Editor’s Note: We’re changing things up. Every year, Loomis Sayles features outlooks from our sector teams—teams composed of traders, analysts, strategists and portfolio managers immersed in their respective sectors of the market. This year, we’re tailoring our outlooks to focus on what’s top-of-mind for many investors. We asked each sector team three questions that drill into key themes in their respective sectors. We will publish views from each sector team over the next few weeks.

To set the stage, we’re starting with Craig Burelle, Senior Macro Strategies Analyst, and his views on the macro backdrop in 2021.

1. What are some key macro themes that could drive asset performance in 2021?

We see three key drivers supporting asset performance in 2021—COVID-19 vaccine distribution, supportive fiscal policy and monetary policy accommodation.

Let’s look at the first driver, COVID-19 vaccine distribution. The likelihood of an effective vaccine and its distribution has had the markets priced for optimism as they anticipate an eventual end to social distancing measures. As long as the vaccine remains effective and distribution stays on track, risk sentiment should be positive. However, any setbacks may cause investors to reassess valuation levels.

We believe the second driver, supportive fiscal policy, is critical for carrying consumers and small businesses through what will likely be a difficult few months. We expect growth to moderate in the first quarter of 2021 as COVID-19 continues to surge, but continued fiscal support should help contain economic weakness and keep investors focused on the longer-term outlook.

Finally, central banks around the world have signaled their intention to keep monetary policy accommodative for a long period of time, likely beyond 2021. Markets appear satisfied with a dovish tilt to monetary policy. However, ultra-low rates and sizable liquidity are likely to keep developed market and investment grade corporate bond yields in a tight range.

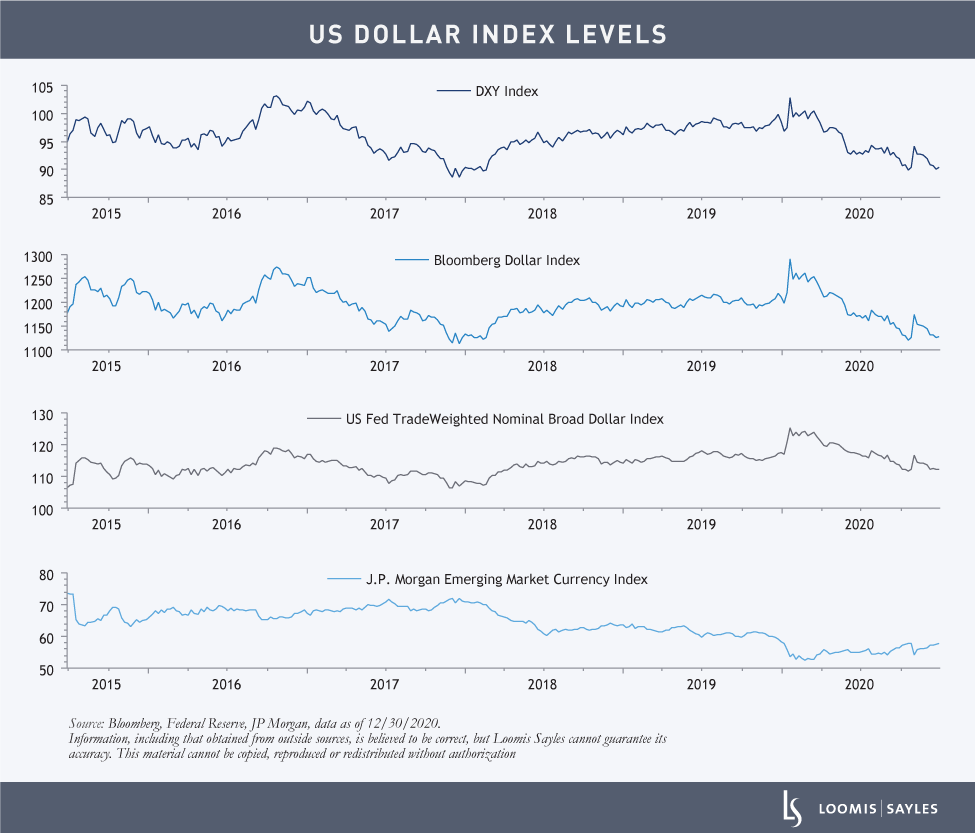

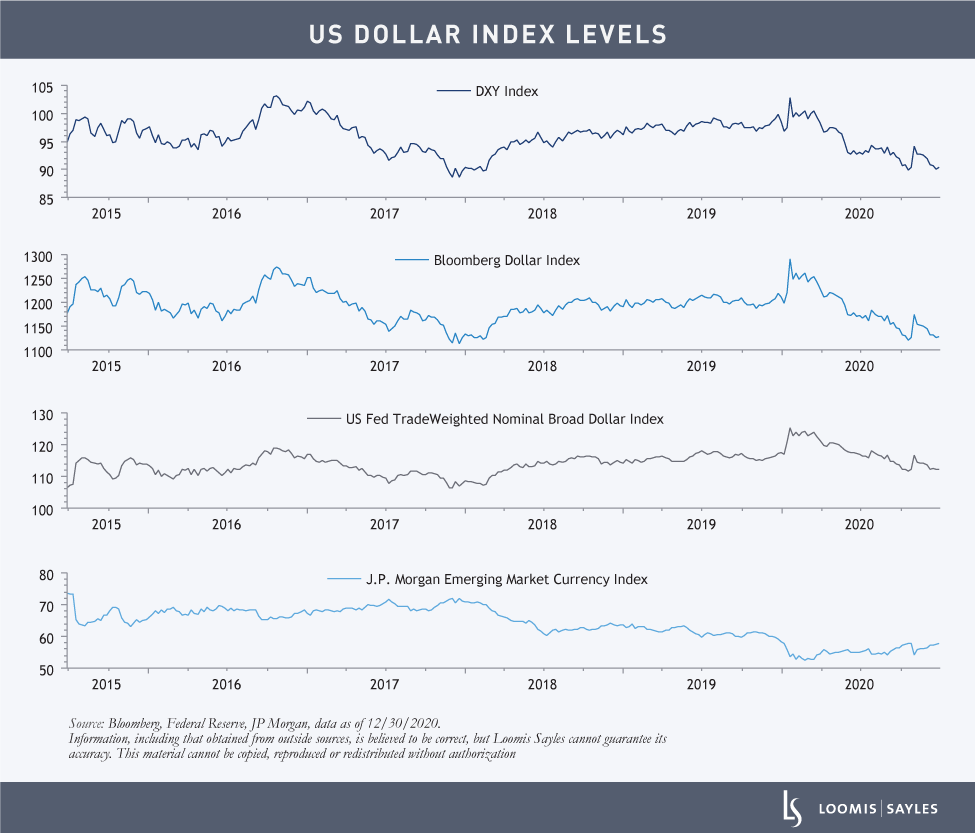

2. The Loomis Sayles Macro Strategies Team believes we’re in the recovery phase of the credit cycle, which is historically consistent with a weakening dollar. Do you see a weaker dollar trend in 2021?

Yes. We expect the dollar to slowly trend weaker as long as risk appetite remains strong and the global recovery continues. However, we’re not calling for a multi-year dollar bear market; we think the weakness will be relatively modest. It’s a space we’re watching closely.

3. Which asset classes are positioned to perform well in this environment?

We believe relatively higher-yielding asset classes could perform well if the credit cycle progresses through the recovery phase, particularly in emerging markets and foreign exchange. US high yield corporate credit could also benefit from improved economic activity. However, for long-term investors, we believe security selection will be important for helping to distinguish quality securities from those that may be riding the tide of positive investor sentiment.

MALR026577

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.