Investors and financial markets are forward-looking. They are constantly trying to anticipate the future and how to position for it. In a COVID-19 world, where economic uncertainty and financial market conditions are at extremes, that’s no easy task. A key question at times like this is: which models and data sets may be best equipped to inform our decision making?

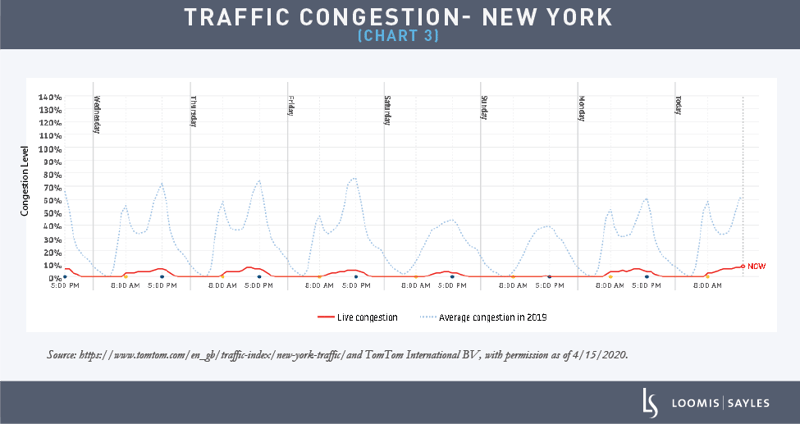

Macroeconomic data alone isn’t a prescient guide because it is lagged. Relying on backward-looking data to make forward-looking decisions is like driving by looking through the rearview mirror. In recent years, there has been tremendous progress in harnessing important alternative data insights through machine learning models. Insights from high-frequency data such as live traffic, hotel and restaurant reservations, and mobility can help investors analyze the road ahead.

For example, in order to understand how the economic and sector impacts of the virus might play out in the United States, it can be important to track developments in countries whose cases peaked ahead of the US.

