1. What’s the current state of the municipal bond market, and what’s your outlook for 2025?

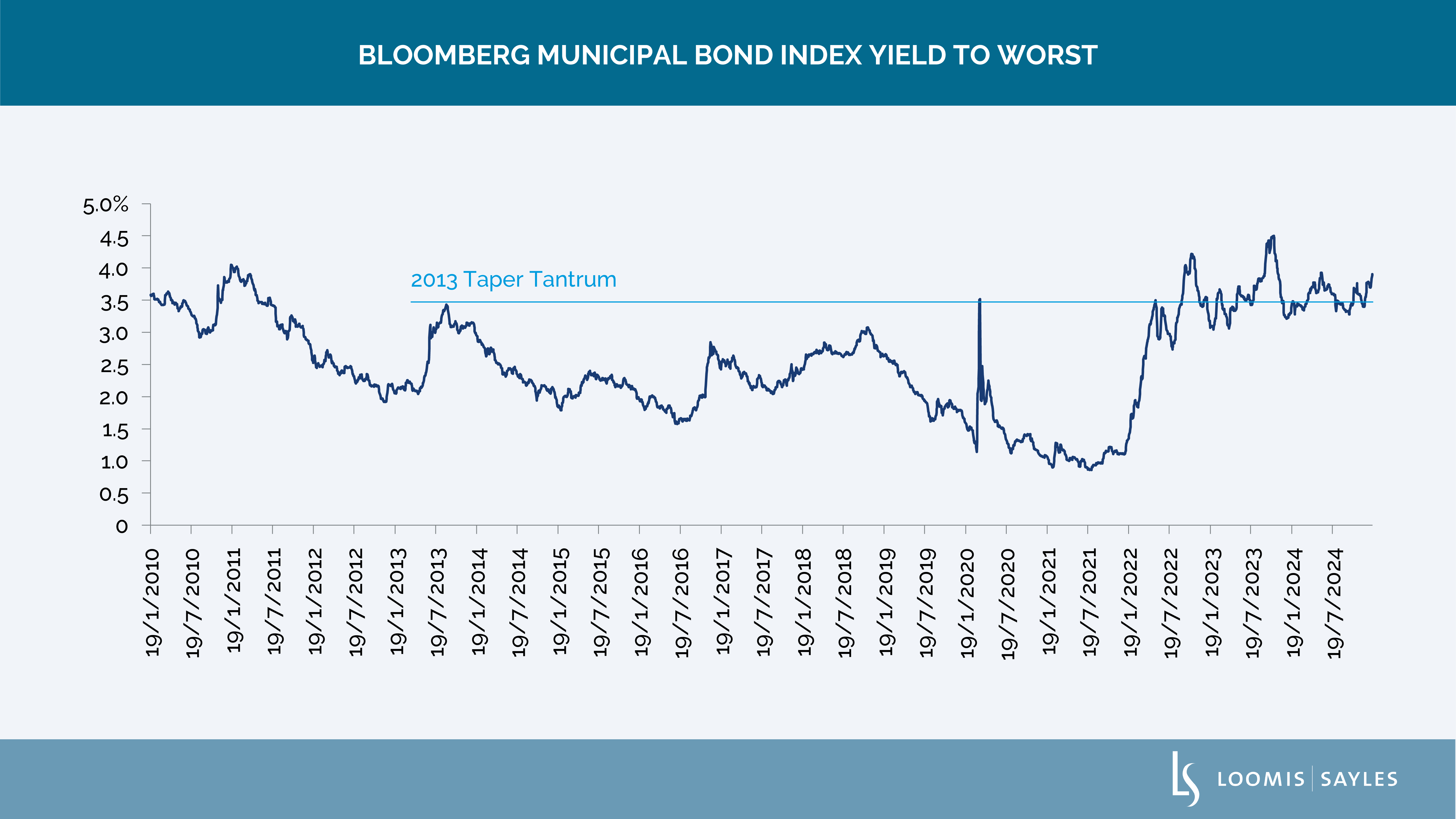

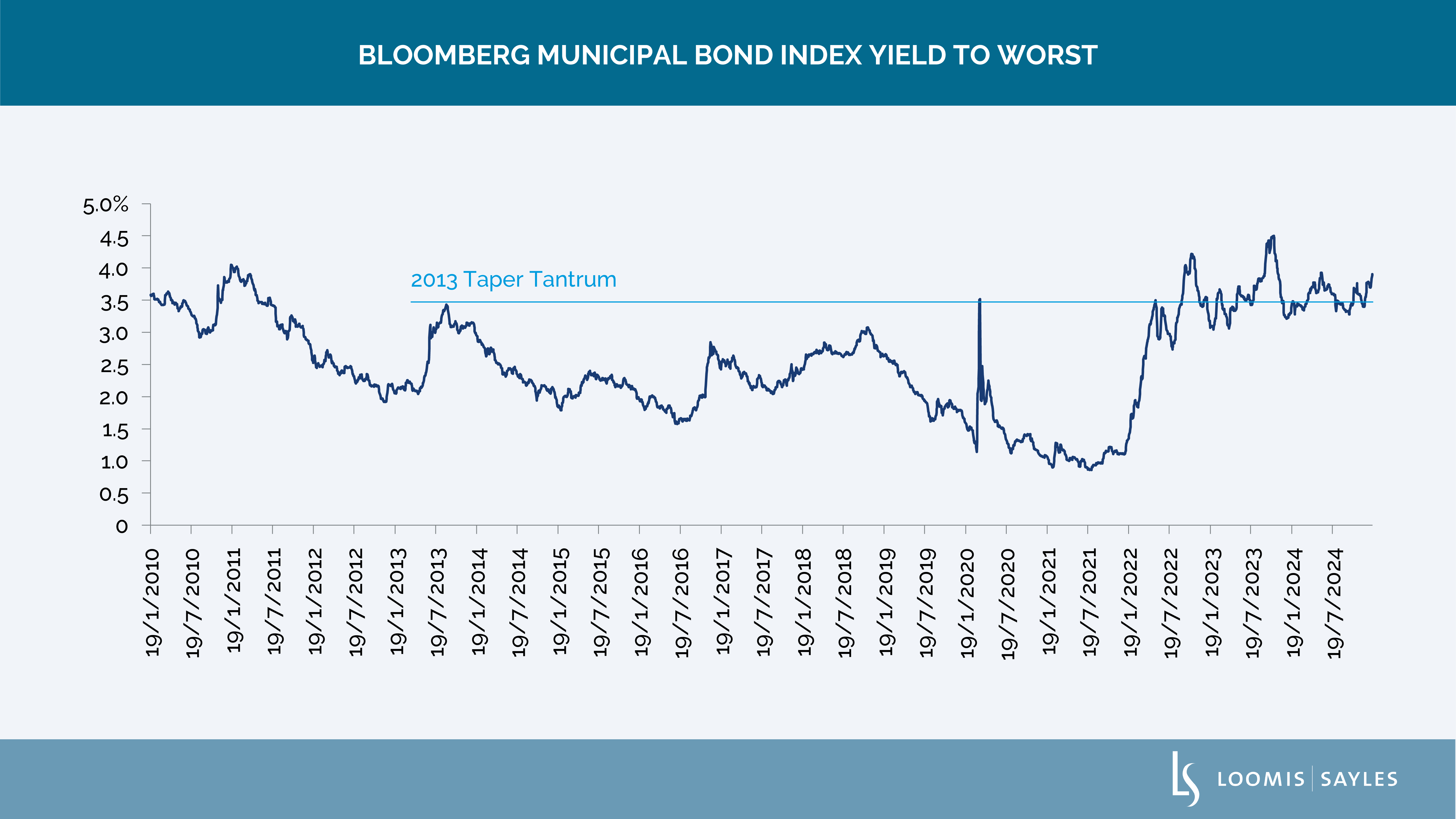

After years of very low interest rates and pandemic-related distortions, the municipal market finally started to normalize last year with a positively sloping yield curve, healthy issuance and very strong investor demand. As 2025 begins, investors appear to have reduced expectations for additional Federal Reserve monetary easing and longer-term rates continue to move higher and steeper. Market cycles are never exact replicates, but yields are now roughly at levels reached during the 2013 “taper tantrum,” when yields surged in response to the Fed’s announcement that it would taper its quantitative easing program.

Chart source: Bloomberg, as of 15 January 2025.

Chart source: Bloomberg, as of 15 January 2025.

Used with permission from Bloomberg Finance L.P. This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past performance is no guarantee of future results.

We believe credit fundamentals across the state and local market are largely supportive given the strength in the US economy, but we see some pockets of elevated risk. The risk of natural disasters is always present and ongoing, with the devastating wildfires in California unfortunately the latest disaster to strike. We expect the state and federal government to backstop disaster relief and recovery efforts in California, along with insurers, but the scale of the destruction of human lives and homes is staggering and still evolving. The task of rebuilding neighborhoods and communities is immense and will likely take years.

Looking ahead, we anticipate positive total returns for the municipal market in 2025, given the current higher base level of rates and prospects for carry. While painful in the short term, we believe higher yields present an improved return profile going forward and a potential increased level of downside protection if rates continue to move higher.

