In a previous post, we presented several risk mitigation strategies with the potential to help bolster and defend portfolio performance by hedging against market-moving events. The following synopsis takes a look in the rearview mirror at how risk mitigation strategies fared post-election. And with potentially no shortage of volatility-inducing events in the future (e.g., Brexit, January Senate election, stimulus debate), this information could be vital.

Seeking to achieve financial goals

Typically, the goal of most investors comes down to protecting invested capital and earning attractive risk-adjusted returns. As we have witnessed over the years, market crises can derail that goal – sometimes dramatically. A 50% drawdown implies the need to earn 100% just to come out even. Drawdowns may occur more often than many investors think. On average, there has been a major drawdown nearly every two to three years.

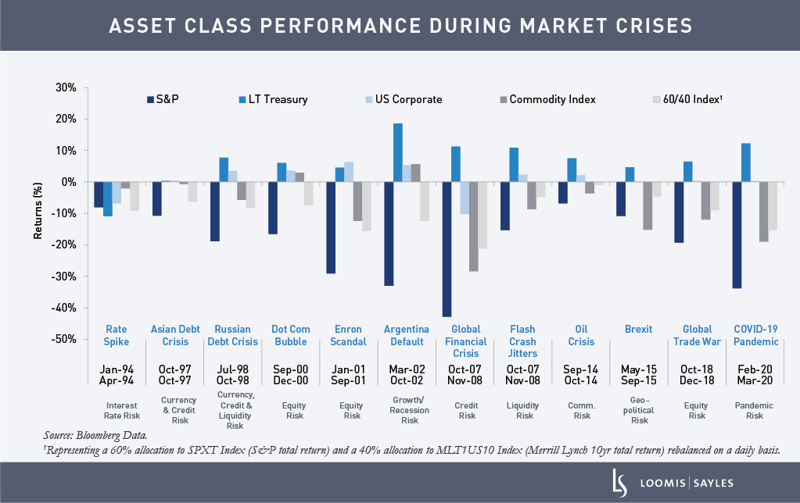

Crises don’t present the same challenges

There are a variety of risk mitigation strategies available in the market, including puts, managed futures, Treasurys and alternative risk premia (ARP). In our view, demand for a variety of alternatives persists because each crisis may present a different hedging challenge. Consider the asset class performance during each of the 12 crises shown in the chart below. It’s no wonder that risk mitigation isn’t a one-size-fits-all endeavor.

In our view, if crises do not look alike, neither should a portfolio hedging strategy.

2020 election

The 2020 election provided another set of characteristics that influenced hedging outcomes. Prior to the November election, market participants appeared to be bracing for a “blue wave” and the potentially negative implications for risk assets (higher inflation and rates). We saw indications of this in the VIX1. Even though it averaged 17.52 for the five years ending November 5, 2020, and averaged just over 28 for the past six months, it shot up to about 40 days before the election. This market sentiment contributed to excessive demand for risk mitigation hedges.

With this backdrop, it is understandable that implementing a hedging a strategy in the days before the election came at a steep price. Was it worth it?

Hedge Vehicle

|

Potential Outcomes

|

| Puts |

In this instance, an expensive hedge using puts would have likely detracted from portfolio performance. |

| Treasurys |

Treasurys could have been an effective hedge immediately following the election. However, vaccine news would likely have derailed that performance. The result was a range-bound 10-year Treasury. |

| Managed Futures |

All in all this could have added to portfolio performance and been a positive strategy. |

| ARP |

The premise underlying most ARP portfolios is to add diversification to a portfolio while also mitigating risk. By choosing certain risk premia (equity, foreign exchange, rates) the goal typically is to generate alpha and earn income to pay for hedges. Given that ARP portfolios are typically market (beta) neutral, they likely would have added positive performance post-election. |

It is unlikely that any one of the hedging strategies listed above would have been effective in the period surrounding the November election. In our view, this is typical of hedges. Therefore, we believe investors should consider a multi-solution strategy. This approach involves seeking to identify market regimes and tactically increasing or decreasing duration hedges in addition to alternative risk premia and managed futures.

Balancing a permanent and prudent mix

In our view, protecting a portfolio is equally as important as seeking performance—and can be harder to achieve. As noted, we advocate for a permanent and prudent mix of managed futures, multi-asset risk premia, regime-biased Treasury allocations and options in an attempt to provide solid protection.

WRITTEN BY:

1The VIX stands for the CBOE Volatility Index. It is a measure of the 30-day expected volatility of the broad U.S. stock market.

Past performance is no guarantee of future results.

Commodity, interest and derivative trading involves substantial risk of loss.

Any investment that has the possibility for profits also has the possibility of losses.

Diversification does not ensure a profit or guarantee against a loss.

Market conditions are extremely fluid and change frequently.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

MALR026482

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.