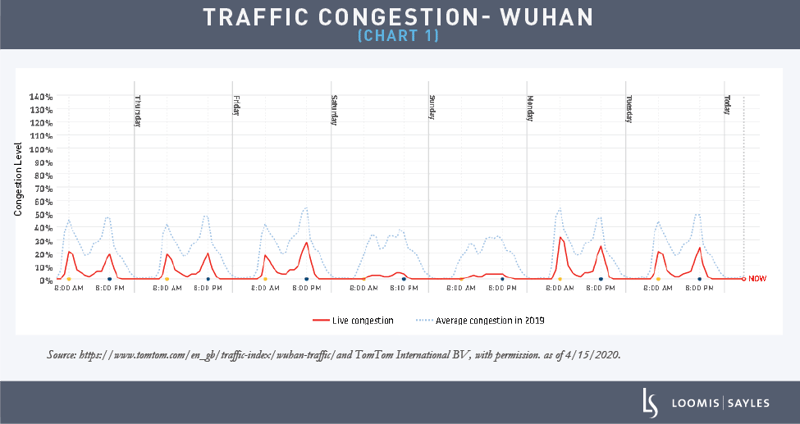

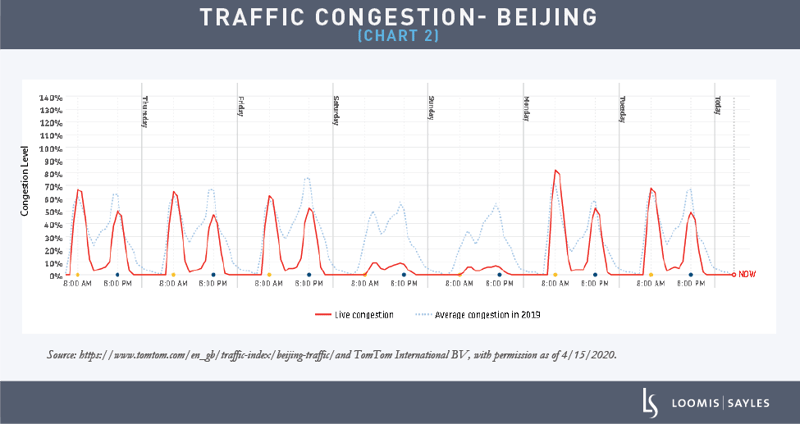

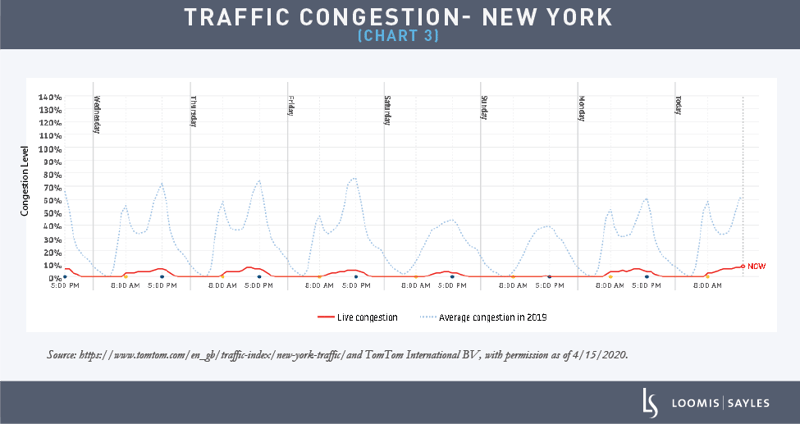

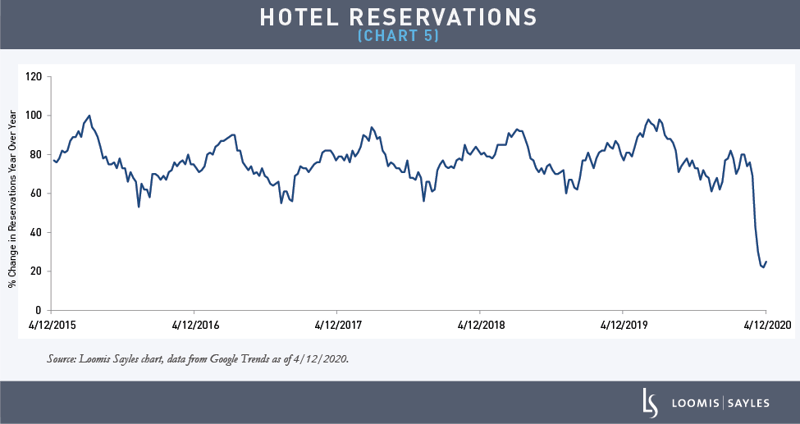

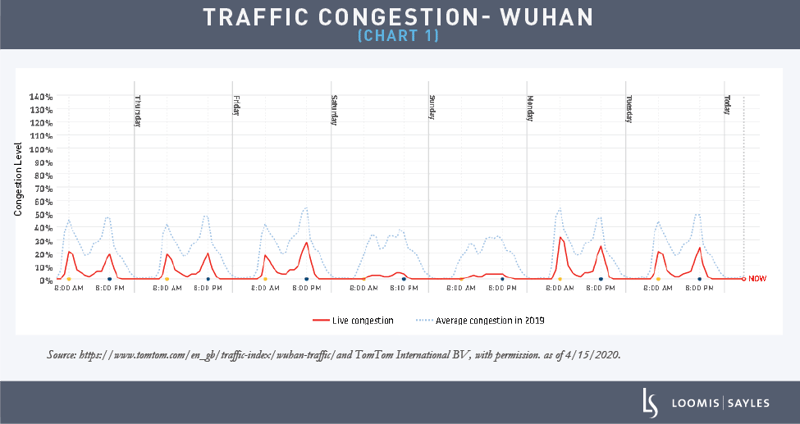

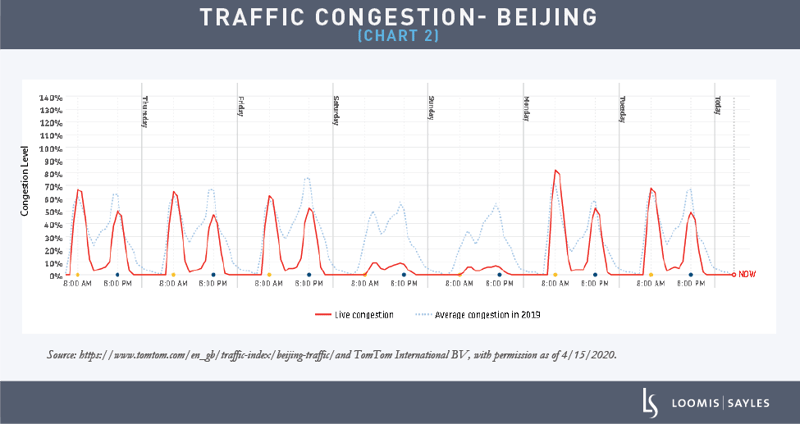

Chart 1 below shows that Wuhan, the first epicenter of the COVID-19 outbreak, has been limping back to normal after the city’s lockdown was eased in the first week of April. Chart 2 shows that work and commerce have returned to pre-COVID-19 levels in Beijing and other major Chinese cities following more than three months of restrictions. However, there’s a noticeable pattern to the Beijing chart: a sharp drop in activity during lunch hours and after 6:00 PM. The country remains closed for entertainment. It may be months before people feel comfortable stepping out for non-essential activities. This doesn't bode well for hotels, restaurants, cafes, or sports venues, which are all likely to feel pain for a long time.

