1. What’s your overall view of the high yield market as we enter the year?

High yield bond investors have enjoyed a good run over the past couple of years, thanks to attractive all-in yields, tightening spreads and broadly stable credit fundamentals. Looking ahead, the fundamental picture continues to look solid, supported by a positive earnings backdrop and a resilient US economy. On the other hand, we think spread compression may have run its course for this cycle. At Loomis Sayles, we like to look at the difference between spreads and expected credit losses from potential downgrades and defaults, known as the risk premium. Today's high yield risk premium is on the narrow end of its historical range, even considering the generally positive economic backdrop. The good news is that we expect relatively mild credit losses this year, with defaults likely to stay around 3%. Putting it all together, we think high yield bonds will continue to be an attractive place to get carry, though investors should lower their total return expectations a bit.

2. Is there anything interesting happening in the market that stands out to you?

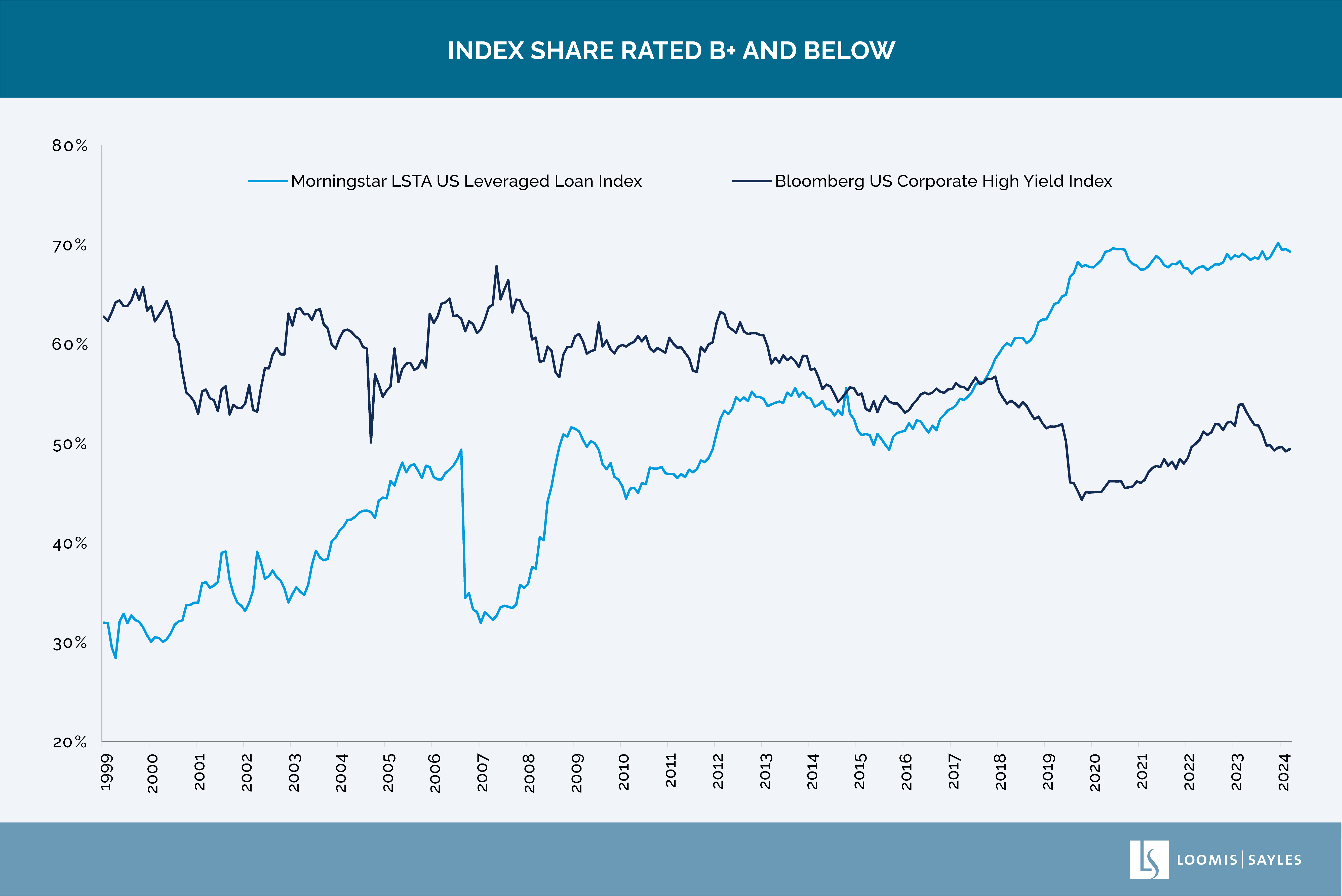

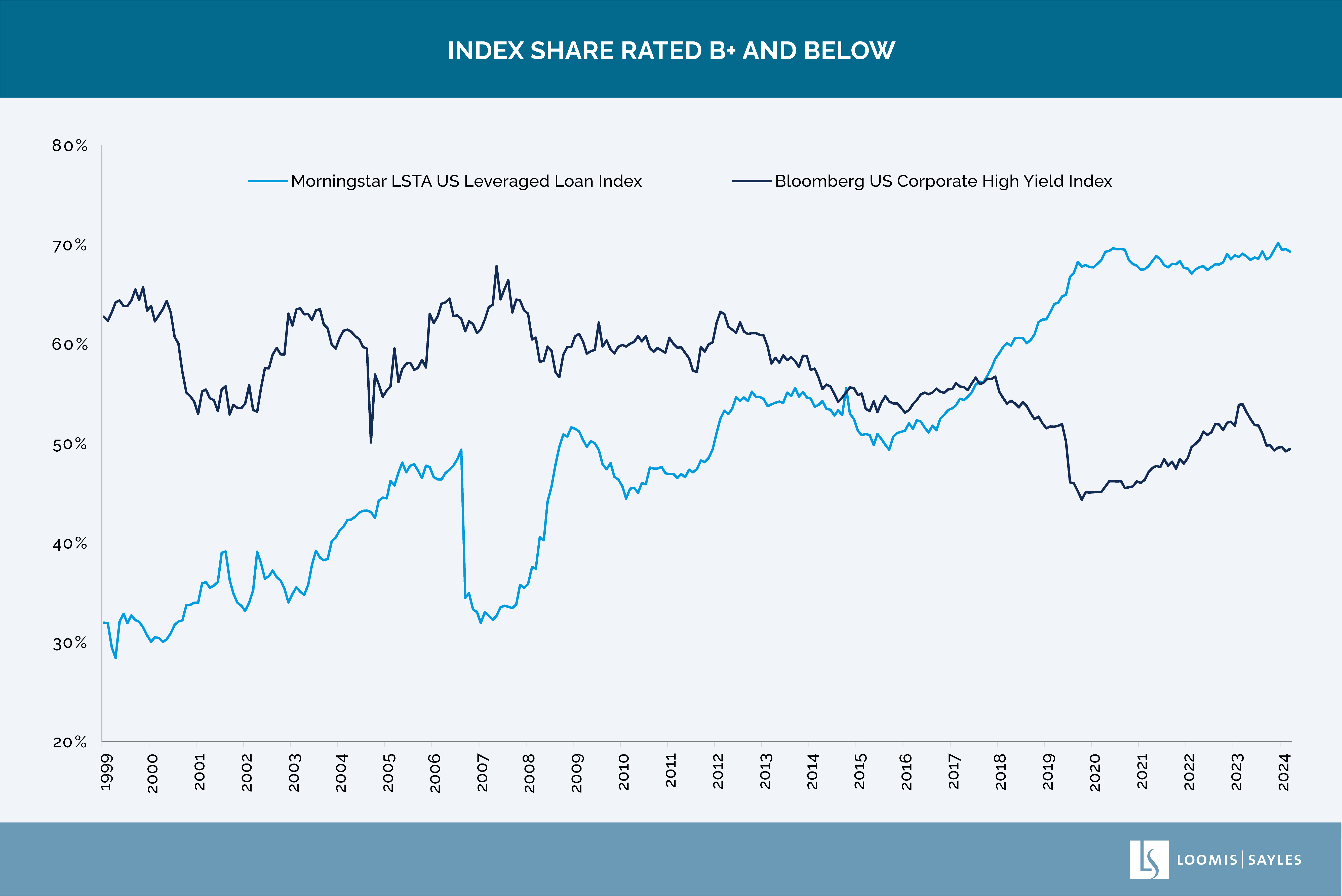

There has been a long-term trend of issuance shifting from the high yield market to the syndicated bank loan market. We find that interesting because many credits that normally would come to the high yield market for funding have gone into the leveraged loan market. As a result, the overall quality in bank loans has dropped from about a BB level on average a few years ago to a B average today, which is more in line with historical average quality for the high yield market. In high yield, issuance has largely been refinancing activity to address upcoming maturities, and we believe the default probability and the average quality has possibly even improved a bit. It’s a dynamic we're keeping an eye on. The idea that high yield and bank loans are more similar will likely persist into the coming years.

Chart source: Bloomberg and Morningstar LCD as of 31 December 2024

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

3. What are the main risks you’re watching going into 2025?

To start, we expect policy-related volatility in the United States. Announcements about tariffs, budget considerations, tax policy and more could translate into an upside or downside event depending on how it affects the economy and corporate profitability. We’re also mindful of any inflationary boost that might come from new government policies. Inflation is one of the key downside risks we’re focused on this year. If inflation starts climbing again, we believe it could stop the Fed’s easing cycle in its tracks, tightening financial conditions and putting the pressure on corporate health. Right now though, we’re anticipating another year of relatively mild credit losses. If spreads happen to bump out wider, we would view it as more of a buying opportunity given the current supportive macroeconomic and fundamental backdrop.

WRITTEN BY:

Matt Eagan, CFA, Portfolio Manager, Head of Full Discretion

SAIFdgnvzqvd

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.