1. What was the main objective of your engagement with this issuer?

This issuer is a European transportation and infrastructure group, primarily focused on toll roads and airports. A few years ago, infrastructure within the issuer’s network failed, tragically resulting in fatalities. A subsequent investigation revealed weak social and governance practices. In 2019, we engaged with the issuer to help improve our understanding of management's strategy to address and improve those practices.

2. How did you structure your engagement with the issuer?

After the initial engagement in 2019, we established an ongoing dialogue with the issuer. We have held several virtual meetings with senior management. Over time, we have increased the frequency of our engagement and more leaders from the issuer’s senior management team (including the CFO) have gotten involved.

Our engagement has covered an array of social and governance topics, including:

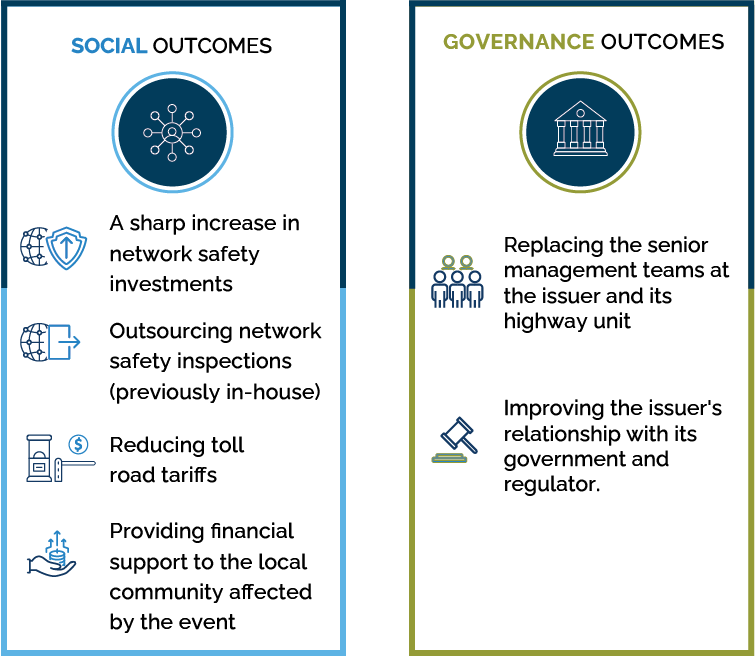

- The strategy behind increased capital spending on infrastructure maintenance and safety protocols;

- Measures to support the local community affected by the event;

- Governance and regulation around the planned divestiture of the issuer’s highway unit;

- Discussion and monitoring of senior leadership changes.

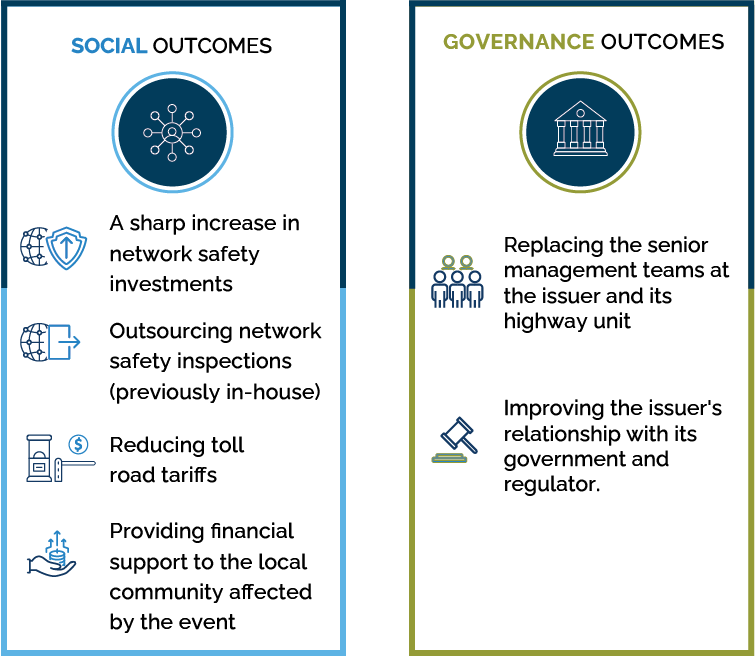

3. What changes have you observed during the course of your engagement?

Our discussions with the issuer have given us a higher level of confidence that its management team recognizes the strategic importance of social and governance considerations, has the desire make changes, and is taking action to improve its corporate social and governance programs. We believe the issuer has made tangible progress toward addressing our social and governance concerns.

While we believe the issuer has made substantial progress, there is one final milestone we’d like it to reach—the divestiture of its highway unit. We believe the issuer’s governance-related risks will materially decrease once the deal is closed.

MALR028274

Market conditions are extremely fluid and change frequently.

Past performance is no guarantee of, and not necessarily indicative of, future results.

Other industry analysts and investment personnel may have different views and opinions. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted, and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product.