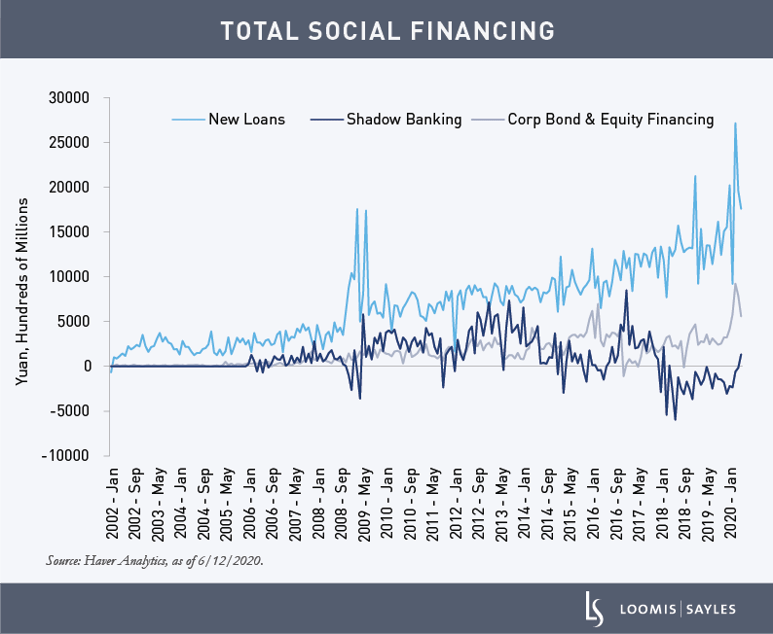

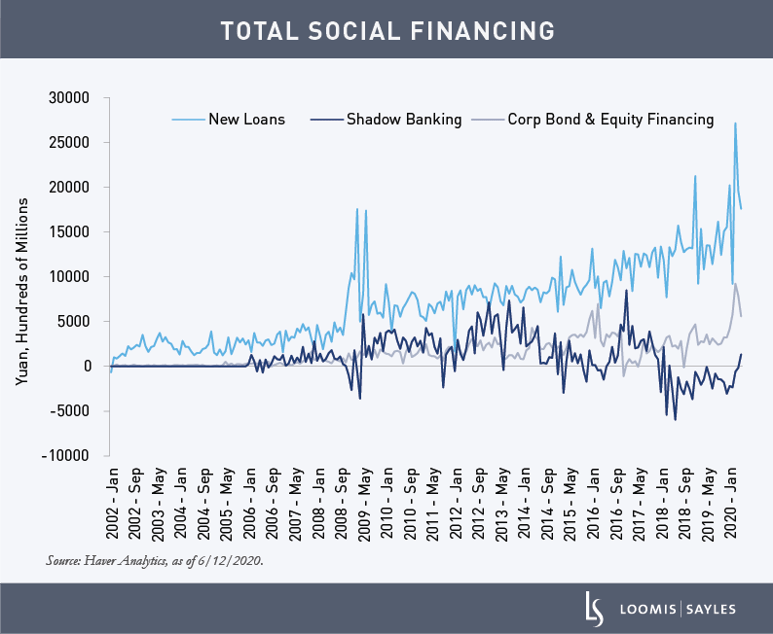

An unexpected development caught my attention in China’s June 12 credit report—the acceleration of shadow credit over the last few months after a very lackluster period.

