Leveraged loans have beneficial characteristics that make them distinct within the fixed income universe: they’re floating-rate instruments, senior in a company’s capital structure, secured by collateral and tend to have short average lives. Those traits make them attractive to investors seeking yield potential with typically lower volatility, and those investors have different options for accessing the loan market. Some institutions invest through separately managed accounts or commingled vehicles, while individuals might choose to access the market through mutual funds or exchange-traded funds. But the biggest source of demand for loans, especially over the last year, has been collateralized loan obligations, or CLOs. A wide variety of investors come together to form each of these special purpose vehicles, and they help provide stability to the loan market through multi-year commitments. Representing 59% of the leveraged loan investor base at September 30, 2020, and 72% of new loan purchases for the 12 months ending September 30, 2020, it’s important to understand how CLO managers behave and what incentives they have.

CLO managers buy the same types of loans that other loan investors buy, but they must adhere to a strict set of tested covenants that help ensure diversification and other requirements While CLO managers are seeking a high total return for the investors who own the equity of the structure, they cannot breach the indenture guidelines[i] without the prospect of the structure being downgraded. Therefore, in addition to the credit research work that must be done to understand each company and the prospects for being repaid, each loan must be evaluated within the portfolio overall to make sure that all of the guidelines are met. That imperative can lead CLO managers to behave in ways that impact the loan market overall. We believe CLO behavior is a factor that all loan managers should consider when making their own credit selections.

A few ways that CLOs can impact the loan market:

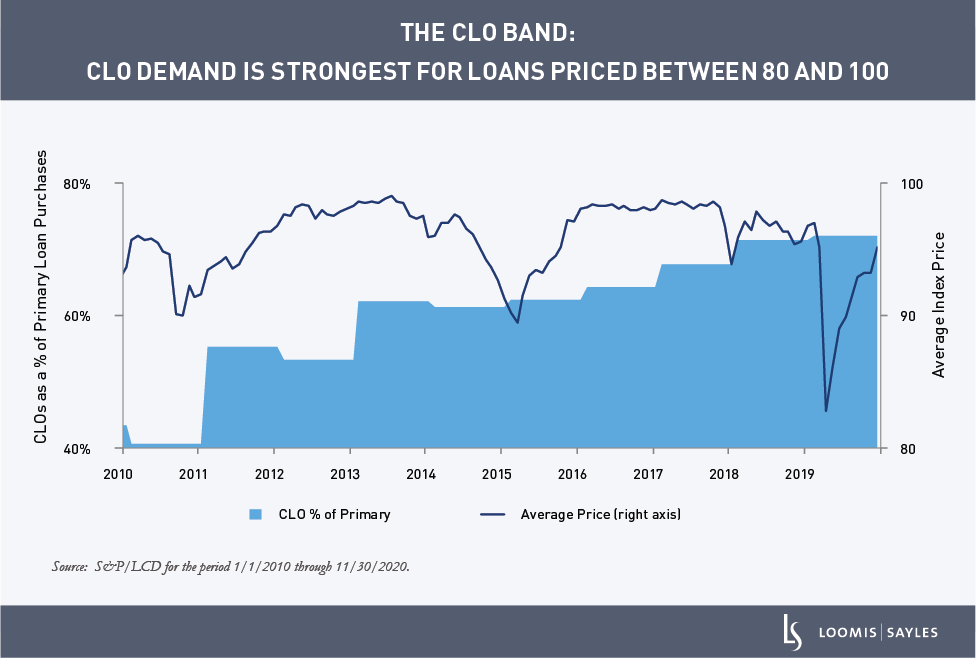

Loan pricing: CLOs are incentivized to “build par” by buying loans at a discount to par value. If they choose to purchase a loan above 100% of par value, they are penalized on the par tests required by their covenants. When demand for loans is very high, it’s not unusual to see higher-quality loans trade at that premium level. But when demand levels are more reasonable and dominated by the CLO buyer, it’s less likely that the market will see many loans trading above par. This scenario can help keep loan prices (and yields) relatively attractive versus high yield bonds that are chased up to and beyond their call prices by yield-hungry investors.

On the flip side, CLO managers do not help their par tests when they purchase deeply discounted loans, or loans typically priced below 80% of par value. Without this lower barrier, it would be easy for CLO managers to improve failing test scores by buying loans that might be to more troubled companies. When a loan’s price is heading into this territory, it might be less attractive to CLO managers. This could reduce demand for low-priced loans at least temporarily, which non-CLO managers need to consider as they analyze challenging credits.

Downgrades and CCCs: One of the most important guidelines for CLO managers is the weighted average rating factor (WARF). This test takes the rating on each loan and converts it to a number, and a portfolio average is then calculated. Those results are compared to the results of other CLO managers, and it’s a helpful way to gauge how risky a portfolio might be. It’s a critical metric, and continuously evaluated as ratings change all the time. CLO managers trade the loans in their portfolios to keep these results in line with other CLO managers.

This task was especially challenging at the start of the pandemic, when the rating agencies quickly downgraded a host of companies facing potential struggles in the ensuing year. Rating agencies were quick to downgrade, but haven’t been as fast to upgrade ratings now that conditions have improved. When a loan comes to the market with a lower rating from the start, it’s important for managers to consider what that rating’s path might be. With most CLOs limited to a CCC bucket of just 7.5%, a loan with a lower single-B rating might seem unattractive to CLO managers, and its liquidity could be thinner than for higher-rated loans.

Loan and CLO issuance: CLO portfolios average about $400 million in assets under management and contain hundreds of individual loans. Their guidelines generally require them to be as fully invested as possible, since they do not need cash on hand for client redemptions. The issuance process is a bit like the chicken and the egg; CLOs need new loans to purchase and companies can only issue new loans if they can find enough investors. Those two types of demand tend to work together, and when there’s a lot of CLO issuance, there is typically a bump in new loan issuance to help those portfolios get stocked. Otherwise, CLOs won’t be able to form. With forecasts ranging from $90-$120 billion in new CLOs in 2021, we’re likely to see loans issued to help absorb some of that new demand. That can have ramifications for the secondary loan market as well.

Consider how the investor base can shape demand in the loan market

As the investor base for leveraged loans continues to evolve, investors need to consider how that demand shapes trends in the market. When managing a loan portfolio, one might want to have more conviction regarding low-single-B loans and further manage that risk through position sizing. Deep credit work remains important, but it can’t be done in a vacuum. Acknowledging other market participants, both big and small, can help investors remain competitive in the loan market.

[i] An indenture is a legal and binding agreement, contract or document between two or more parties.

MALR026741

Diversification does not ensure a profit or guarantee against a loss.

Market conditions are extremely fluid and change frequently.

Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.