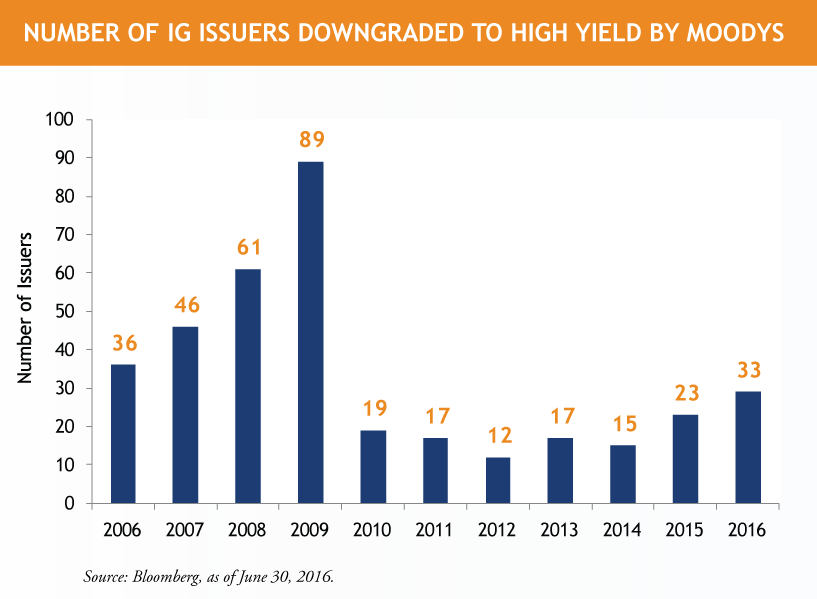

Pain of a downgrade to high yield is often realized quickly

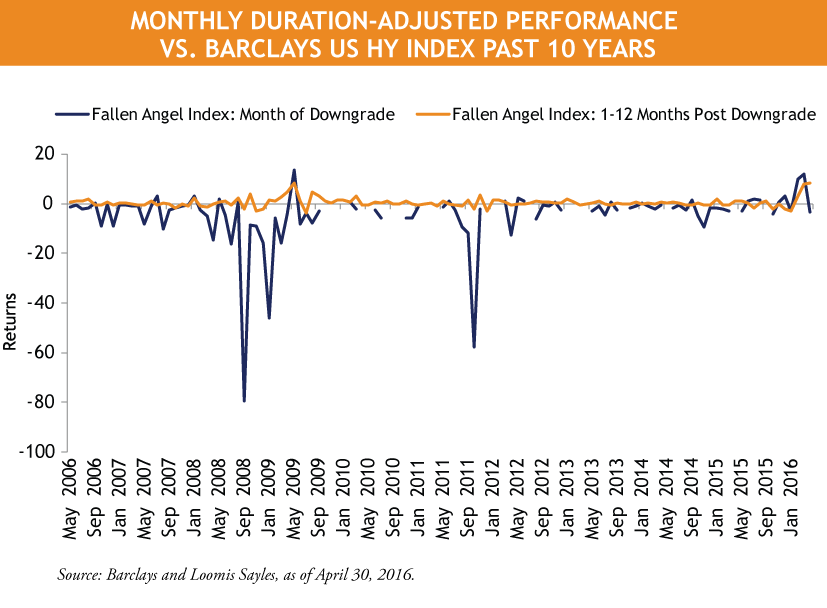

As we analyze the historical performance of fallen angel securities, we find that excess returns for these securities during the transition from investment grade to high yield often lag the broader investment grade (IG) and high yield (HY) markets. Digging deeper, we find the selloff is often sharp but short-lived, with the worst selloffs frequently taking place during the month in which the downgrade takes place.

Markets respond quickly when a rating agency like Moody’s takes action, bringing an IG issuer to HY. To analyze how fallen angels have performed historically, we constructed two custom fallen angel indices:

- One index containing only securities downgraded to HY in the particular month being analyzed

- The second index containing securities 1 to 12 months removed from the month of the downgrade to HY

