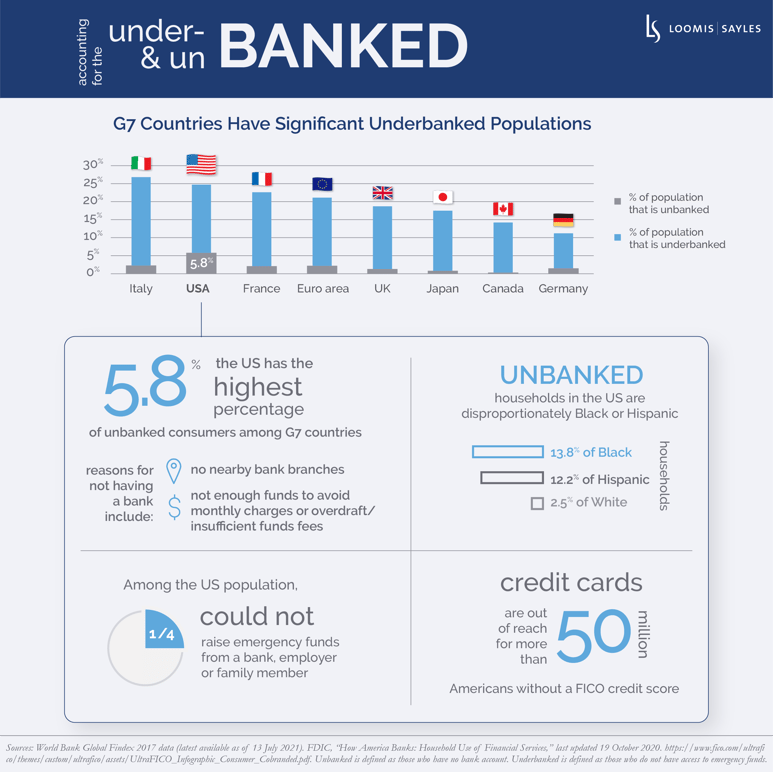

The pandemic has increased the public’s awareness of the racial wealth gap and the role that banking has played in racial wealth inequality. According to the Federal Deposit Insurance Corporation (FDIC), approximately 7 million households in the United States are “unbanked,” meaning no one in the household has a checking or savings account at a bank or credit union.[i] Many more are “underbanked,” meaning they have only limited access to mainstream financial services.[ii] Instead, the underbanked typically rely on cash or high-cost alternative financing such as pre-paid debit cards, check-cashing services, pawn shops or payday loans. FDIC surveys show that unbanked and underbanked households are disproportionately low-income and minority populations.

The role of banking in racial wealth inequality

I believe banks can provide three key financial products that help build wealth over time:

1) Deposit accounts that are free or have low monthly fees, with safeguards to prevent excessive overdraft charges. Excessive charges and overdraft fees can cause a debt trap for people with low incomes and low savings. To illustrate, large US banks received more than $11 billion in overdraft fees in 2019. Just 9% of all bank accounts were responsible for paying 84% of those fees.[iii]

2) A credit card or other tool to cover short-term deposit account shortfalls and surprise financial needs. Remember, consumer credit scores haven been largely based on past borrowing behavior. Therefore, consumers that have never borrowed from a bank or credit union could be denied a credit card even if they have a strong track record of paying bills on time. People that don’t have credit cards often have to resort to high-interest payday loans if they have a cash shortfall.

3) Affordable mortgages. Affordable and accessible mortgages enable homeownership, which can help build wealth over time and potentially lead to multi-generational wealth.

Until recently, banks had done little to reduce racial wealth inequality. In fact, one major US bank was fined in 2019 for charging Black people higher mortgage rates,[iv] and another was fined in 2020 for discriminatory hiring practices against Black people.[v]

Steps toward financial inclusion

Things have been changing fast. In 2019, the Business Roundtable, an association of CEOs of some of the largest US companies, redefined a corporation’s purpose “to promote the interests of all Americans.”[vi] That’s to say, the association believes a company should seek to benefit all stakeholders—customers, employees, shareholders and society at large—not just its shareholders.[vii] With this change, top CEOs have sent a signal about how they expect companies to behave, and I believe it reflects an increased focus on social and environmental issues among shareholders. In addition, banks must also satisfy the requirements of regulators that seek to ensure bank soundness, customer protection and fair access to financial services.

This shift in corporate thinking, along with increasing public pressure to address the structural causes of racial wealth inequality, has motivated banks to improve financial access. As a result, many banks have set targets to meaningfully increase small business loans and mortgages to underserved communities. Some have promised growth capital for minority-owned banks. Banks are also looking at changing product design to improve financial inclusion, such as offering basic bank accounts with limited fees. And banks are finally rethinking the decades-long practice of using credit scores to determine creditworthiness. They have begun exploring other criteria to help expand access to loans. I’m hopeful that the number of unbanked and underbanked people in the US will see meaningful reductions in the next few years.

Good citizenship is good business

For banks, there’s more at stake than just being good citizens. I believe it can also be good business. Citi has estimated that the racial wealth gap has cost the US economy $16 trillion over the past 20 years.[viii] Lending to an underserved segment of the population opens up new growth opportunities. Financial technology companies have figured this out and have been targeting these customers, creating new competition for banks. Digitization and mobile banking make banking more accessible to underserved communities and they’re cheaper than traditional product distribution. So, in many ways, I believe banks can help narrow the racial wealth gap while also serving their shareholders.

[i] FDIC, “How America Banks: Household Use of Banking and Financial Services,” last updated 19 October 2020.

[ii] FDIC, “2017 FDIC National Survey of Unbanked and Underbanked Households,” October 2018.

[iii] Center for Responsible Lending, “Overdraft Fees: Banks Must Stop Gouging Consumers During the COVID-19 Crisis,” June 2020.

[iv] https://www.occ.treas.gov/news-issuances/news-releases/2019/nr-occ-2019-27.html

[v] https://www.dol.gov/newsroom/releases/ofccp/ofccp20200824

[vi] https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

[vii] Business Roundtable, “Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans,” 19 August 2019. https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

[viii] Citi, “Citi Launches More Than $1 Billion in Strategic Initiatives to Help Close the Racial Wealth Gap”, 23 September 2020. https://www.citigroup.com/citi/news/2020/200923a.htm

MALR027516

Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.