Losing interest in bank loans now that rates have begun to fall? It’s a common gut reaction for those who have a narrow view of loans as a tactical play on interest rates. However, loans have other virtues worth considering in the current environment. Here are two factors that might have you rethinking your instinct to swipe left.

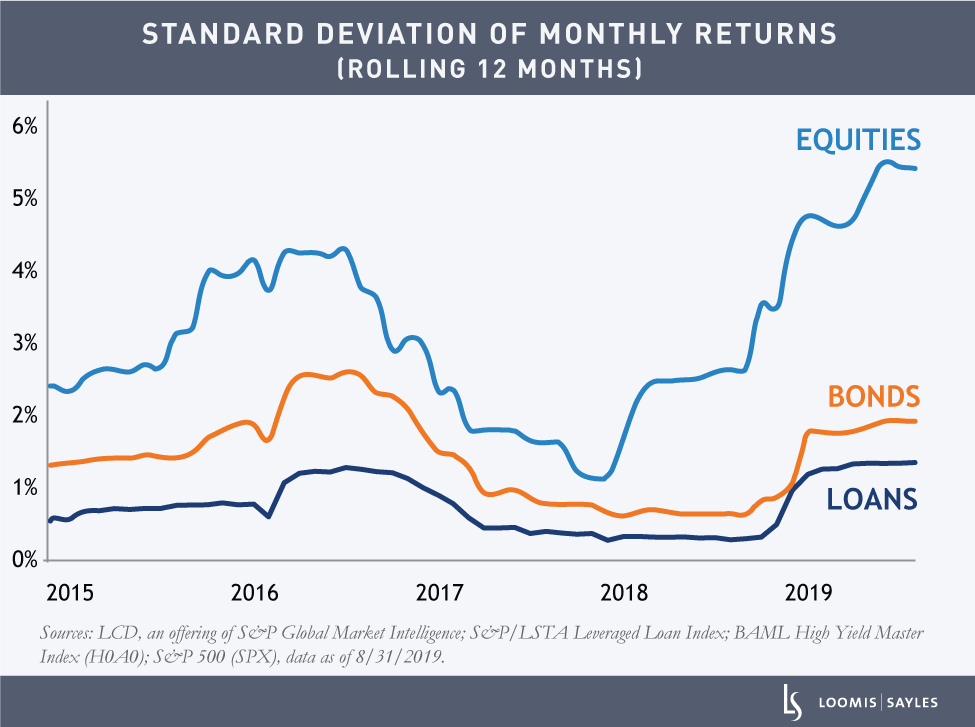

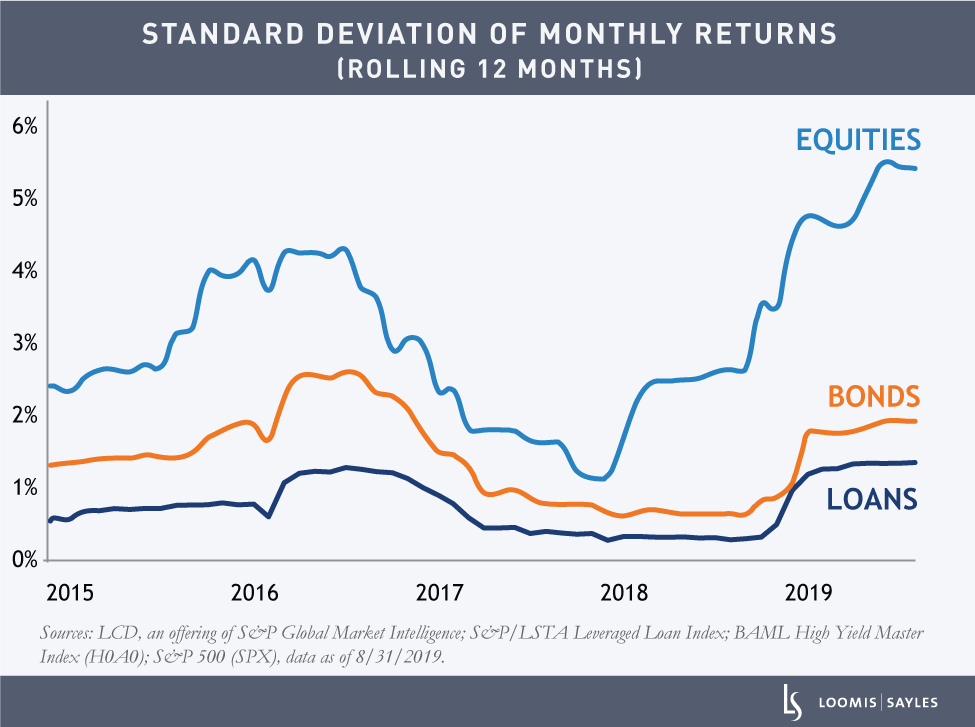

1. Reduced volatility

Volatility exists for a variety of reasons, but a common one is the fear of loss. Many investors are getting nervous about recession risks as the credit cycle ages, and the fear of loss appears to be rising. This fear comes from the idea that a company is worth less than it used to be, perhaps due to poor prospective earnings or because markets have priced in too much irrational exuberance.

Here’s where bank loans could help. Due to their seniority and security, bank loans tend to reduce volatility in a portfolio as their prices can be relatively stable compared to other securities. The goal with bank loans is to be paid back at a reasonable interest rate. Yes, this means loans generally offer less upside than equities and high yield bonds. But the value of seniority and security is worth considering later in the credit cycle, when rates may not rise or may even fall to some extent.

