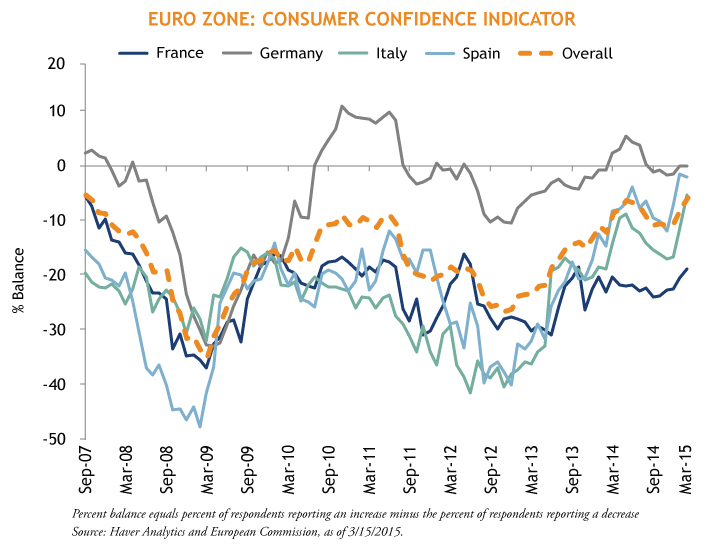

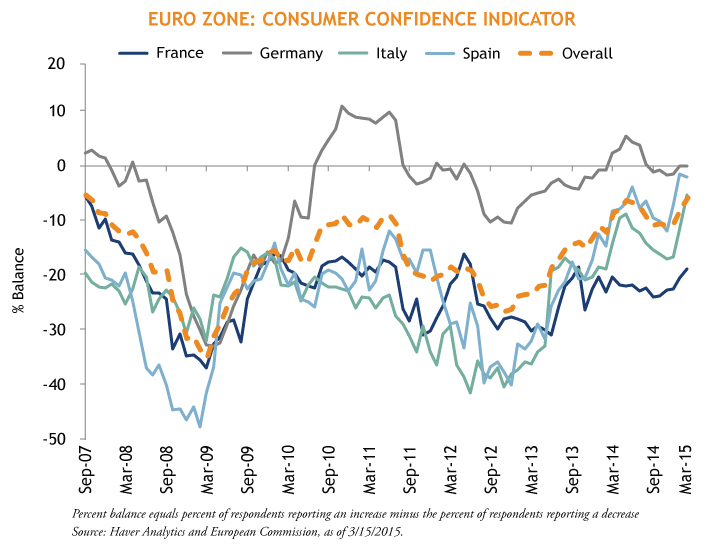

Euro area growth appears set to outperform in 2015, thanks in part to a stronger consumer. Consumers are feeling more confident about their own economies, and in some spots, job growth and wage increases provide an additional boost. Here are some of the major consumer trends I have noticed across the euro zone:

Current star performers:

- Consumer durable goods – including cars and furniture – are performing well as consumers replace aged goods

- All things pharmaceutical & medical are growing strongly across Europe given the aging demographic

- Germany printed two strong retail sales numbers in a row (including the 5% increase reported 3/3/2015 in year-over-year volume across most categories of consumption goods)

- Consumers in Italy appear confident, increasing their new car, household goods & hardware purchases

- In both Spain and Portugal, consumers, regardless of their employment status, report feeling more confident about their country’s economic outlook

- Ireland is cranking on most fronts and consumers are spending in tandem

Laggards:

- French consumer confidence has lagged, weighed down by weak housing trends and little job growth. This could improve in coming months but it’s important to watch given French consumers account for 57% of French GDP and 20% of euro GDP

- Ongoing political strife and recession in Russia continues to restrain the economy and consumers of Finland, where job cuts and house price declines curb consumer behavior

- Greek consumers perked up for a time, but spending was ultimately squashed by the country’s January elections

- The most depressed consumer sectors across Europe? Sporting equipment, camping goods, toys and games

MALR013019

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.