1. Outside of Europe and Hong Kong, global equity markets are near all-time or 52-week highs. What is your view on emerging market (EM) equity valuations? Can EM equities continue the strong performance seen in the second half of 2020?

We see several factors that should contribute to strong EM equity markets in 2021:

- Stronger consumer and business confidence due to the COVID-19 vaccine rollout

- Manufacturing sector recovery from a low base

- A rise in global travel and tourism

- A US administration with a less hawkish attitude toward globalization

- Continued strong V-shaped recovery in China

- Accommodative monetary policy from the US Federal Reserve and the European Central Bank (ECB)

If growth in EM economies rebounds as we anticipate, inflation could play the spoilsport. However, we believe economic recovery could help supply chains normalize and aggressive developed market monetary expansion could help EM currencies appreciate, which should contain inflation pressure. Several of these emerging economies also have high real interest rates that should afford their central banks room to maneuver. EM economies have benefited tremendously from the surge in global liquidity unleashed by the Fed and ECB. This increased liquidity was one of the key factors supporting a significant increase in EM hard-currency sovereign debt issuance during 2020. Conversely, declining liquidity and/or a steepening of the US yield curve could certainly pressure the debt dynamics of some EM countries, which could hurt their equity markets.

EM equities currently look expensive on a price-to-earnings basis, trading at almost 15x compared to the 20-year mean of almost 11x.[i] However, when taking into account the prevailing low interest rates, we believe EM valuations look attractive on a forward-earnings-yield-ratio[ii] basis, which is currently at around 8.0, two standard deviations cheaper than its long-term average of 5.0.[iii]

2. Emerging market economies are a diverse bunch. As markets anticipate a global recovery, are there certain economies that you believe are well-positioned?

We believe the Indian economy is well-positioned as we enter the new year. High-frequency indicators such as power demand, manufacturing PMI, passenger vehicle sales and tax collections point to a strong rebound in growth. Indian corporates have largely taken advantage of the environment to restructure, cut costs and raise capital for future growth. The resulting operating and financial leverage could help boost consensus earnings and macroeconomic growth estimates.

Further, the policy response from the government and the Reserve Bank of India (RBI) has bolstered investor confidence. The government passed historic agricultural bills that could make the sector more market-driven, boost productivity and attract investment. Other reform measures include incentives for manufacturing and proposals for privatizing India’s rail system, one of the largest rail networks and employers in the world. Investors have also welcomed proposed labor reforms that could attract American and Japanese supply chains to India. In our view, the RBI has done a commendable job navigating through the storm by cutting benchmark interest rates, infusing domestic liquidity, easing regulations and communicating with the market. All of this, in addition to a good harvest and a recovery in exports, should continue to help investor sentiment.

Going forward, the RBI will have to adroitly manage the “impossible trinity problem”—the trilemma of maintaining an open capital account, setting an exchange rate and having an independent monetary policy. This needs to occur within the context of a tight fiscal situation, as public sector borrowing could exceed 15% of GDP in fiscal year 2021 and the fiscal deficit could hit 7% of GDP—twice the budgeted amount. Furthermore, inflation has been creeping higher due largely to supply bottlenecks and ample liquidity.

3. At the height of the pandemic, the EM equity financial sector was selling off on concerns of liquidity, loan quality, and loan moratoriums. Were those fears unfounded? What is your outlook for the sector in 2021?

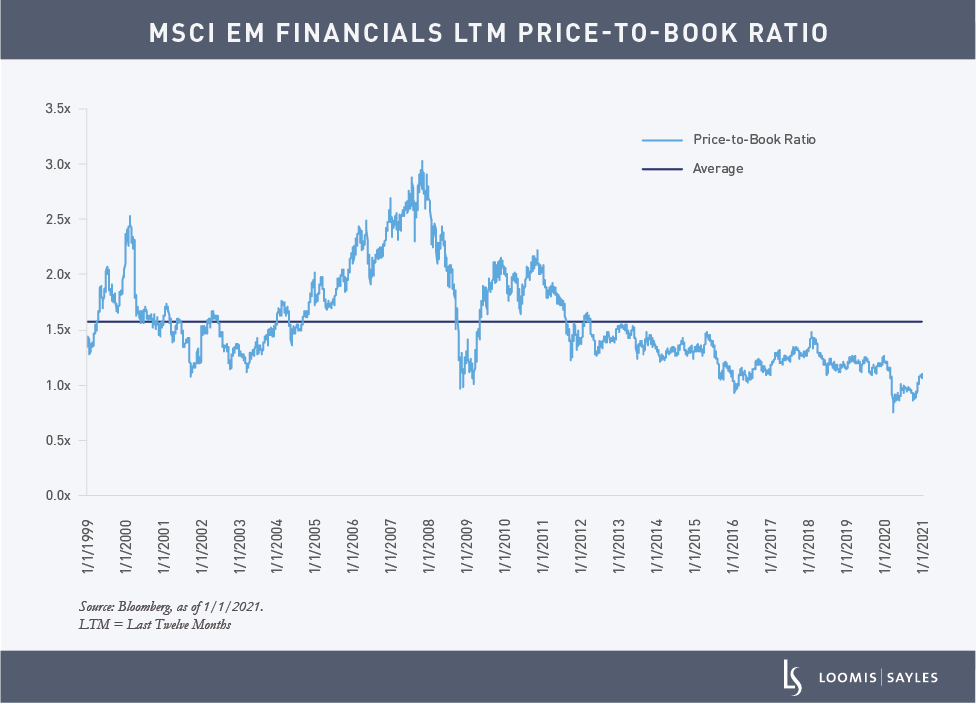

While the selloff in EM financials was understandable given the uncertain economic outlook at the time, we believe the price action in many financial stocks was too severe, reflecting valuations last seen during the global financial crisis. In response to the pandemic, many EM banks and other financial companies provisioned excessively due to concerns about worsening asset quality. They pulled back from lending, hoarded capital to maintain a defensive position, and suspended dividends. EM central banks also resorted to unconventional measures to help protect the financial sector, including loan moratoriums, easing of loan classifications, loan restructurings and relaxing non-performing loan (NPL) recognitions. These measures were in addition to the monetary and fiscal stimulus unleashed by developed and several EM central banks. As a result, the EM financial sector, for the most part, has been able to survive the storm quite well, incongruent with the initially dire view of the equity markets.

We believe a rebound in growth in EM economies should lead to a normalization of provisioning expenses and a recovery in credit growth. EM banks have remained well-capitalized. EM regulators that suspended dividend payments are likely to allow banks to resume those payments soon. The EM financial sector index ended 2020 down more than 8%, significantly underperforming the broader MSCI Emerging Markets Index, which was up more than 18%.[iv] We believe valuations of EM financials remain attractive trading at 1.10x price/book compared to their long-term average of 1.58x price/book.[v]

[i] Bloomberg, as of 1/1/2021.

[ii] Forward earnings yield ratio is defined as the reciprocal of the 12-month forward P/E ratio divided by the US 10-year Treasury yield.

[iii] Bloomberg, as of 1/1/2021.

[iv] Bloomberg, as of 1/1/2021.

[v] Bloomberg, as of 1/1/2021.

MALR026567

Past market experience is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Market conditions are extremely fluid and change frequently.

Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.