Over the past several weeks, a handful of Chinese state-owned enterprises (SOEs) defaulted on their onshore debt commitments, sending shockwaves through China’s onshore debt markets. Despite the volatility, we do not believe the situation presents a systemic risk to the broader Asian high yield bond market. Here, we recap what happened and explain why we believe the correction was based on market fears instead of a real surge in credit events.

The defaults that triggered it all

The situation started with the default of Brilliance Auto, an SOE also known as the Huachen Automotive Group, in late October. Market fears picked up steam when Yongcheng Coal & Electricity Holding Group Co. defaulted on November 10. Rumors that the enterprise had transferred valuable assets ahead of the default left bondholders concerned about recovery value. Finally, Tsinghua Unigroup, a large chipmaker partially owned by Tsinghua University under China’s Ministry of Education, defaulted on small-sized bonds valued at CNY 1.3 billion on November 18.

As a result, liquidity dropped for weaker SOEs, particularly in economically weaker provinces. Funding costs rose for AA+ credit, considered speculative grade in China’s onshore bond market. Spreads widened in the three-year AA+ segment of the market, which generally contains the weakest SOEs. The largest movements were concentrated in the defaulted bonds and bonds of entities with a perceived weak government link or headline-driven nature, representing less than 0.5% of the entire market. Spreads in the five-year AA+ segment were relatively stable as it is a much smaller part of the market and investors in this longer-maturity segment tend to be stickier.

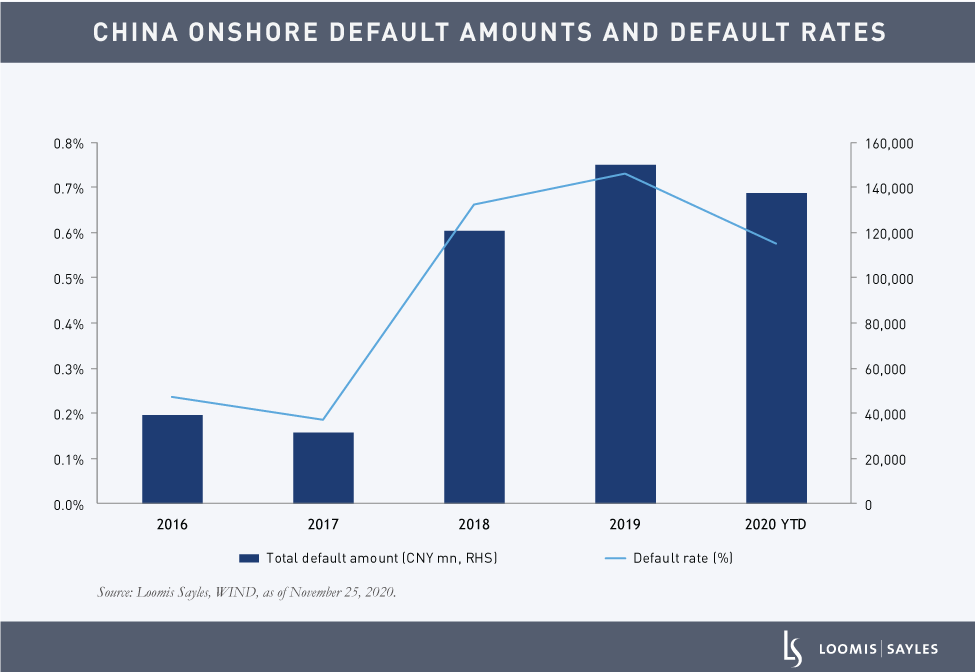

China’s onshore bond market experienced a large shift in the number of defaults in 2018. The number of defaults soared from 34 in 2017 to 125 in 2018, and has stayed above 100 each year since then. Because defaults on this scale are a relatively new phenomenon in this market, market participants are still gaining an understanding of the legal framework and steps involved with defaults and debt restructuring. As a result, defaults in segments of the bond market that are perceived as different from historical defaults tend to cause market panic.

After observing the market reaction, the Chinese government took swift, decisive action to contain the market impact. The State Council Financial Stability Development Committee, chaired by Vice Premier Liu He, met about two weeks after the Yongcheng Coal event on November 21 to regulate bond market development and help maintain bond market stability. The government also implemented a fraud probe of Yongcheng Coal, and expanded the inquiry to include banks, rating agencies and accounting firms. Furthermore, Yongcheng Coal has now agreed to pay back 50% of the bond proceeds and return the rest within 270 days. We believe this action signals to the market that the Chinese authorities will step in to regulate fraudulent activities.

Default rate reality check

Despite the headlines and volatility, China’s onshore default rate has not reached an elevated level. In fact, defaults appear to be on track to finish 2020 in line with or slightly below their 2019 level, which is remarkable given the economic stress from the pandemic. The year-to-date total onshore default rate was 0.6% as of November 30, well below the broader EM corporate default rate of 3.2% and the US high yield default rate of 6.7%.[i]

The default rate for the US-dollar-denominated Asia high yield bond market (which contains offshore Chinese issuance) also compares favorably to EM and DM high yield default rates. As of October 31, 2020, the market’s default rate stood at 2.7% year to date and default expectations for 2020 were about 3.0%.[ii]

Defaults likely to be contained in 2021

We have long held the view that Chinese authorities will increasingly allow defaults to reduce leverage within the financial system. Allowing defaults can reduce "moral hazard" and enable more efficient pricing of credit risk. Additionally, the central government is requiring SOEs to deleverage, and most SOEs have been in balance sheet repair mode over the past few years. Looking out to 2021, we expect China to continue to focus on financial stability and improving bond market efficiency. SOEs operating in sectors that have overcapacity or are highly commercialized (e.g., coal and chemicals) may face higher default risk.

When we assess the default backdrop for the USD Asian HY market, we consider the debt stock maturing in 2021, the issuers currently trading at distressed levels and issuers operating in challenged sectors. While the dollar amount of defaults for the USD Asian HY market has grown, so has the universe itself. The total Asian HY bond stock has more than doubled from $123 billion at the end of 2015 to $260 billion today.[iii] Based on these factors, we believe that defaults should remain manageable.

More broadly, we believe a global growth recovery, a continued low-rate environment, thirst for yield and a constructive technical backdrop are easing refinancing pressure for high yield issuers. This should help mitigate defaults. While pockets of default risk are likely to persist, we don’t see a major uptick in onshore defaults causing contagion in the offshore market in 2021.

[i] Source: JP Morgan.

[ii] Source: JP Morgan.

[iii] As measured by the JP Morgan Asia Credit Index Non-Investment Grade, data from October 31, 2015, to October 31, 2020.

MALR026450

There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. Market conditions are extremely fluid and change frequently.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.