1. About $184 billion of investment grade debt was downgraded to high yield in 2020. How could these downgrades affect the high yield market in 2021?

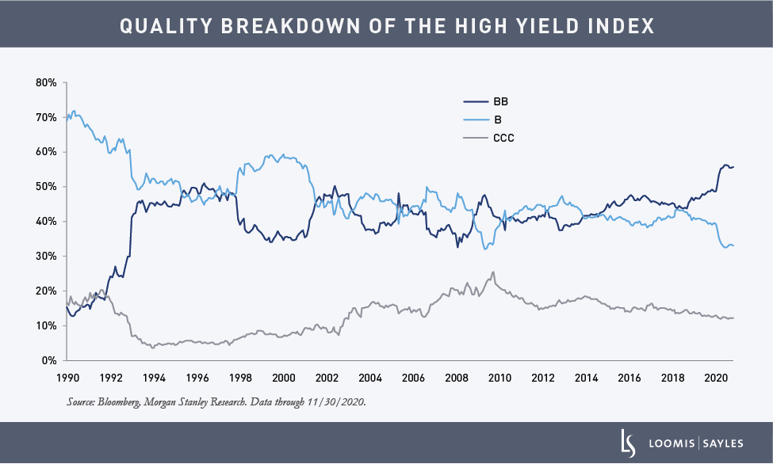

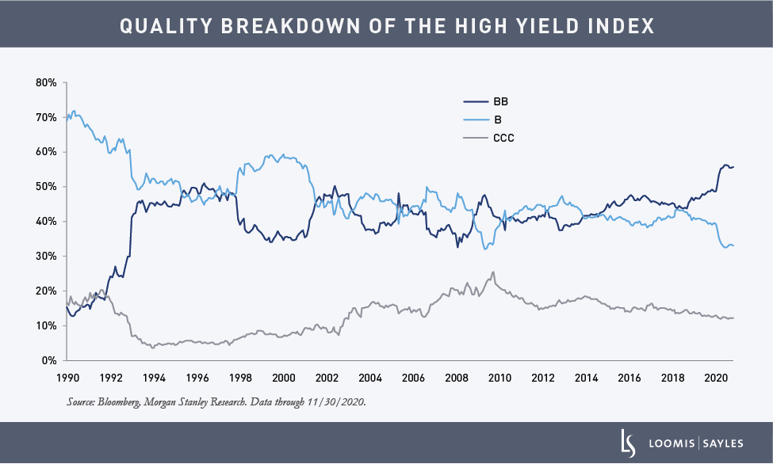

Rating agencies downgraded a number of weaker investment grade credits in the wake of the COVID-19-induced downturn, flooding the high yield market with fallen angels and expanding the share of BB-rated debt. At the same time, CCC issuance continued to contract, a trend that began before the global pandemic. Together, these forces have helped to increase the overall credit quality of the high yield market. We believe the higher average quality of the market could help drive high yield spreads toward historic lows on the back of unprecedented amounts of global quantitative easing.

2. What are your default estimates for 2021? How do these expectations shape your outlook for spread levels?

Generally, Wall Street has projected high yield default rates of 4%-6% over the next 12 months, but current market pricing suggests that number could be even lower. With less than 4% of the high yield index trading below $90 and less than 0.50% of the market trading below $60, the market seems to be betting on default rates being very low.[i] Further, the strength of the new issue market suggests market participants may be willing to refinance almost any capital structure, which we believe is a sign that the Federal Reserve has done its job to help ensure capital is freely flowing.

Given the recent positive news on multiple COVID-19 vaccine approvals and releases, we tend to agree with the market view on default and loss rates. We believe our expectations for low losses due to defaults could provide ample space for spreads to compress further.

