Seasonally adjusted, US real GDP rose a strong 3.5% in the third quarter of 2016, but then slowed to a lousy 1.9% in the fourth quarter. (All growth rates are at an annual rate). Are these figures representative of an underlying economic trend? Believe it or not, soybeans were actually an important factor in the swings in growth.

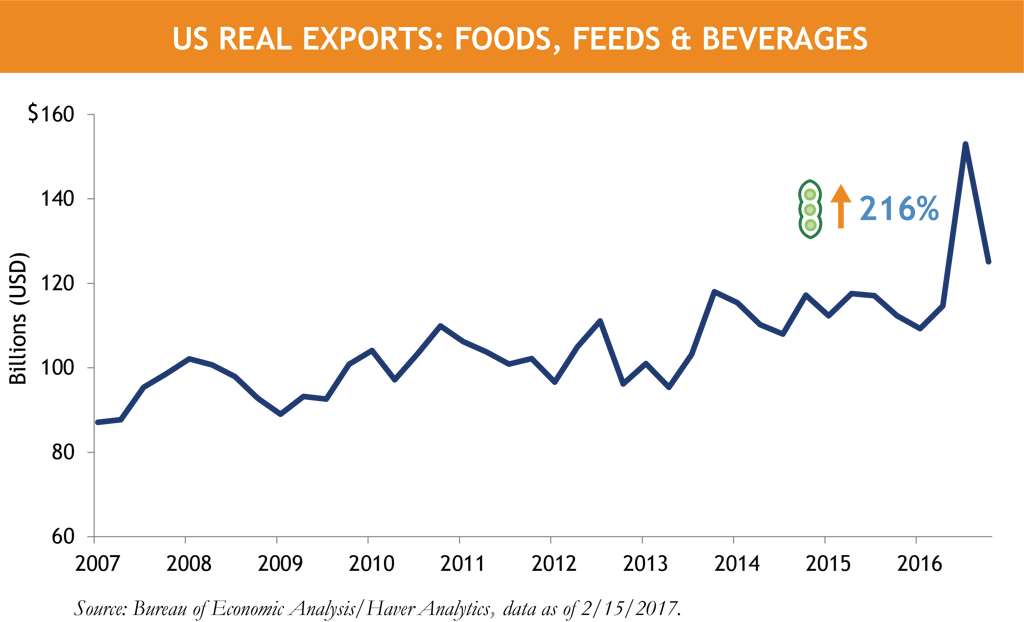

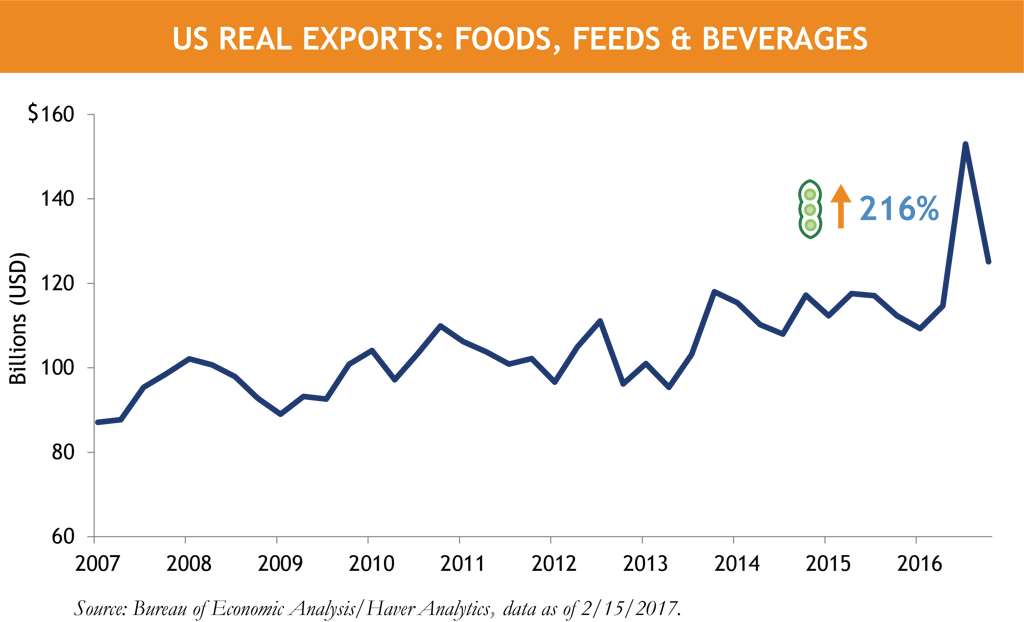

The US had a bumper crop of soybeans last year and exported a huge amount to China, recorded in third quarter exports. Seasonally adjusted, total real exports of food surged 216% in that period, the largest quarterly gain since 1969. The rise in good exports accounted for most of the rise in merchandise exports that quarter and the surge boosted third quarter real GDP.

Exports of food fell substantially (55%) in the fourth quarter as soybean exports dropped to a more normal level. It was the biggest drop since 1969. The drop in food exports accounts for the entire drop in total exports in the fourth quarter. Excluding food, real exports of goods rose, and real exports of services rose also. The chart below gives the level of real exports of food. It looks like food exports need to decline a bit more to get back to normal, but the next decline is likely to be much smaller than the one seen in the fourth quarter.

If you remove food exports from GDP, it is possible to get an approximation of GDP strength, without the flukish distortion caused by soybeans. It is just an approximation because exports of food include much more than just soybeans, but we don't have GDP detail for real exports of soybeans.

The resulting figures rose 2.6% in the third quarter and 2.6% also in the fourth quarter. Not great, but not bad either. Those figures were much stronger than the very weak results of the US “mini-recession” of the fourth quarter of 2015 and the first two quarters of 2016. We expect moderate growth through 2017, barring further flukes such as the surge and snapback in soybean exports.

MALR016776

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.