Non-bank financial institutions (NBFIs), which typically operate with less regulatory oversight compared to banks, have existed in China for decades. Recently, we’ve witnessed another boom in wealth-management products (WMPs) originated by both banks and these NBFIs. These activities are referred to as China’s shadow bank. Traditionally sold to retail investors, these WMPs are increasingly bought by banks and even repackaged into other WMPs.

The Chinese banking system remains largely funded by domestic deposits, even if that share is declining. This factor mitigates the risk of a financial system meltdown. But absent tighter regulation, I believe that increased shadow banking activities, increased fragmentation of the banking system and higher dependence on wholesale funding by smaller banks is a potent combination of stress build-up that could trigger risk of financial accidents.

The Chinese banking system remains largely funded by domestic deposits, even if that share is declining. This factor mitigates the risk of a financial system meltdown. But absent tighter regulation, I believe that increased shadow banking activities, increased fragmentation of the banking system and higher dependence on wholesale funding by smaller banks is a potent combination of stress build-up that could trigger risk of financial accidents.

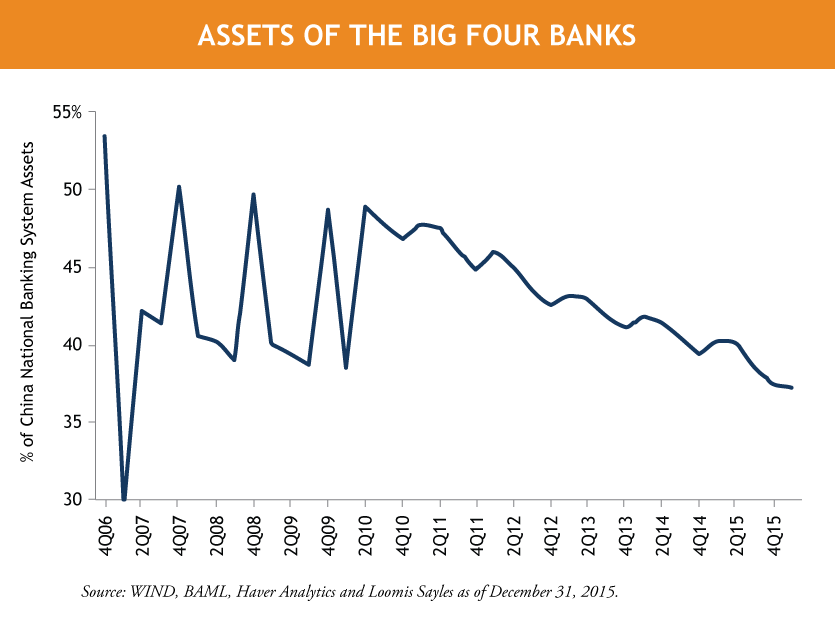

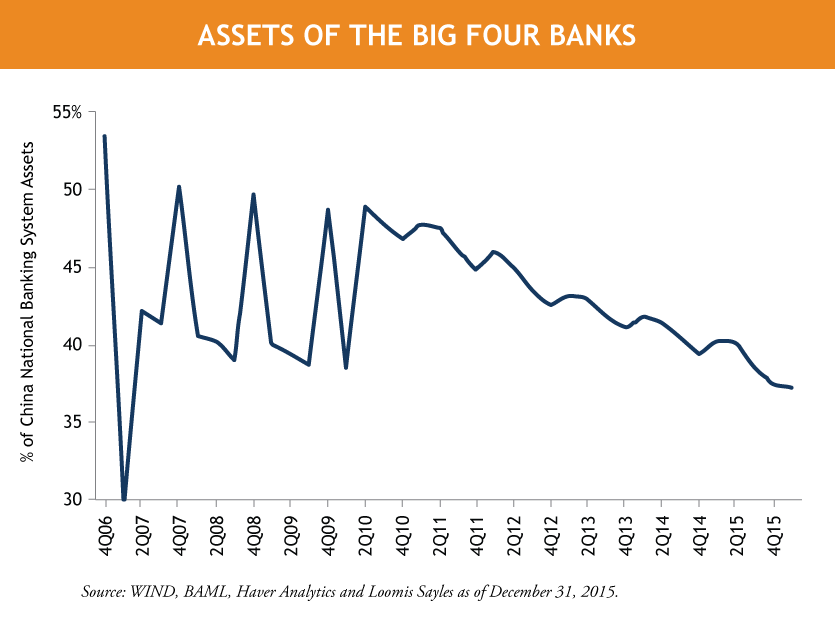

The ‘big four’ are getting less big

Small banks and the thriving shadow banking industry are the culprits of this current round of clever financial engineering, their share of assets as a proportion of the total financial system are on the rise. The corollary is assets of China’s four biggest banks¹ – the ones with the strongest sovereign backing and government protections – as a proportion of the financial system are shrinking. As of the end of March 2016, the big four held only a 37% share of the total national banking system, down from about 50% in 2006. In the wake of a financial crisis, the government would have reduced ability to ring-fence financial problems.