Given that New York was the epicenter of the virus in the US, it is very likely that the city’s recovery time will lie somewhere between that of Wuhan and Beijing. As a result, some sectors of the economy—particularly entertainment, restaurants, and similar services— will experience persistently weak demand for a significant period of time. I believe it will take testing, tracking and eventually a vaccine to assure people that it is safe to step out in public again.

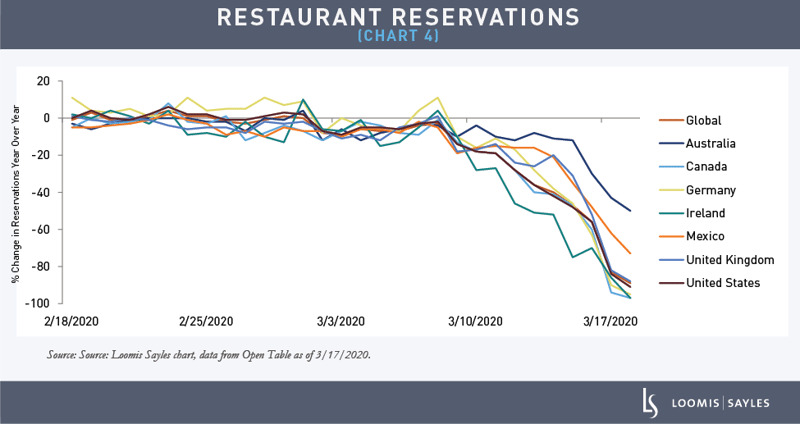

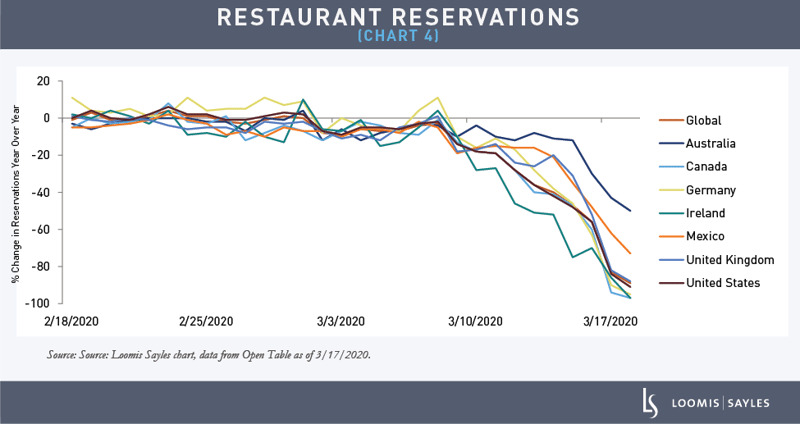

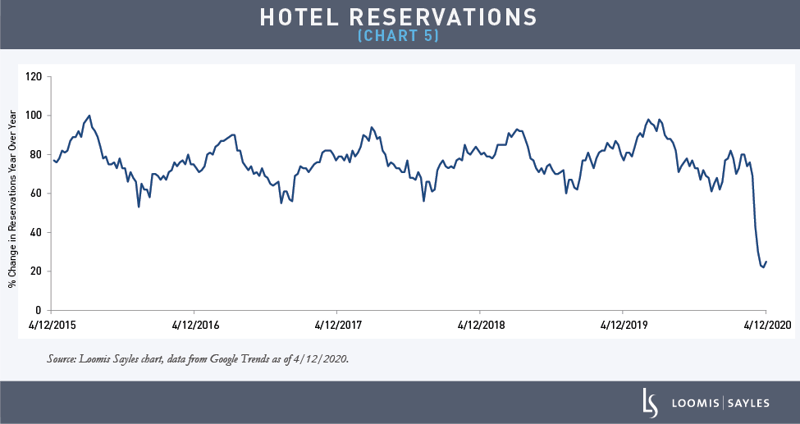

Restaurant and hotel reservations are also key datasets that we compile to analyze how different geographic regions are recovering and how sectors of the economy might perform. As Chart 4 shows, from February 18 to March 17, 2020, reservations dropped by almost 100% in nearly all countries.1 Similarly, Chart 5 shows hotel reservations have plummeted and occupancy rates are under 20%. We will be monitoring these indicators for a pickup in activity.

Investing for the next phase of the cycle

We’ve seen massive dispersion in relative equity sector performance as markets grapple with COVID-19. Sectors including energy, industrials and restaurants have lagged thus far while technology and healthcare have rebounded very quickly. These distinctions are important. I believe that in the next phase of the cycle, alpha will be contingent on picking appropriate sectors and on security selection. Systematic models and alternative data are key inputs to inform our decision making as we aim to stay ahead of the curve.

1Based on the 80+ countries OpenTable operates in.

Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

MALR025316