3. Where do you see value in the high yield market?

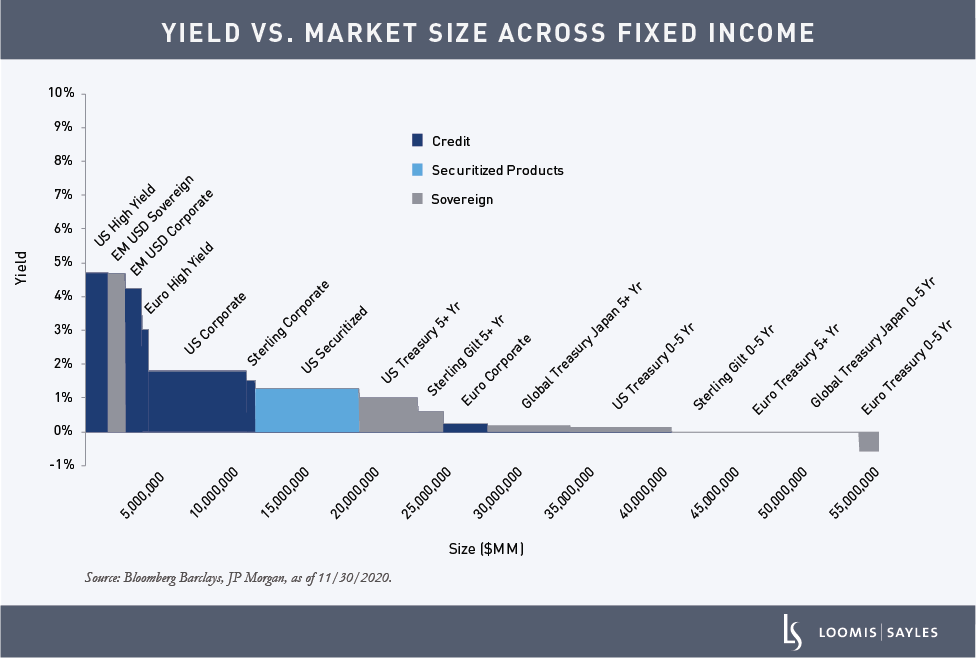

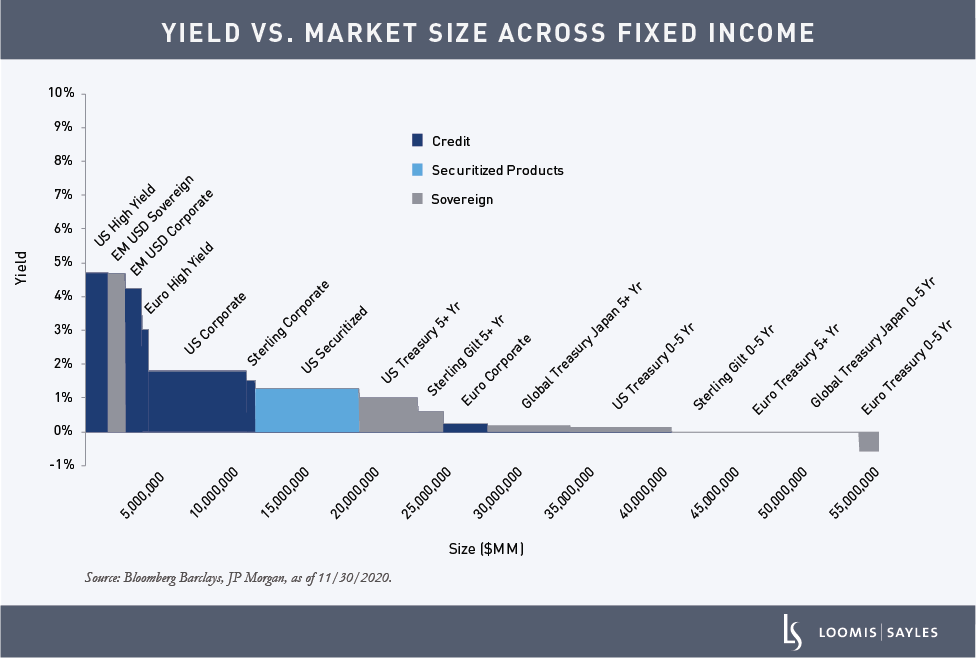

Overall, we believe the US high yield market can offer strong yield potential relative to the global marketplace. Within the high yield market, we believe there are pockets of value in industries that were hit particularly hard by COVID-19, including airlines, leisure, commodities and aerospace/defense. These credits have generally outperformed recently on vaccination optimism, but we see opportunity for additional tightening.

[i] Bloomberg Barclays, as of 12/29/2020.

MALR026558

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodity, interest and derivative trading involves substantial risk of loss.

Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.