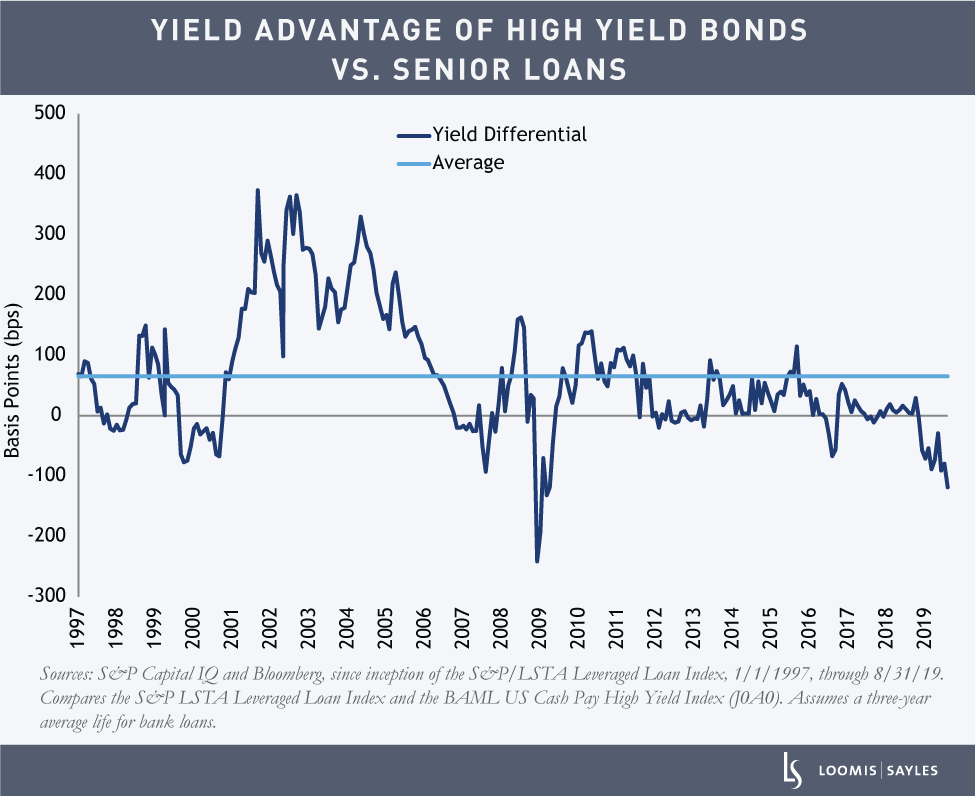

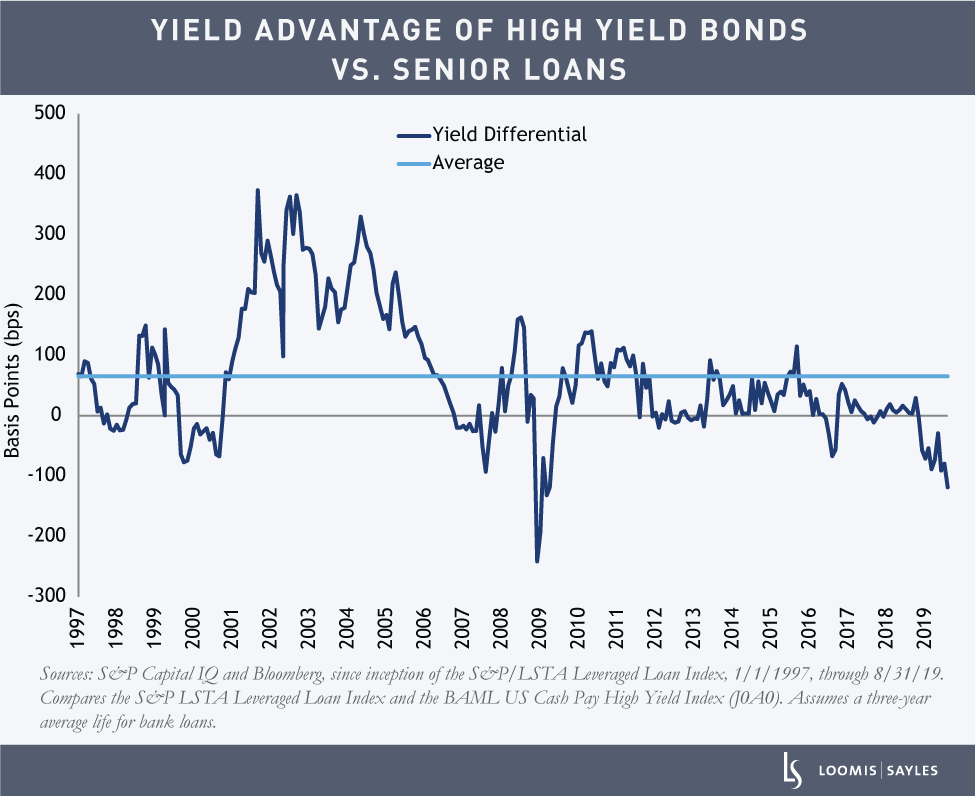

2. Attractive yield potential

Right now, loans also offer a yield advantage over high yield bonds. Historically, the reverse has generally been true, because high yield bonds carry additional risk relative to bank loans. However, as the chart below illustrates, bank loans have offered higher yields than high yield bonds since November 2018. For investors seeking income, we believe bank loans can offer attractive yield potential, especially in the current environment.

Don’t underestimate the value of loans

Asset allocation is difficult, especially as business and credit cycles age. History suggests that someday there may be a major, sustained flight to quality that will likely favor cash and Treasurys over riskier assets. But remember, this stage of the credit cycle can last for years, and many investors need to earn return in the meantime. Don’t swipe left and dismiss loans—we believe they merit a place in many portfolios as a yield producer and a volatility reducer.

MALR024198