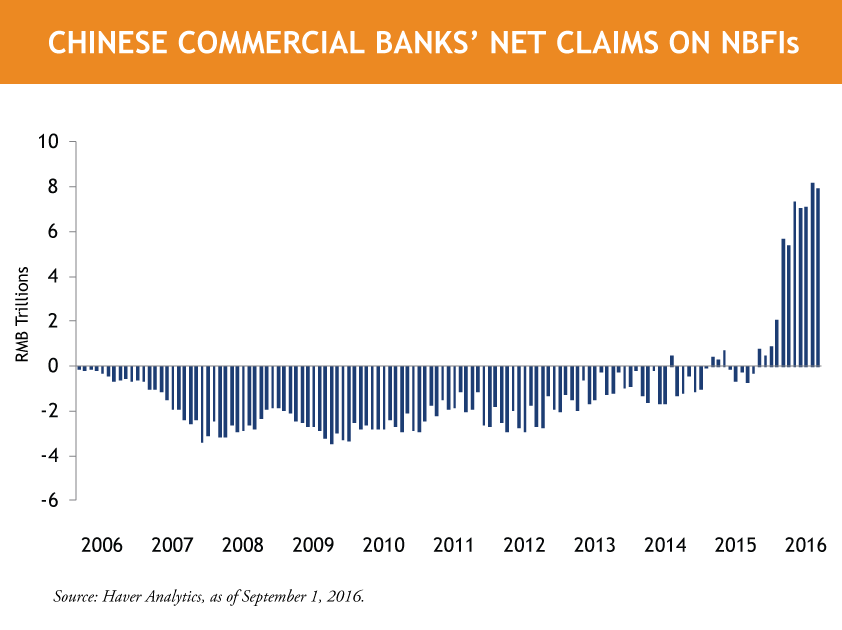

NBFIs are growing in significance

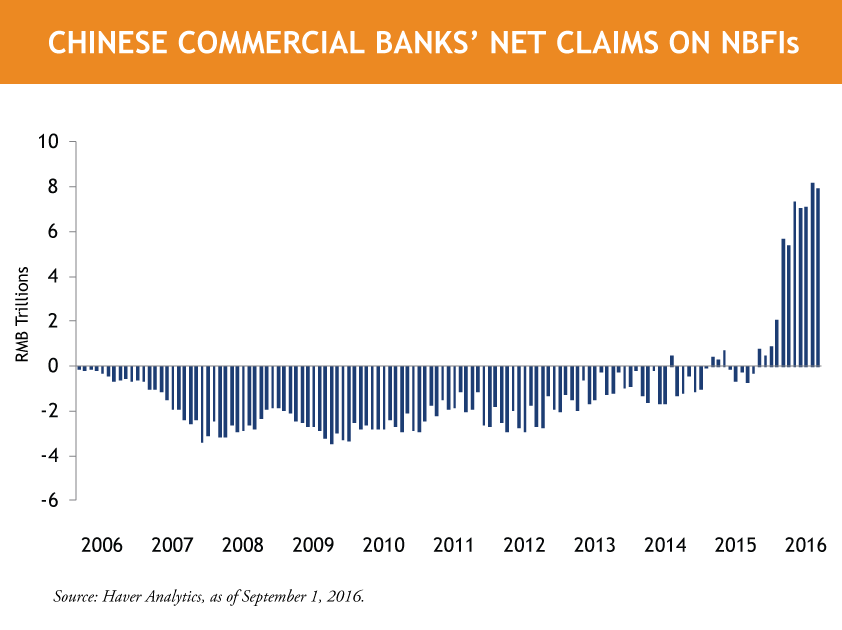

More concerning still is approximately only 30% of WMPs are originated by banks. The other 70% of these products are originated by NBFIs, which experienced significant asset growth of over 50% in 2015 to 67 trillion renminbi. This amount is equivalent to approximately a third of the country’s bank assets. The growth in bank lending to NBFIs has been rapid, and commercial banks’ total claims on NBFIs have swung into a material net credit position, a phenomenon only witnessed this year.

Convoluted transactions hinders adequate oversight

Increased layers of transactions have made it more difficult for regulators to untangle the web of exposures, limiting their ability to determine if banks are holding appropriate levels of capital buffers. One bank could be indirectly making loans to a firm that regulators know little about through purchase of an NBFI originated WMP. Meanwhile, repackaging of non-performing loans by banks into WMPs helps banks dodge loan loss provisions required by regulators. Illustrating the substantial increase of such transactions, bank exposure to such shadow products rose 58% last year to 15.2 trillion renminbi according to the International Monetary Fund (IMF).

MALR015858

¹ Agricultural Bank of China, Industrial and Commercial Bank of China (ICBC) China Construction Bank and Bank of China

The Chinese banking system remains largely funded by domestic deposits, even if that share is declining. This factor mitigates the risk of a financial system meltdown. But absent tighter regulation, I believe that increased shadow banking activities, increased fragmentation of the banking system and higher dependence on wholesale funding by smaller banks is a potent combination of stress build-up that could trigger risk of financial accidents.

The Chinese banking system remains largely funded by domestic deposits, even if that share is declining. This factor mitigates the risk of a financial system meltdown. But absent tighter regulation, I believe that increased shadow banking activities, increased fragmentation of the banking system and higher dependence on wholesale funding by smaller banks is a potent combination of stress build-up that could trigger risk of financial accidents.