It’s no secret that the retail sector has been under a lot of pressure. Retailers are facing significant headwinds, including high competition, increasing promotional costs and declining mall traffic. So is retail exposure a problem for CMBS? The short answer is yes. But it’s complicated.

Loan quality matters more than concentration

Prior to the financial crisis, the typical retail concentration in conduit commercial mortgage-backed securities (CMBS) varied from 30% to more than 50%. Retail concentrations ticked up in CMBS issued in 2010 and 2011 due to the pattern of maturities and lack of alternative financing. Though concentration rose, the retail loans originated during the early days of the recovery, were generally very conservatively underwritten, secured by institutional-quality properties and run by top real estate operators (the top-tier retail real estate investment trusts (REITs)). Today, retail concentration in new CMBS is much lower, and a handful of deals have no retail.

Retail concentration poses a risk to some of the lower-rated classes of CMBS, but so does concentration of any property type. When investors purchase the subordinate, or lower-rated, classes of any CMBS, they are effectively buying the credit performance of the weakest loans.

If an asset is old, functionally obsolete or owned by weaker sponsors, it is vulnerable. Old malls can fail, but so can suburban office buildings in markets with weak job growth, hotels competing with Airbnb, and older industrial buildings that no longer fit into modern distribution networks. In my view, loan quality matters more than concentration.

Mind the gap

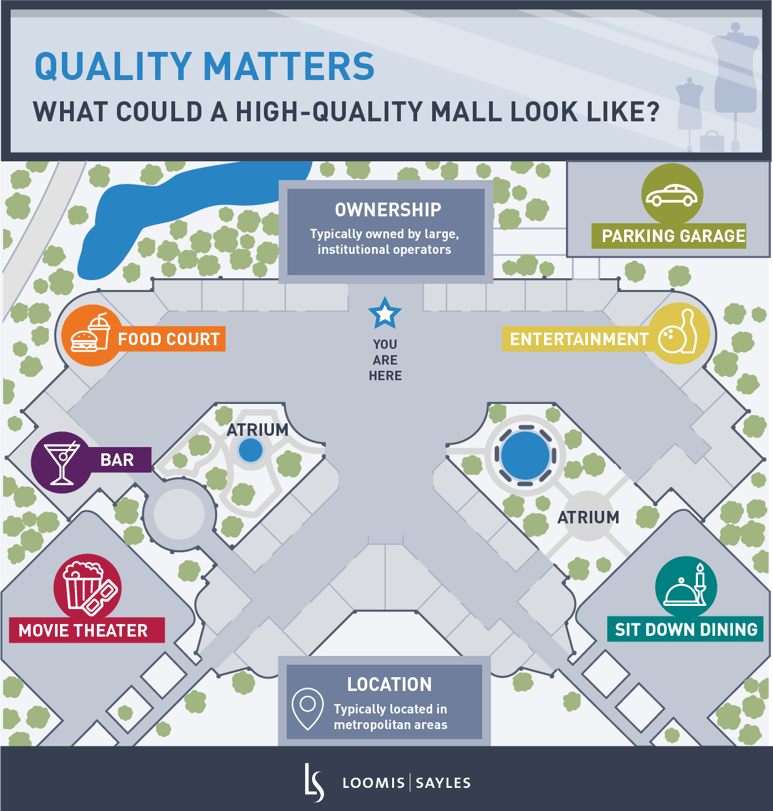

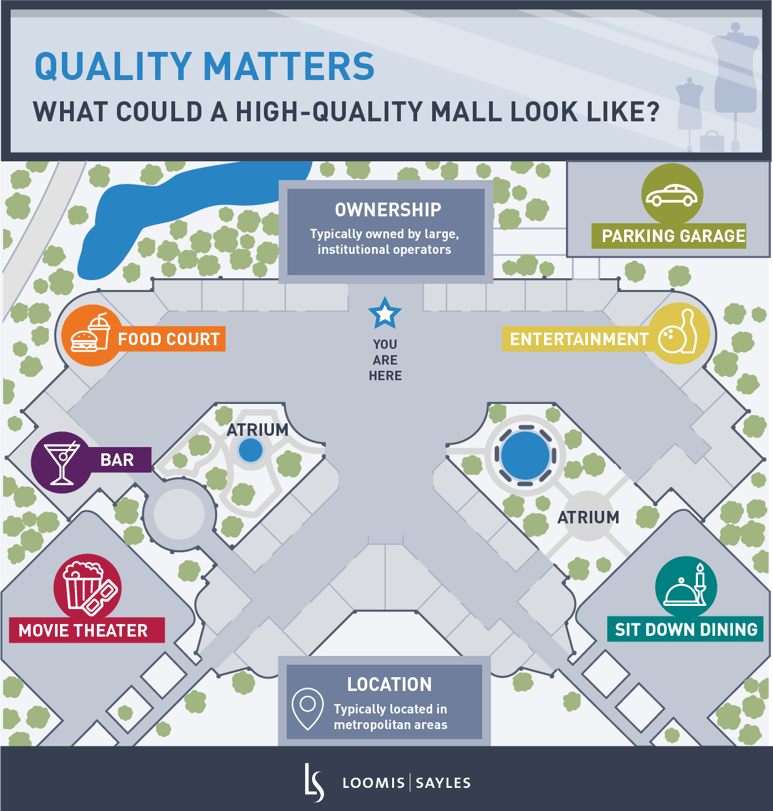

There’s a gap in retail asset and loan performance, and it’s tied to quality. Credit performance of higher-quality malls has been good during the recent recovery of commercial real estate values (2009 to present). The large operators that typically own these higher-quality malls have been able to handle tenant bankruptcies or downsizing by bringing in new tenants or repositioning malls to offer a more “experiential focus” to draw consumers (think movie theaters, sit-down dining, etc).

The problem malls (in terms of declining net operating income) are typically older, lower quality, less competitive, and located beyond the top 25 metropolitan markets. They’re often operated by weaker REITs or private sponsors. Unfortunately, smaller, older, poorly located centers remain vulnerable to disruption from tenant bankruptcies and store closings.

Focus on the underlying loans

The retail industry is always reinventing itself. Evolution or disruption can have consequences for any industry, property type or loan. This is why I believe CMBS investors should focus on the operational viability of each property given the competitive landscape (in both traditional brick and mortar and online channels). Property performance, and the ability of owners to increase cash flows and enhance value, helps determine the performance of each loan. And the collective performance of each loan backing a CMBS issue determines the ultimate performance of the associated CMBS bonds.

MALR021511

Reference to specific securities or holdings should not be considered recommendations for action by investors. They may not be representative of a strategy's current or future investments and they have not been selected based on performance. Loomis Sayles makes no representation that they have had a positive or negative return during the holding period.