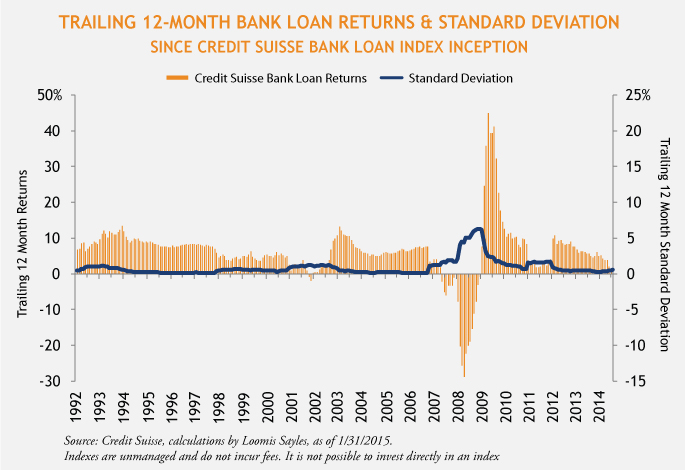

Bank loans are designed to be steady returners with low volatility

The global financial crisis did not change the nature of bank loans.

Bank loans were specifically designed by bankers to resist the forces that drive volatility in most other asset classes. Bankers designed bank loans to reduce the volatility that comes along with changes in interest rates and company values, so they insisted that loans have floating coupons and that they be senior and secured.

History shows they did a very good job. 2008 was the only year since loan indices began when loans had a negative return. 2008's performance was not driven by credit quality but by a global leverage unwind that created many forced sellers and far fewer buyers in a very short period. When the selling and rebound were finished, loans resumed their historically typical role: to be the tortoise rather than the hare.

MALR012991

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.