Our bank loan team has long believed that BB-rated bank loans can be very attractive to asset allocators who wish to reduce volatility, improve risk/return trade-offs, and ameliorate drawdown in high risk categories such as high yield and equities. One of the main benefits of investing in higher-rated loans is a historically higher return per unit of risk, which many investors are seeking.

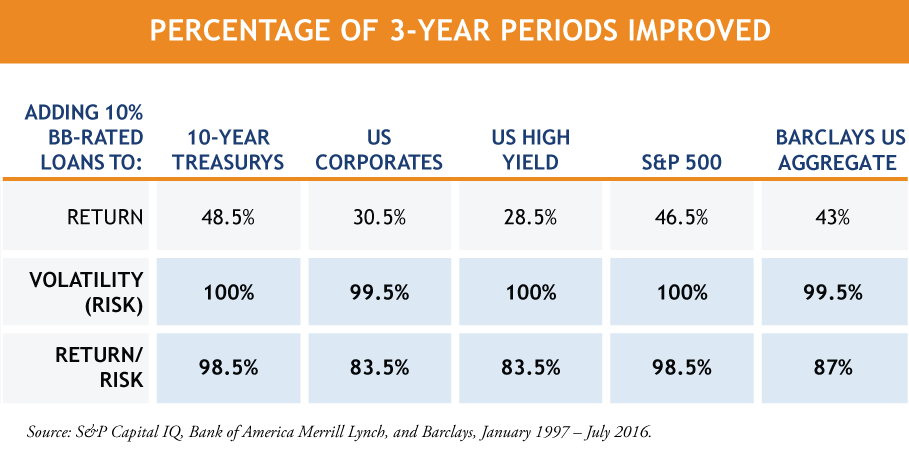

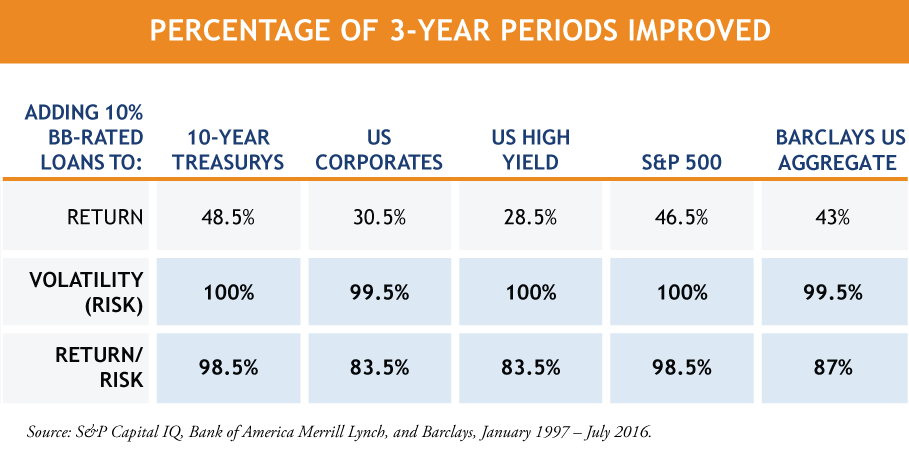

Our latest analysis looks at how a 10% allocation to BB-rated loans mitigated volatility and drawdown risk. We looked at three and five-year returns, volatility (risk), and returns/risk for index portfolios (composed of 10- year Treasurys, US investment grade corporate bonds, US high yield bonds, the S&P 500, and the Barclays US Aggregate Index). We compared those results to portfolios that added a 10% allocation to the S&P/LSTA US BB Ratings Loan Index. We looked at the entire period since the bank loan index inception in 1997.

Over both the three-year and five-year periods, an allocation of BB-rated loans to those other asset classes reduced volatility in almost 100% of the periods for every asset category (the one exception being October 2008, during the depths of the global financial crisis). The addition of BB-rated loans also improved the return/risk for the majority of periods, as you can see in the chart below.

On a three-year basis since March 2012, BB-rated loans have been additive to return/risk, in every period, for every asset category we examined.

Of course, adding BB-rated loans to reduce volatility can also reduce the volatility on the upside of returns, which is why the table above does not show consistently improved returns across asset categories. However, when considering negative return volatility for high yield bonds and the S&P 500 (the only asset classes that had more than two negative return periods) over three-year periods, BB-rated loans added return 94% of the time for high yield bonds and 100% of the time for the S&P 500.

MALR015864

Diversification does not ensure a profit or guarantee against loss.

Indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.