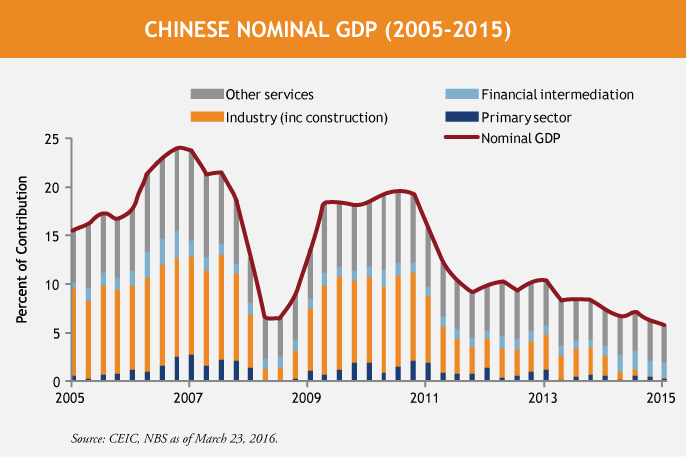

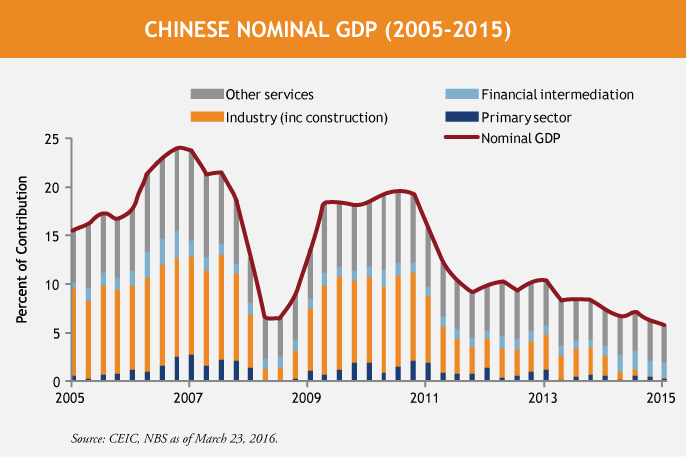

The main contributor to China’s economic slowdown is its manufacturing sector, which is suffering due to overcapacity and lower global demand for Chinese products. While these conditions have tempered local bank loan growth substantially, there doesn’t seem to be any significant increase in banks reporting non-performing loans (NPL). That is surprising…NPLs typically rise in a country when the economy weakens after a period of very high loan growth.

The Chinese banks that are the biggest lenders to state-owned manufacturing companies are undoubtedly feeling pressure from their weaker borrowers. Heavy industrial companies including shipbuilders, coal miners and steelmakers are especially hard-hit. But even now, reported NPLs are only 1.7% at the end of 2015 compared to a peak of over 20% in the early 2000s.

What are some reasons for this?

- First of all, it’s generally in the best interest of all parties if a weak corporate borrower has time to recover and repay its loans. Classifying a loan as ‘non-performing’ kicks off a loan recovery process that includes cutting off all lending to the borrower, pushing it into bankruptcy and seizing assets that have been used as collateral for the loan (typically a factory). Bank officials may be reluctant to initiate that process if it looks like relief might be on the horizon. However, this is a dangerous practice as non-performing loans to weaker borrowers could rise suddenly. Even relatively small companies typically borrow from more than one bank and as a company’s outlook continues to deteriorate, competing banks would likely want to initiate the loan recovery process in order to be first in line to try and recover its loan and increase its overall recovery rate. Recently, increasing pressure from the central government to reduce excess capacity may hasten this process.

- Once corporate borrowers become unable to repay a loan, Chinese banks typically sell that non-performing loan to a loan recovery company at a big discount to its face value, rather than try and recover the collateral themselves. This keeps their NPL ratios low even though the pace of new NPL creation could be quite high. I estimate that NPL formation has recently been running at a 1.5% annual pace, before the impact of write-offs and NPL sales.

- Many of the region’s mid-sized banks have weaker capital bases than their large, state-owned counterparts, which probably leads them to classify weaker corporate loans as ‘performing’ even if a borrower has stopped paying. This is because Chinese banks have to set aside onerous reserves equivalent to 150% of their non-performing loans. Mid-sized banks have less capital cushion to meet this reserve requirement. Bank of Communications, China’s 5th largest listed bank, reported NPLs 40% lower than its 90 day overdue loans at the end of September.

- Regional governments have encouraged banks to keep lending to loss-making state-owned enterprises (SOEs), in order to support local employment. But the tide is now turning. The central government is putting pressure on loss-making SOEs to restructure, in order to reduce China’s excess manufacturing capacity.

The behavior of China’s biggest banks suggests a difficult outlook for non-performing loans. Several bankers that I spoke with late last year expressed concern that NPLs are likely to continue to rise. That said, the larger banks appear to currently have enough capital to cope with a significant rise in NPLs from current reported levels.

Overall, I expect that the Chinese economy will continue to slow, and NPLs will keep rising. Even so, I’m not very pessimistic: consumer spending appears to be healthy. Car sales have picked up and property prices are recovering in the largest cities, both in response to government stimulus. A likely rise in NPLs is a by-product of a rebalancing of the economy away from capital investment and export, and towards consumption and services. This leads me to believe that some of the more interesting opportunities in China are not in the "old economy" industries like banks and manufacturing, but in "new economy" businesses like internet retailing.

MALR014806

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.