This year saw a lot of buzz about the retail apocalypse as a record number of retailers filed for bankruptcy, participated in distressed debt exchanges or simply shuttered thousands of stores. Traditional retailers were plagued by declining mall traffic and several days or weeks of store closures due to hurricanes and other natural disasters. On top of it all, secular pressure from online competition was forcing sky-high promotional activity to clear inventory. Going into November, expectations for traditional retailers were pretty low and retail fear was at an all-time high.

Holiday spending on track to beat expectations

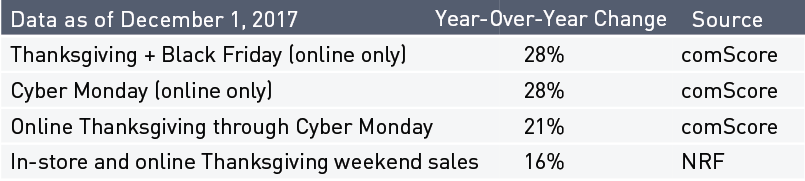

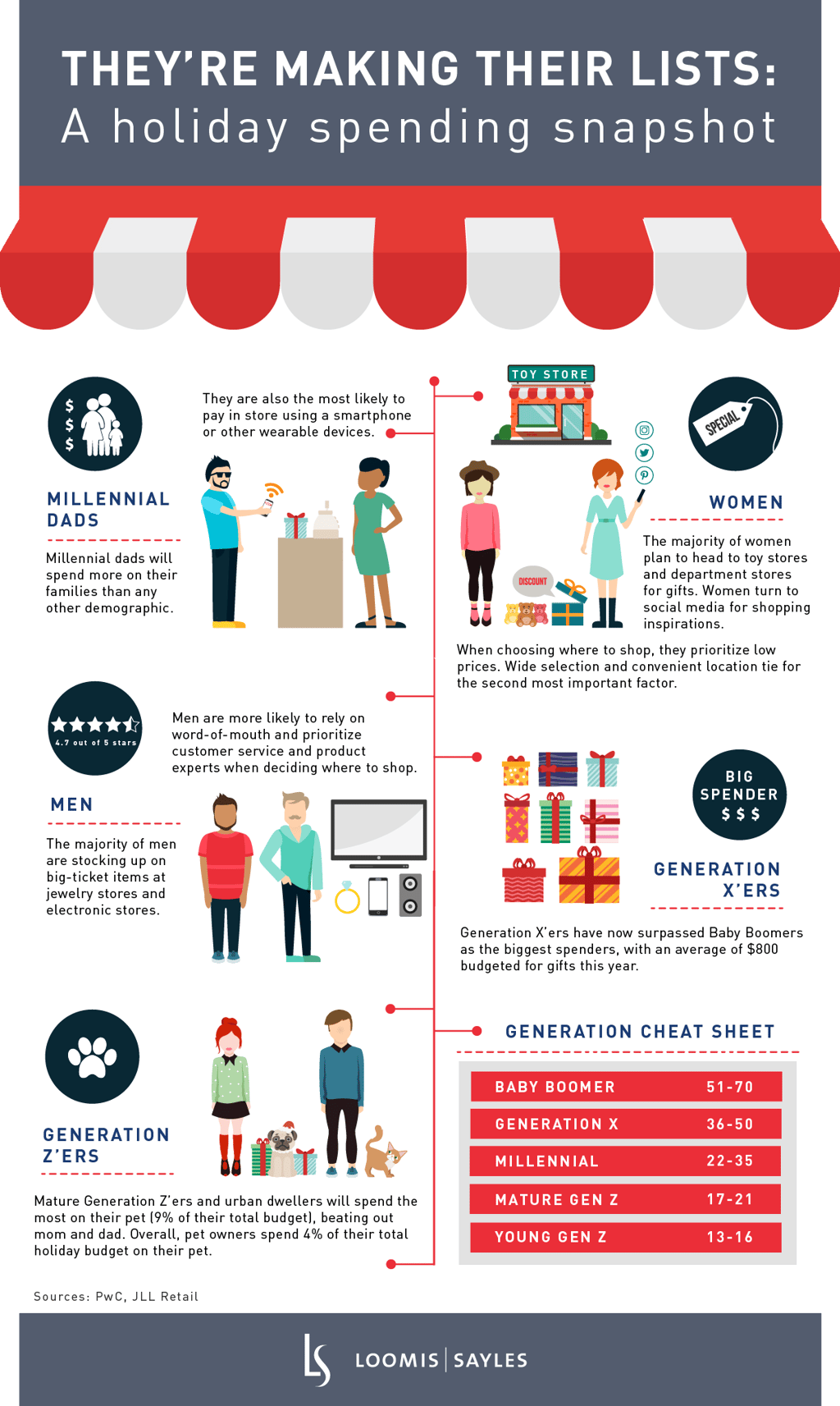

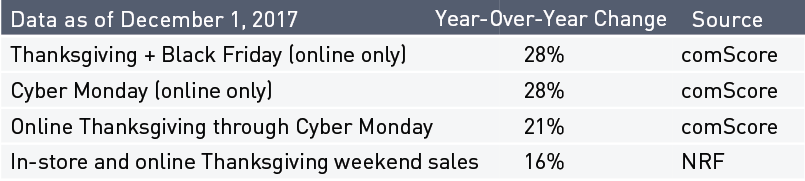

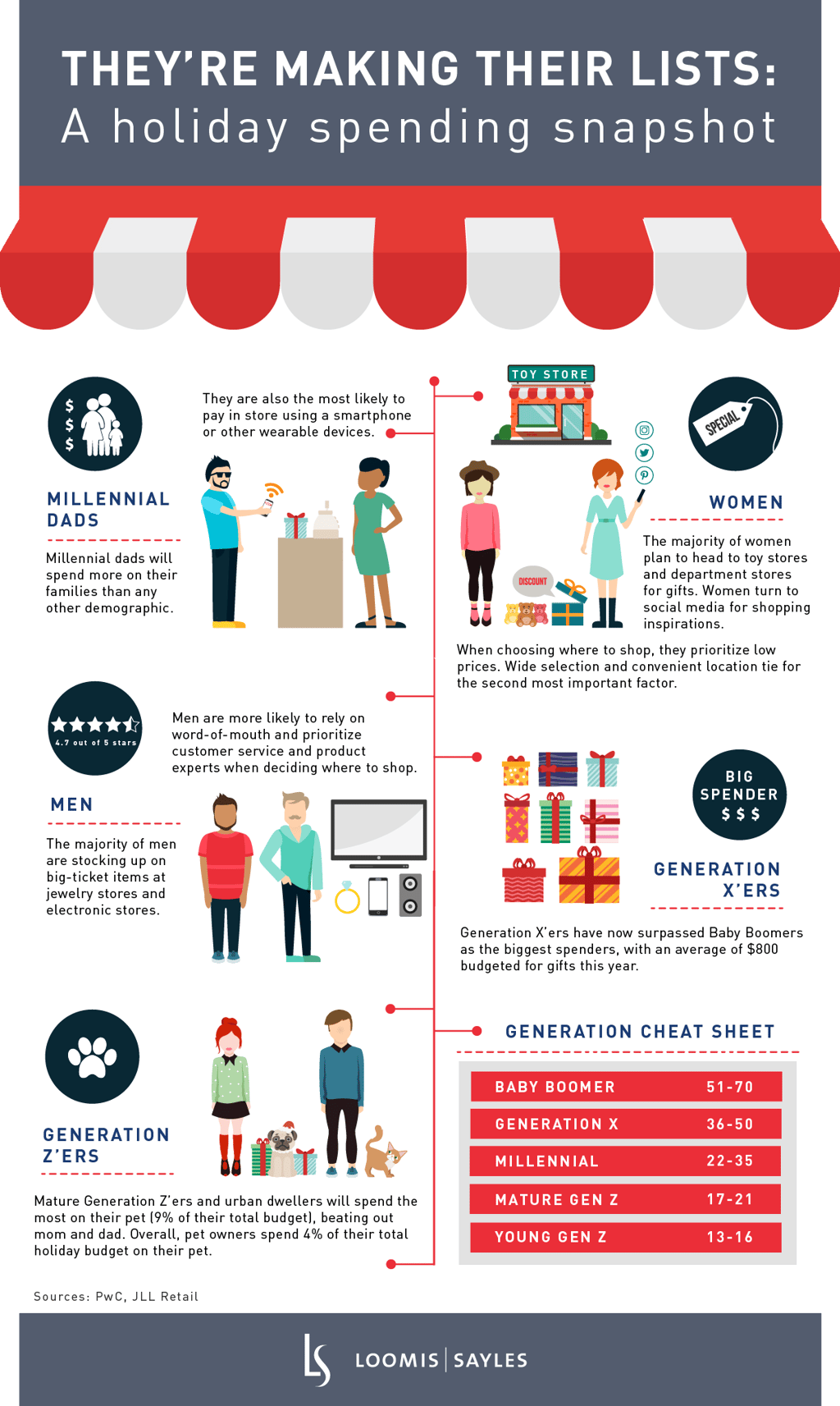

Finally, we’re seeing some positive news for the retail industry. Data so far suggests consumers are spending this holiday season, bolstered by positive tailwinds like good weather over Thanksgiving weekend, a strong selection of hot products and pent-up demand for apparel. An extra shopping day relative to 2016 should also boost results.

I expect this better-than-expected holiday spending to drive stronger-than-anticipated fourth-quarter earnings for many retailers. Recall that the fourth quarter accounts for the majority of a retailer’s revenue, profits and cash flow generation. This means that higher-quality retailers with appropriate financial leverage could generate more cash to invest back into the business, return to shareholders or participate in industry M&A, while over-levered/distressed retailers could extend their lifeline by paying down debt or gaining some bargaining power with lenders.

But don’t get your hopes up

While the holiday season is shaping up nicely for retailers as a result of healthy consumer spending and a few other short-term tailwinds, this does not change my longer-term view. The secular headwinds facing the industry are still accelerating and are likely to remain key concerns for retail investors. These headwinds include intense online competition, highly promotional activity, the need to invest in omni-channel capabilities, declining brick-and-mortar store traffic and store closures. Closures of anchor stores like Macy's could also have an impact on malls; an operator of a low-quality mall could have a hard time filling vacant anchor space, making the mall appear undesirable.

MALR021112