There’s an important debate bubbling among investors and policy-makers: have residential mortgage lending standards tightened too much for too long in the post-crisis period?

There’s general agreement that lending standards are tighter than the “housing bubble period” (2005-2007), but some continue to argue that credit availability is “normal” and similar to the pre-bubble period (1999-2004). While the debate is complicated by lack of long-term historical information and differences in underwriting standards, the data show that residential mortgage lending today is much more restrictive than under normal (1999-2004) conditions.

Residential mortgage lending today is very restrictive

Below we look at both explicit borrower characteristics and actual performance, which shows that credit is much tighter today than in any period since 1999. Even within the fully documented, 30-year mortgages from Fannie and Freddie, mortgage availability is much lower.

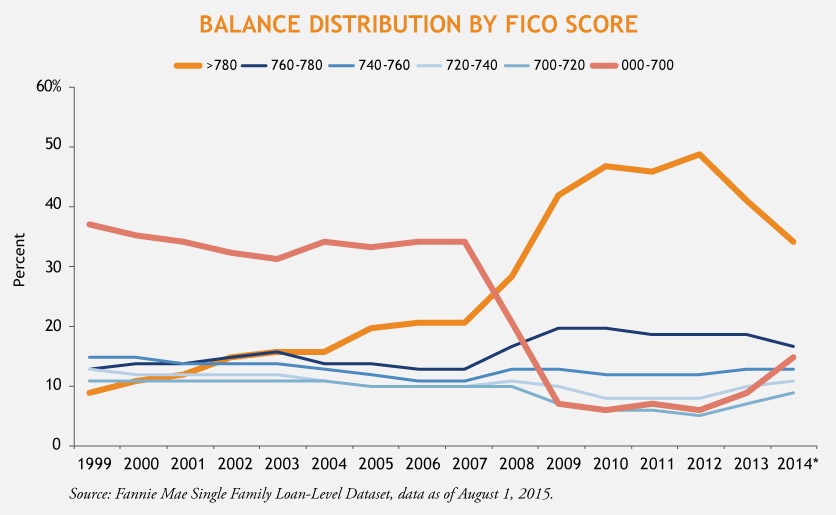

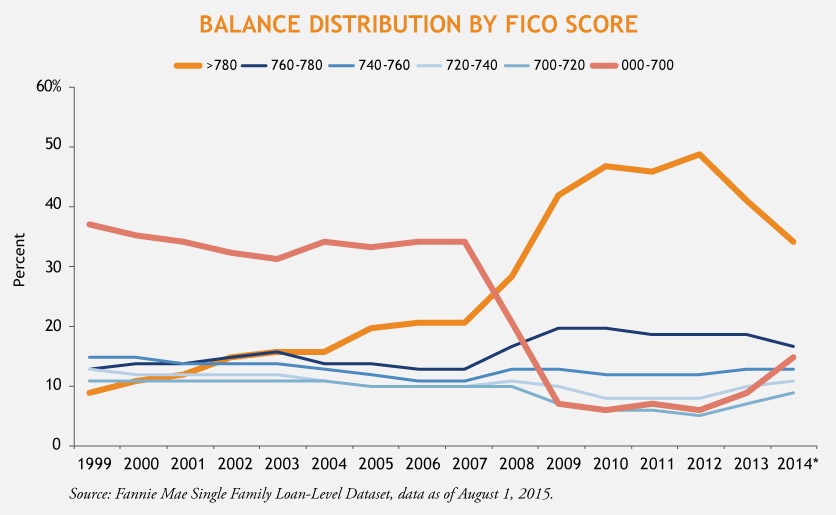

The simplest way to measure credit quality is by looking at the borrower’s FICO score. Higher FICO scores indicate better payment history and forecast lower defaults. Borrowers with FICO scores below 700 (considered more risky) made up around 35% of all Fannie Mae loans from 1999 to 2004 – but since the crisis, have made up less than 10% of loans. At the same time, borrowers with above 780 FICO have increased to over 40% today.