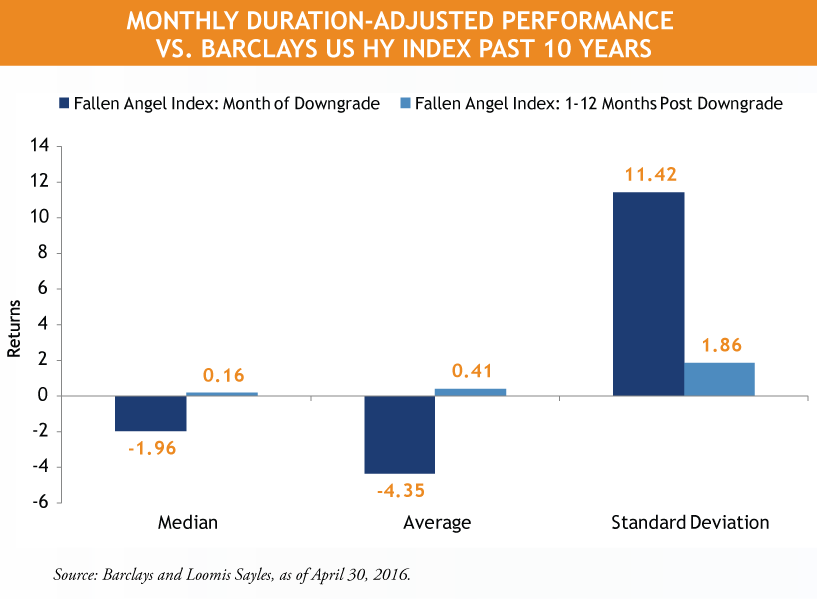

In short, we find that the “month of downgrade index” has tended to exhibit much greater volatility and more frequent, sharp negative excess returns relative to the Barclays US High Yield index.

On the other hand, excess return volatility has been much lower for fallen angel securities 1-12 months removed from the month in which the downgrade took place. These securities often outperformed the broad US high yield market on an excess return basis. It appears that fallen angels are susceptible to being oversold around the time of the downgrade, as many pure investment grade investors and indexers are forced to sell their bonds. Essentially, the exits become crowded in that first month, temporarily pushing spreads wider than fair value until supply and demand rebalance.

Rules-based selling of fallen angels may cost performance

The worst of the worst for fallen angels, in terms of excess returns versus the US HY market, is often front-loaded. As a result, investors following a rigid, rules based approach (requiring fallen angels to be sold immediately upon downgrade or prior to the security exiting the investment grade index) are potentially subject to turning losses on paper into realized losses. This could mean missing out on potential spread retracement in the months following the downgrade as selling pressures ease.

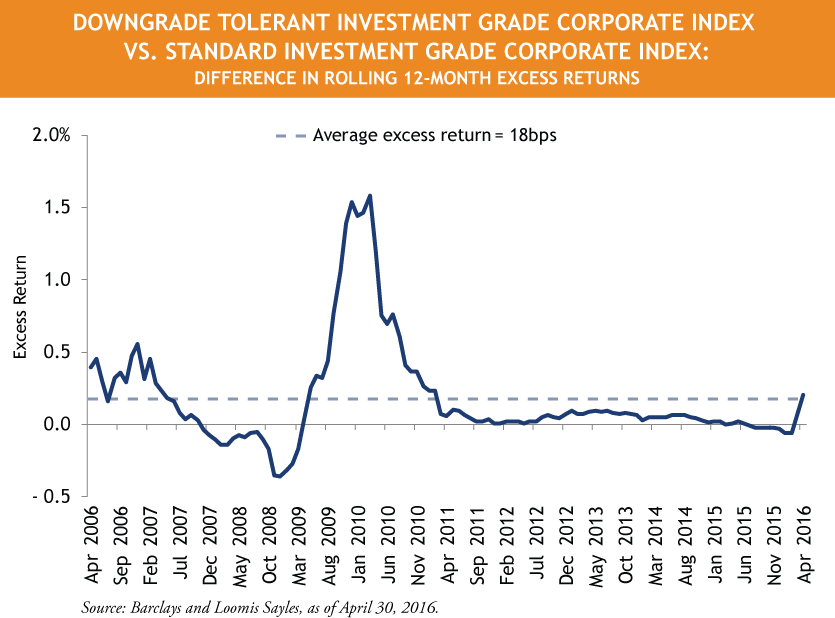

To quantify this, let’s analyze historical excess returns of a custom, downgrade-tolerant version of the Barclays US Investment Grade Corporate Index versus the standard Barclays US Investment Grade Corporate Index. The standard index drops fallen angel securities in the calendar month immediately following the downgrade while the custom, downgrade-tolerant index allows fallen angel securities to remain in the index for 12 calendar months after the downgrade.

Over the past 10 years, we find that annual excess returns for the downgrade-tolerant investment grade corporate index are, on average, 18 basis points better than the standard investment grade index, supporting the case against knee-jerk selling of fallen angels soon after the downgrade. It is important to note however that there is a good degree of variance around the mean, and there have been periods where the downgrade tolerant index underperforms the standard index.

Additionally, allowing for a longer leash when it comes to fallen angels may add some high yield beta to a portfolio and therefore the degree to which a more lenient fallen angel strategy outperforms or underperforms can be influenced by the overall high yield market.

MALR015323

Barclays US Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and assetbacked securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Barclays US Corporate High-Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. Original issue zeroes, step-up coupon structures, 144-As and pay-in-kind bonds (PIKs, as of October 1, 2009) are also included.

Indexes are unmanaged and do not incur fees.

It is not possible to invest directly in an index.Investing involves risk including risk of loss.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.