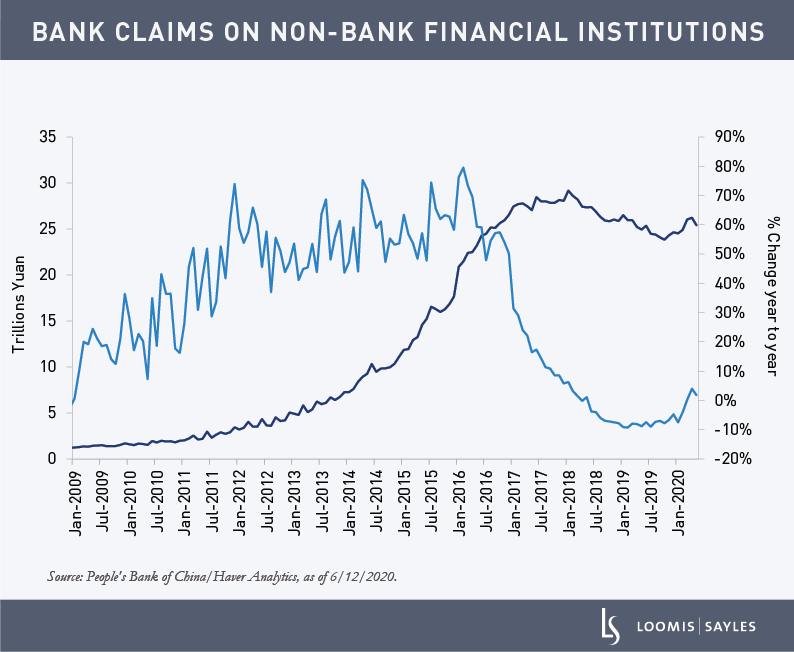

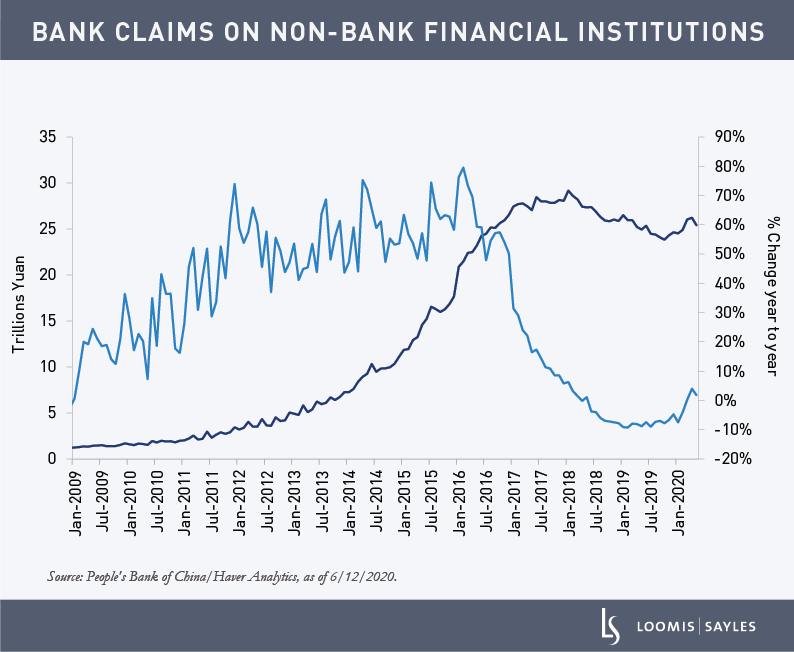

Interestingly, flow of funds data (separate from the June 12 credit report) shows an acceleration of growth in bank claims on non-bank financial institutions (NBFIs). Recall that China specifically clamped down on shadow lending and channel loans since 2017 in an attempt to reduce risks in the financial system. Banks had been shifting loans off balance sheets through partnerships with NBFIs, such as trust companies and banks' asset management arms. These NBFIs would then lend on to small- and medium-sized enterprises (SMEs). The clampdown caused a lot of pain in these SMEs, the bulk of China’s private sector. In spite of efforts to encourage commercial banks to lend directly to this private sector, the sector continues to struggle to get funding.

Shadow banking is an important source of funding for China’s private sector, which represents more than 60% of GDP growth and approximately 80% of jobs. In my view, improved financing to this sector is a key support for its recovery, which would be positive for China's growth and, in turn, global risk appetite.

MALR025603

Used with permission from Haver Analytics. This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.