Credit is even tighter than the numbers suggest

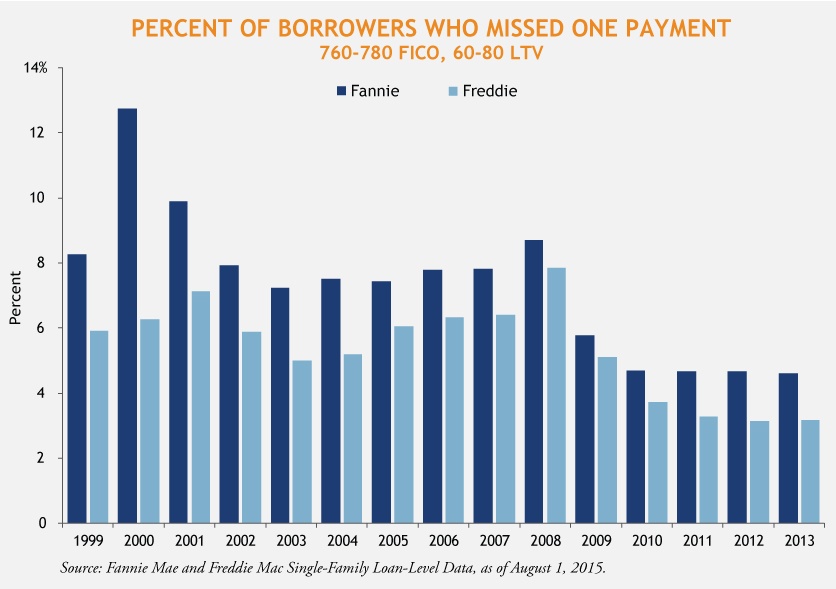

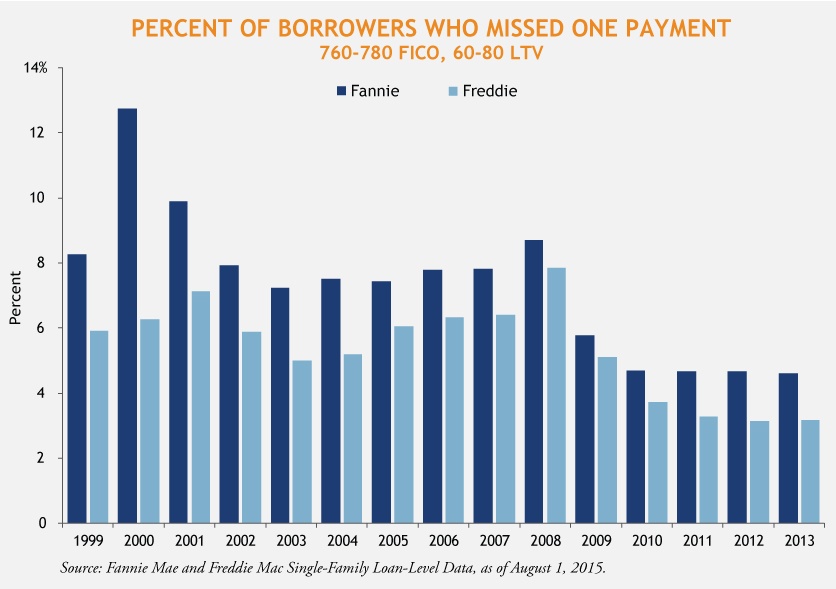

After the crisis, the mortgage underwriting process became more rigorous, making it difficult for even high-credit borrowers to get a mortgage. We can measure this by holding constant the observable credit characteristics of a group of borrowers for each origination year, and seeing how they perform. We measure actual credit quality by seeing how many borrowers miss a payment in the 12 months after origination.If we hold borrower FICO constant (we use 760-780 FICO scores) and loan-to-value (LTV) constant (60-80% LTV), we find that:

- Early missed payments have declined from 6 -12% in the pre-crisis period to 3 - 4.5% today. This means that even holding borrower characteristics constant, credit is 2-3 times tighter than in the pre-bubble period.

- There has been a 2-3x tightening in credit compared to pre-crisis period beyond what we see in higher FICO scores.

Why does it matter?

For investors, tight mortgage standards may present an opportunity to buy mortgage bonds with low levels of credit risk. But for the broader economy, abnormally tight credit has stymied home-buying and construction, which has led to a reduction in economic growth.

Is there a silver lining?

Yes. We believe there is room to responsibly relax credit standards, and this would provide a tailwind for economic growth in the coming years.As a matter of fact, several recent developments signal a change in the direction of mortgage lending standards:

- Fannie Mae and Freddie Mac announced changes to their underwriting systems in an effort to use broader metrics to measure credit risk and allow more deserving borrowers to qualify for loans.

- Quicken announced they would partner with Freddie Mac to provide new opportunities for “millennials, first-time homebuyers and middle-class borrowers” who want to put down, or can only put down, minimal down payments as low as 3%.

- We believe these revisions inch us in the right direction. Originators seem to be feeling more comfortable with the risk they are taking, making more borrowers eligible for a mortgage and implementing technology solutions which reduce some of the friction associated with mortgage lending.

MALR014003