US consumers are feeling friskier according to recent data.

While the three surveys below differ on the degree to which consumers have become more optimistic, they agree that consumers have developed relatively upbeat attitudes. Consumers appear to have, at long last, shaken off the “blues” they suffered on account of the severe recession of 2007-2009 and the subsequent slow recovery.

I don’t think we can attribute the improved consumer outlook to any one factor, but rather from a combination of factors: over a year of solid payroll growth, improving wage gains, a plunge in gasoline prices, rising stock and house prices, and low interest rates. Moreover, my view is that real consumer spending is likely to continue rising at a comparable pace in the first half 2015.

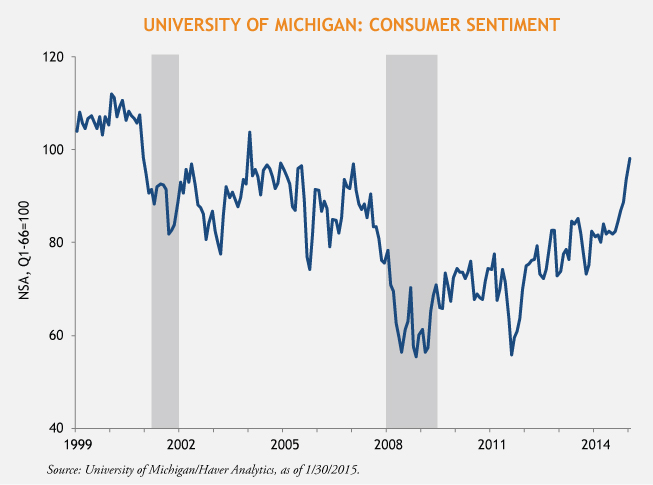

1. Consumer sentiment rises

Index of Consumer Sentiment by the University of Michigan rose 4.8% in January, its sixth consecutive rise (01/30/2015). The level of the index was its highest in 10 years and its second highest since 2000.

Shaded areas in the chart below indicate recessions.

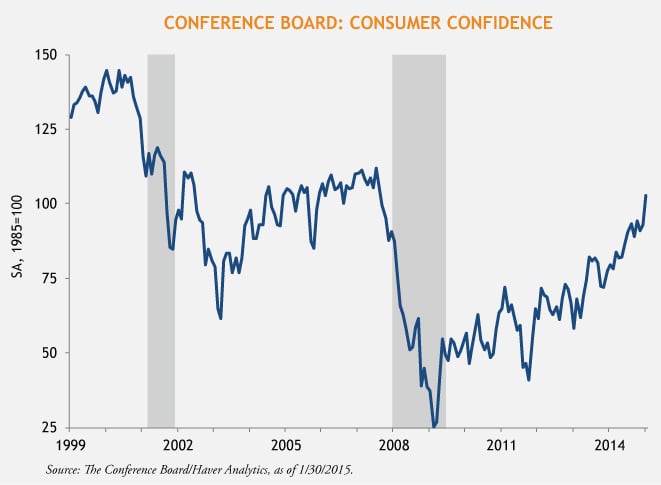

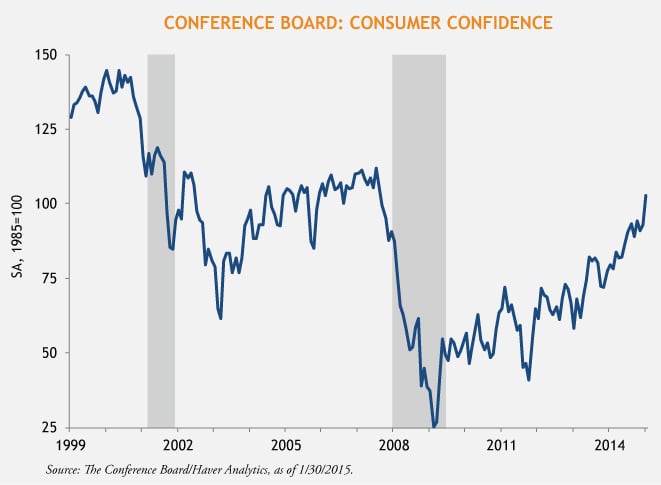

2. Consumer confidence at a seven year high

Second, the Conference Board announced that its Index of Consumer Confidence rose a robust 10.5% in January (01/27/2015). Its level was the highest since August 2007 (at the start of the financial crisis) and is on the high side of the past 12 years.

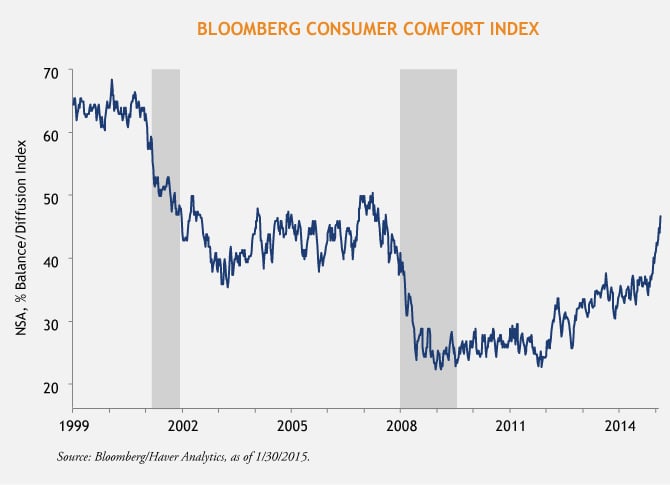

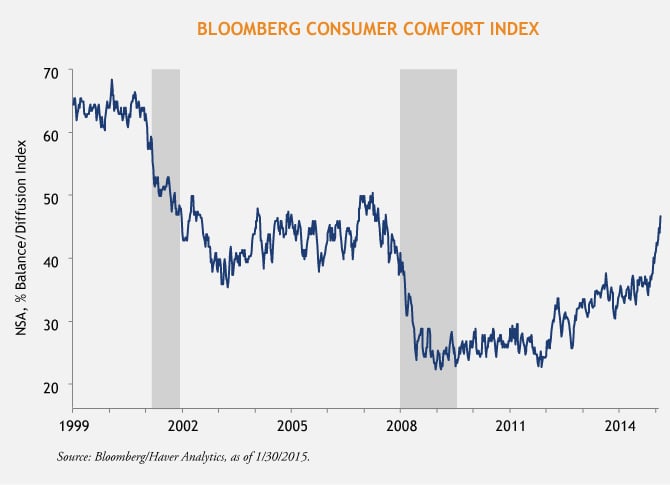

3. Consumer comfort highest since 2007

Third, the weekly Bloomberg Consumer Comfort Index rose by the end of January 2015 to the highest since April 2007, a few months before the financial crisis started. Indeed, this reading was one of the highest in the past 13 years.

MALR012815

Please note that shaded areas in the charts indicate recessions.