Coming into the home stretch of 2020, continued concerns about COVID-19 and the political environment persist and have been feeding risk-averse sentiment for many investors. Given the year the world has experienced, it’s not surprising people are focusing on portfolio risk mitigation.

Preparing a portfolio for a crisis?

During the past two decades, we have had an internet crisis, a housing crisis, an energy crisis and most recently, a crisis brought on by a virus. Notably, what caused a past crisis may not cause the next one.

Every risk-mitigation technique has pros and cons. In our view, an extreme step would be to avoid risk and exit the position or portfolio, thereby incurring considerable transaction costs. By eliminating a position, the chance of participating in a recovery could result in a potentially significant opportunity cost. We believe an effective risk-mitigation strategy should allow for simple and transparent reduction of risk—with consideration for expense.

A relatively simple approach to risk-mitigation strategies

The first step in most risk-mitigation exercises is to define risk tolerance. With this determined an investor can move across a spectrum and weigh the likely advantages and disadvantages.

Puts can be a typical defensive hedge. For example, an investor with a portfolio exposed to the S&P 500 Index can try and limit the potential downside by purchasing puts on the S&P 500 Index as an explicit hedge. The cons include that they can be expensive, especially as risk sentiment escalates. This could cause a significant performance drag during normal periods.

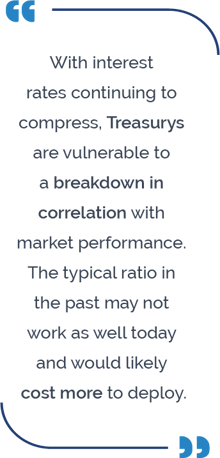

Reexamine traditional hedge relationships

One alternative could be adding exposure to an asset class that has demonstrated resilience in times of stress. Typically, investors have flocked to US Treasurys in these instances. The main advantage is that they are liquid and high-quality, traditionally a good hedge to risk assets.

However, with interest rates continuing to compress, Treasurys are vulnerable to a breakdown in correlation with market performance. The typical ratio in the past may not work as well today and would likely cost more to deploy. In the past, when there was a 20% drawdown in equities, the duration hedge would rally 6% to 8%.[1] However, with nominal 10-year rates at approximately 85 basis points, Treasurys may only rally 2% to 3% during the same 20% drawdown. We believe that a better way to utilize a Treasury strategy would be to consider a systematic regime-based implementation; as risk aversion increases, so does the exposure to Treasurys.

Managed futures

There may be opportunities to add risk through uncorrelated absolute-return strategies. In this instance, adding a diversified and non-correlated risk asset to a portfolio can offset other risk assets and potentially benefit performance.

Managed futures contracts exist on various assets, including commodities, bonds and currencies, interest rates and equity indices. These standardized contracts are both liquid and highly transferrable.

Managed futures strategies can be designed to follow trends and market momentum, either positive or negative. Managed futures are typically combined with other asset classes to offer greater portfolio diversification. Since they often trade a variety of other market categories like commodities and currencies, these instruments are usually uncorrelated with equities. This feature can reduce risk exposure to a portfolio that holds equities and credit risk exposure.

With any trend-based strategy, a sideways market can restrain its benefits. However, in a crisis, markets rarely go sideways.

Factors

Alternative risk premia, or constructing a basket of factors, is another option that adds risk in the quest to mitigate potential overall portfolio drawdown. Factors are born from academic research and supported by intuitive rationales as to why they provide a premia (e.g., using price-to-earnings ratio as a measure to purchase a value stock). These tend to provide positive return potential with low correlation to general market beta but may not be very effective in hedging “gap” risks—crises that occur all of a sudden resulting in prices gapping lower (e.g., terrorist attack).

No one solution

These can all be useful strategies with pros and cons. Our goal for any hedging strategy is that it should not cause drag in a normal market and should be able to provide benefits during a crisis.

Since no single solution is effective to hedge against all types of risks, we prefer a multi-faceted approach that includes regime-based tactical implementation of hedges with alternative risk-premia factors and managed futures. This type of strategy could be included as a core element in each portfolio to complement a broader risk-seeking allocation in an overall portfolio.

WRITTEN BY:

MALR026238

[1] Source: Bloomberg, Loomis Sayles analysis of historical relationship between the S&P 500 Index and US Treasurys.

Past performance is no guarantee of future results.

There is no guarantee that the objective will be realized or that the strategy will generate positive or excess return.

Commodity, interest and derivative trading involves substantial risk of loss.

Any investment that has the possibility for profits also has the possibility of losses.

Diversification does not ensure a profit or guarantee against a loss

Market conditions are extremely fluid and change frequently.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.