits and stimulus payments roll off. I also believe base effects have contributed to higher inflation in industries hit hard by the pandemic, such as travel, tourism, transportation, hospitality and entertainment. Finally, I expect supply chain bottlenecks to open up over time, easing supply-driven cost pressure. I believe these outliers, which have been a big component of the recent increase in US inflation, will ebb away over the next year.

Recalibrating rising rate fears

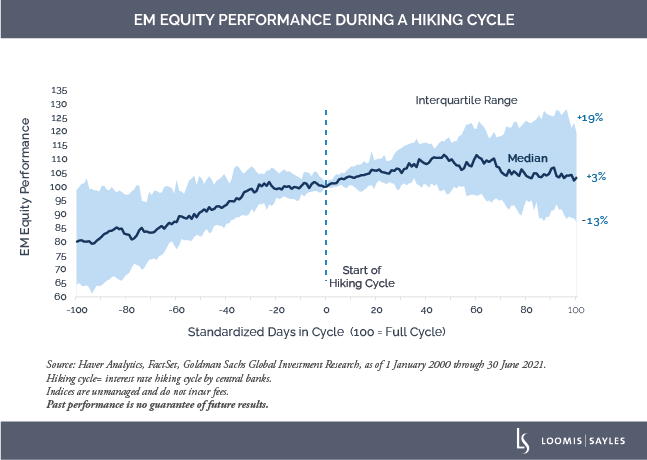

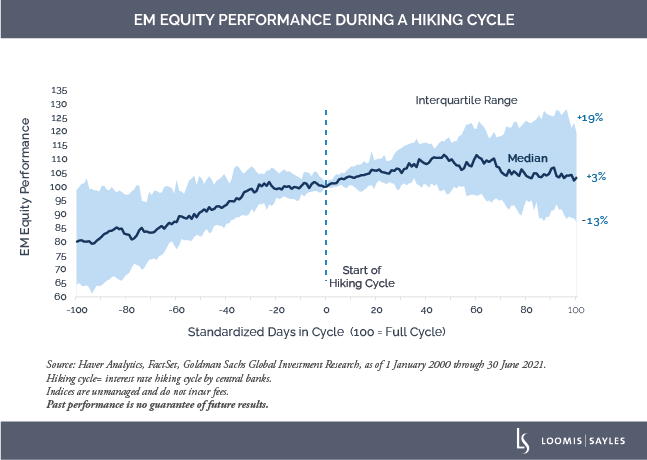

In my view, some investors have a misperception that higher rates are bad for EM equities. However, as you can see in the chart below, the performance of EM equities during a rate hiking cycle can vary widely.

At the start of a hiking cycle, strong growth can help propel EM equity markets higher. Consider Brazil and Russia—both countries hiked rates in the second quarter but still outperformed the broader MSCI Emerging Markets Equity Index.[iii] On the other hand, EM equities can fall when rate hikes are poorly telegraphed. Turkey’s central bank started raising rates in March, primarily due to political reasons, and the country underperformed in the second quarter.[iv]

Remember, real policy rates are still very low in many EM countries. Even if nominal interest rates were to increase 50 to 200 basis points, as many economists have predicted, real rates would still be low by historical standards. Given that many EM countries are still in the throes of the pandemic with very low rates of inoculation, emergence of new virus variants and substantial economic slack, we do not expect nominal rates to rise significantly.

Fear-driven selloffs can bring opportunity

I’ve learned that in the short to medium term, macro fears can overwhelm the “micro” in emerging markets. In macro melt-ups, the rising tide can lift all boats; in macro meltdowns, “babies can be thrown out with the bathwater.” I believe that many global investors are “tourists” in emerging markets without fully understanding what they own, which can lead to indiscriminate selling when markets turn. However, I think this can create potential opportunity for dedicated, fundamental, bottom-up, research-driven EM equity investors that have the conviction, the confidence and the anchor to buy in periods of market mayhem.

[i] Economic slack is a phrase used to describe the amount of unused resources in the economy.

[ii] Source: Goldman Sachs Global Investment Research, as of 30 June 2021.

[iii] Source: Factset, for the period from 31 March 2021 to 30 June 2021.

[iv] Source: Factset, for the period from 31 March 2021 to 30 June 2021.

MALR027588

Market conditions are extremely fluid and change frequently.

Past performance is no guarantee of future results.