Over the past year, headlines about “creditor-on-creditor violence”—situations where different creditor groups clash over restructuring terms—have dominated the conversation in leveraged finance. While these high-profile disputes make for compelling stories, they represent just one component of a broader and more significant trend: the rise of liability management exercises (LMEs).

LMEs, also known as distressed exchanges, involve renegotiating debt terms outside of bankruptcy, often allowing companies to stabilize their balance sheets inorganically and avoid a Chapter 11 filing at an inopportune time, such as when earnings are at a cyclical low. Debtholders can also benefit from these transactions, perhaps through enhanced security due to better collateral or by receiving a higher coupon.

The increasing complexity and volume of LMEs in today’s market present both challenges and opportunities. Here are some key considerations for investors.

Why LMEs are on the rise

The increasing use of LMEs reflects a convergence of factors that have reshaped the leveraged finance landscape. We see three primary drivers behind this trend:

- Higher interest rates are exposing over-levered balance sheets.

Rising base rates have heightened the financial strain on companies with little or no equity cushion. LMEs allow these companies to reduce their debt by capturing material discounts to par. While these transactions tend to leave interest expense largely unchanged, they help create equity value and potentially enable a more sustainable balance sheet going forward. - Weak credit documentation enables opportunistic transactions that can cause creditor infighting.

Flexible and sometimes poorly structured credit agreements have made it easier for companies to pursue tactics like “drop-down” transactions, where collateral or assets are moved away from existing debtholders. This often allows new lenders to secure claims on valuable assets, leaving existing creditors in a weakened position. These dynamics have been more prevalent in smaller or sponsor-backed capital structures where aggressive tactics can be executed with less scrutiny. - Public companies are increasingly embracing LMEs.

Historically, public companies avoided LMEs due to reputational concerns, but we believe this dynamic is shifting. Public issuers with large capital structures have recently appeared more willing to leverage the flexibility in their debt documents to renegotiate terms and extend their financial runway.

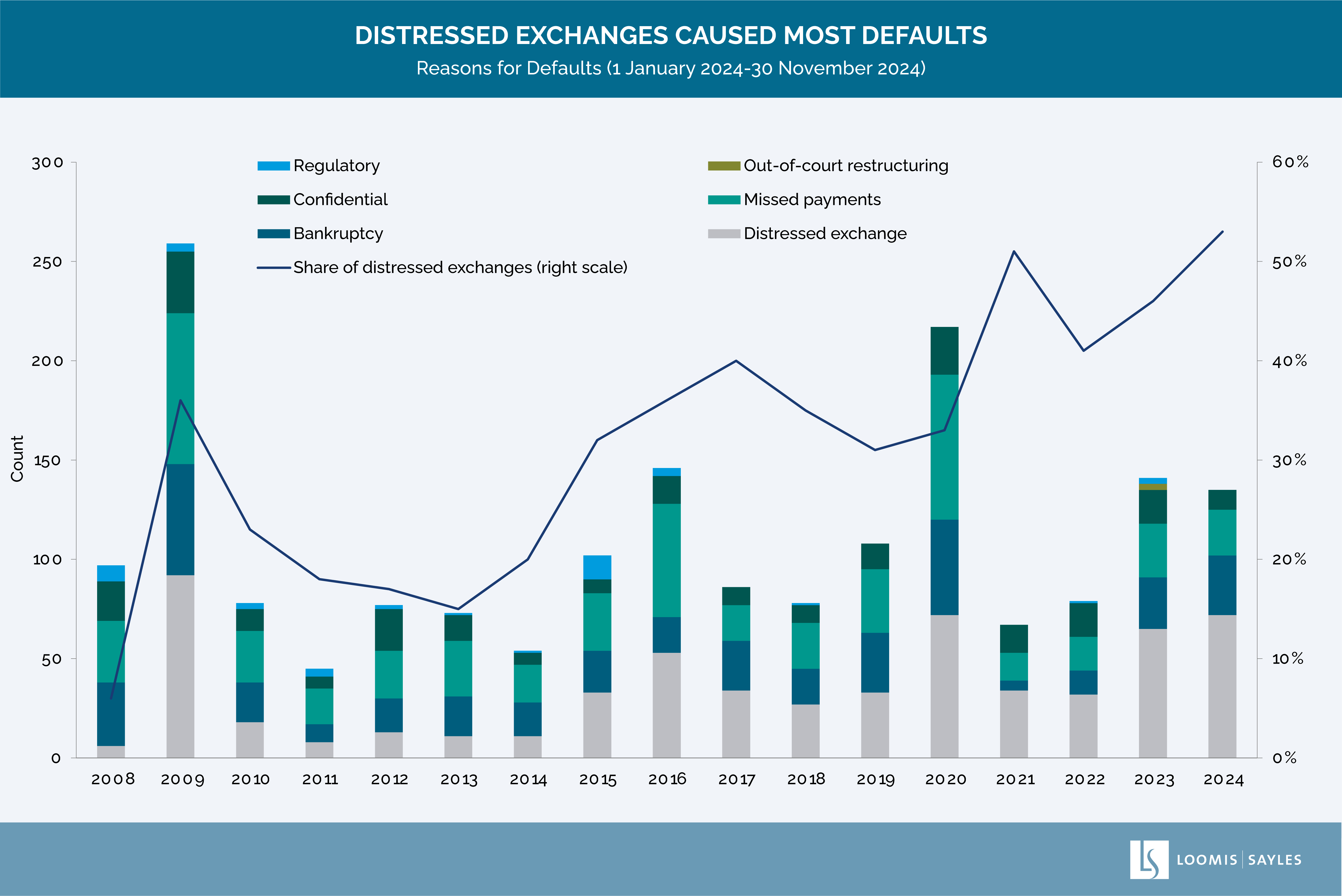

Chart source: S&P Global Ratings Credit Research & Insights, data from 1 January 2024 through 30 November 2024. Data has been updated to reflect confidential issuers.

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

The renewed role of cooperation agreements

As creditor disputes become more common amid rising LMEs, cooperation agreements have reemerged as a useful tool for debt investors. These agreements formalize collaboration among creditors, preventing any single group from securing preferential terms at the expense of others.

While traditionally viewed with skepticism due to concerns about reduced trading liquidity and administrative burdens, recent cases have highlighted their value in protecting creditor interests. At the same time, cooperation agreements are not a silver bullet. Their effectiveness depends on early, active engagement from investors and a deep understanding of borrower motivations.

Taking an active role in navigating LME risks

We believe the growing prevalence of LMEs in stressed and distressed companies demands that debt investors take a more active role in engaging with borrowers and collaborating with other debtholders across the capital structure. In our view, understanding the motivations of all parties involved—a complex, time-intensive process—can help investors better evaluate the risks of creditor-on-creditor violence and, in some cases, help shape the structure of an LME to protect recovery values. We believe managers who prioritize quality over quantity are more likely to succeed.

The rise of LMEs, coupled with concerns around creditor-on-creditor violence, has often led to dislocation in bond and loan prices. The risks surrounding LMEs can trigger selling pressure and push debt prices well below their fundamental value. In these situations, we believe remaining focused on the true worth of the business—and evaluating recovery values under multiple scenarios—can help investors find attractive long-term opportunities amidst the fog of uncertainty.

SAIFrysiekq4

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.