2. The municipal market experienced record issuance in 2024. Do you anticipate strong issuance again in 2025?

Yes, we expect the higher pace of issuance to continue this year with steady demand from upper-tax-bracket individuals who typically benefit from the strong after-tax yield pickups that municipal bonds offer relative to Treasurys, corporates and other taxable alternatives. The strength of individual demand has been a driving factor in the municipal market. The market has traded as if ‘under-supplied’ for much of the past several years and when issuance surged nearly 40% in 2024, investors took it completely in stride. We believe strong demand from individuals will continue to buoy the market in the current environment.

3. Do you expect the new US administration to have an impact on the municipal market?

It is difficult to assess how campaign rhetoric will translate to policy reality; however, we expect Congress to focus on tax policy in 2025. For individuals, the new administration has stated plans to extend the current individual provisions of the Tax Cuts and Jobs Act set to sunset in 2025, not to reduce rates further. We anticipate other proposals regarding state and local tax deductions and alternative minimum tax treatment, but we think individuals will still seek out the municipal market as a meaningful source of after-tax return potential. With a unified government in place, Congress is likely to use budget reconciliation to attempt a budget package that can pass in the Senate with a simple majority. Currently there is little information about what provisions a budget package would contain, but market participants seem to agree that municipal bonds’ broad tax exemption is unlikely to be targeted to create revenue, particularly given the very slim majority in Congress. The significant uncertainty about future fiscal and economic uncertainty, including the potential for tariffs to become a major policy driver, has led to an expanded risk premium in the markets, in our view.

WRITTEN BY:

Jim Grabovac, CFA, Municipal Bond Strategist

SAIFeiqaisng