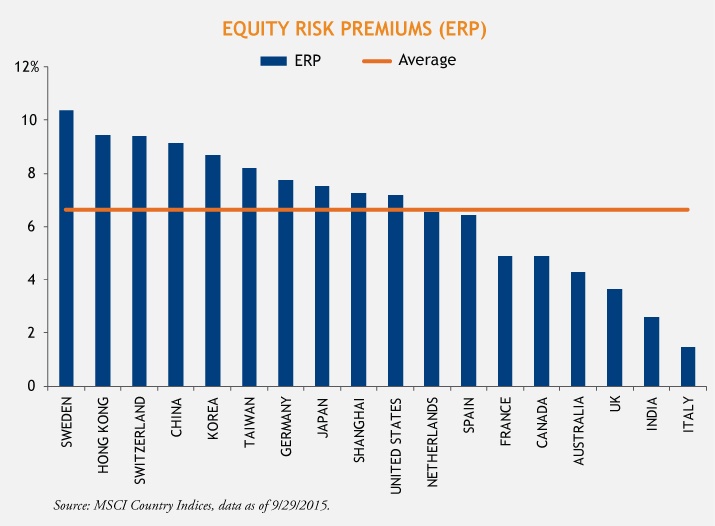

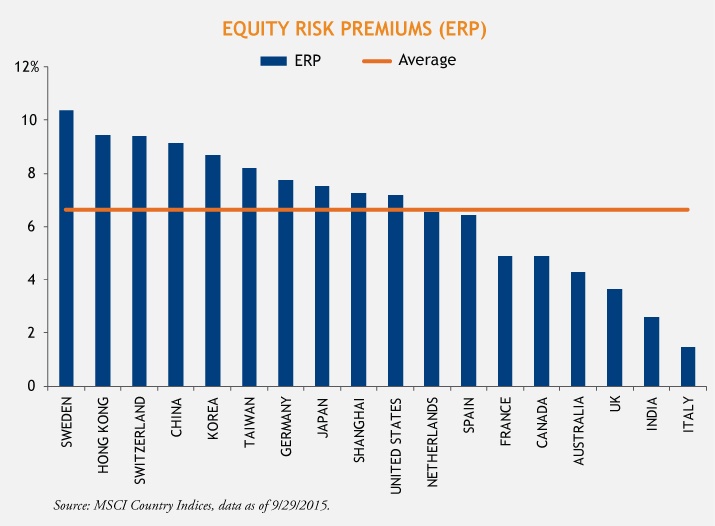

The global average equity risk premium (ERP)–is 6.5%.

This is good news for equity investors. With current low inflation across developed markets, the expected return from a portfolio of equities appears very attractive because earnings retention plus dividend yield is far above the sovereign bond yields, and also far above inflation in most markets.

This is good news for equity investors. With current low inflation across developed markets, the expected return from a portfolio of equities appears very attractive because earnings retention plus dividend yield is far above the sovereign bond yields, and also far above inflation in most markets.

Our bottom line is that while equities have been more volatile recently, I believe the long term drivers of equity returns remain intact and can provide a meaningful premium relative to the low rates of inflation experienced in most countries today.

If stocks were valued at much higher levels, and/or if bond yields were much higher than they currently are, the equity risk premium would be considerably lower than it is today.

By Richard Skaggs, Senior Equity Strategist and Craig Burelle, Macro Strategies Research Analyst

MALR013998

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.

This is good news for equity investors. With current low inflation across developed markets, the expected return from a portfolio of equities appears v

This is good news for equity investors. With current low inflation across developed markets, the expected return from a portfolio of equities appears v