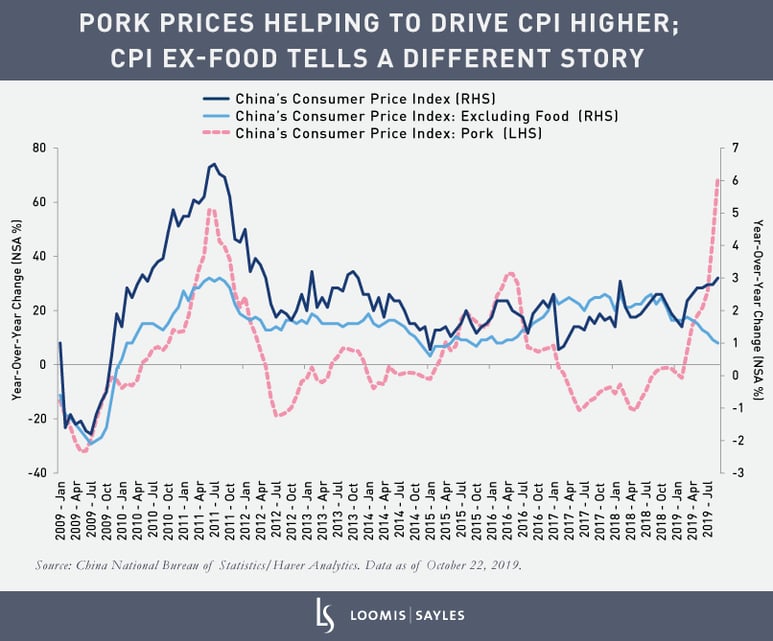

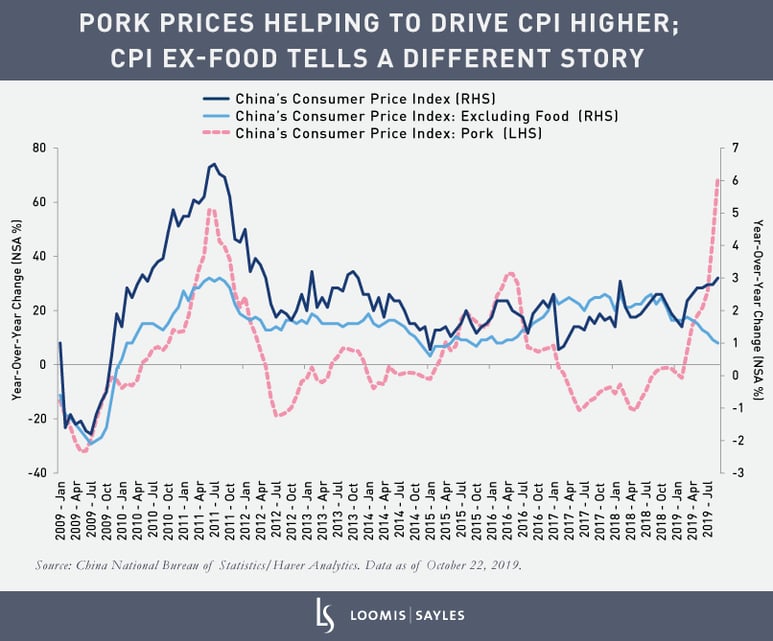

In China, pork prices are up 70% (!) year over year. A swine fever outbreak has crippled the pork industry and caused a surge in pork prices. Pork prices are a main driver of China’s Consumer Price Index (CPI) increase. CPI inflation could reach 4% by year-end, one percentage point above the People’s Bank of China’s 3% target. However, stripping out food prices shows that inflation is on the downtrend (and was just 1%), which appears more in line with the weak state of China’s economy.

China’s policymakers appear reluctant to ease monetary policy meaningfully in spite of lackluster growth — nominal growth slowed to 7.5% year over year in the third quarter of this year, from above 9.0% at the end of the fourth quarter of 2018. Another key price indicator, the Producer Price Index (PPI), is indicating deflation. PPI deflation has negative implications for nominal growth, profits and debt service.

Yet, the PBOC appears focused on CPI inflation, even with the distortion from pork prices. The focus on CPI could be an excuse to argue against easier monetary policy. I see two reasons behind this approach:

- Financial stability concerns. Financial stability is important to Chinese authorities. There are worries that easy monetary policy could exacerbate an already weak renminbi and disrupt financial stability.

- Saving ammunition. If China does not reach a trade deal with the United States, the economy could get worse. Easing now would leave policymakers with less room to ease in a worst-case scenario.

I think more easing of monetary policy is required in China. To the extent the first reason is true, the recent strengthening of the renminbi, if sustained, could give authorities the space they need to ease monetary policy further.

MALR024462

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.