1. The securitized credit sector has lagged the recent broad rally in risk assets. How do you expect the sector to perform in 2021?

In general, securitized credit sectors lagged the broader rally in risk assets. Unlike agency MBS and corporate credit, securitized credit sectors did not benefit from direct Federal support during the pandemic. While fundamentals remained favorable, technical pressures weighed on prices.

Consumers and housing—major drivers of underlying risk in securitized credit markets—did hold up well during 2020 given fiscal stimulus and increased housing demand. In our view, this dynamic coupled with relatively lagging spread tightening have left the sectors positioned to potentially outperform in a continued credit rally. In addition, the sectors’ high carry (income) and short duration could provide downside protection amid potential volatility in an uneven economic recovery.

The securitized credit market currently appears bifurcated. On one hand, you have benchmark risk assets that rallied sharply on news of an effective vaccine in the last few months of 2020. Despite the rally, these assets may still offer compelling value in terms of risk (duration) and quality (rating) relative to corporates. In a tight spread environment, this carry (for the rating and risk) can be attractive. On the other hand, pockets of dislocation remain in areas more deeply impacted by pandemic-related shutdowns, such as transportation-related ABS and commercial real estate (CMBS). Investors able to navigate the complexities of these markets can potentially realize significant upside as the economy reopens and recovers. We believe that pricing pressure in these securities is largely contained, especially if we continue to see sustained improvement in the medical treatment of COVID-19 and the impact of increasing vaccination, which should allow for a return to travel (business and leisure) and other commercial activity.

We acknowledge, however, that there are near-term risks that could give rise to bouts of volatility. Specifically, as COVID-19 cases continue to rise at an alarming pace throughout the country we could see (and in fact have seen in some areas) additional lockdowns, some of which could be protracted. In such instances, additional stimulus beyond what has been extended thus far may be needed to help support consumers and other sectors. Nevertheless, we believe the overall scarcity of risk assets in the securitized credit sectors, favorable carry and attractive valuations relative to other sectors may dampen the impact of any near-term volatility.

2. What are your expectations for the US housing market and implications for mortgage credit sectors?

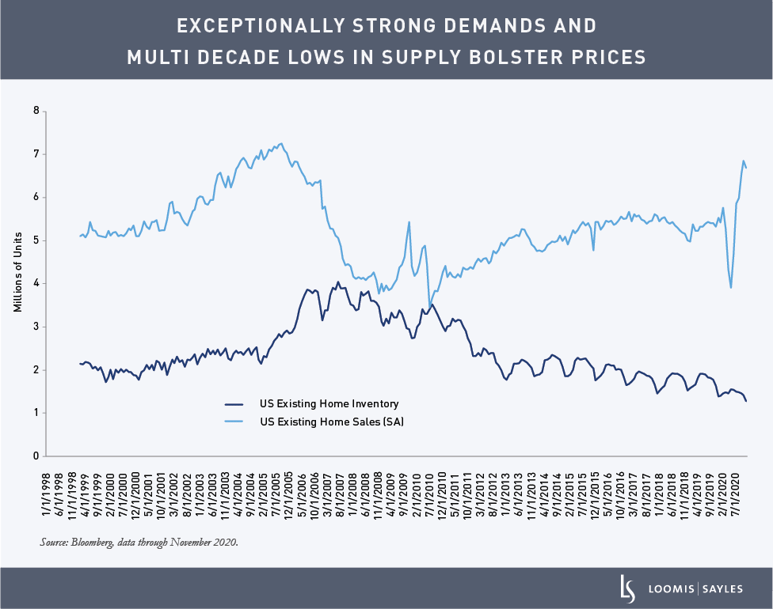

We remain positive about the long-term trends in US housing and US housing credit given insufficient housing supply and positive demographic demand. The implications of COVID-19 amplified supply and demand dynamics throughout the past year and contributed to exceptionally strong performance for US housing-related credit. However, while we believe the housing market is in a strong position as we begin 2021, reduced wage growth, high unemployment and strong 2020 performance have tempered our optimism somewhat. We do not envision a large drop in home prices, but the current pace of appreciation is likely unsustainable. We estimate a return to appreciation in the low single digits (3% to 5%) nationally.

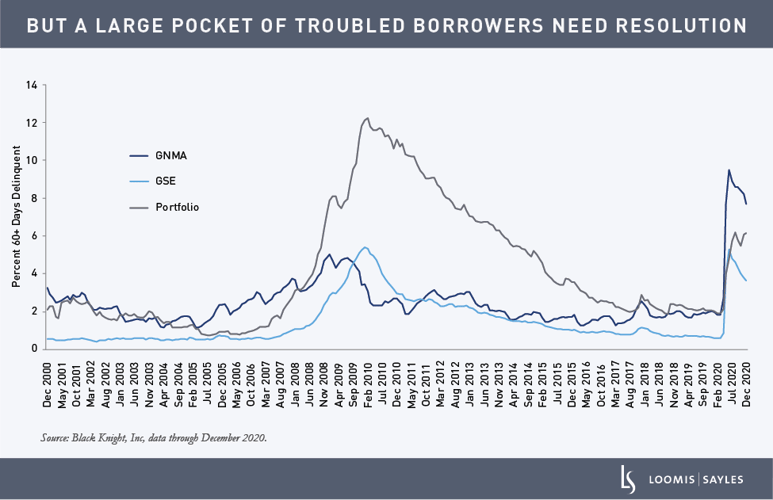

It appears the financing markets have begun to heal, and a positive outcome of the forced deleveraging that occurred in March 2020 has been a more intelligent approach to leverage from lenders and borrowers. This has reduced the near-term probability of another liquidity shock and contributes to our positive outlook for asset performance in 2021. In addition, significant changes to the regulatory landscape may provide a catalyst for growth and outperformance. We expect the single-family rental, non-performing and re-performing loan sectors to continue to exhibit strong fundamental performance on continued high housing demand, and anticipate strong asset performance as a result. The non-qualified mortgage (Non-QM) market is still regaining its footing and the GSEs (government-sponsored enterprises) have remained disciplined in their extension of credit. Overall, housing credit is on a sounder footing following the March 2020 deleveraging, but there is a large cohort of non-performing borrowers and loans that will need to be resolved in 2021.

3. What are the implications of additional fiscal stimulus for the consumer ABS sector? What’s your view of the sector going forward?

With fiscal stimulus as a backstop, consumer ABS fundamentals remained stable throughout 2020 despite high unemployment. However, our 2021 outlook for fundamentals has shifted from neutral to negative. We believe that after expected stimulus in the first half, collateral performance will decline and return to historical patterns.

Given the better-than-expected collateral performance in 2020, spreads have continued to tighten on strong demand in the new issue and secondary markets. Despite the tightening, however, consumer ABS has still lagged the moves in financials. We believe the short duration of consumer ABS, as well as their favorable carry and lower volatility, make it an attractive alternative to short corporates.

Our stress testing indicates consumer ABS structures, aided by strong credit support, should avoid realizing losses even without additional stimulus and an elevated unemployment rate.

MALR026695

Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted. Data and analysis does not represent the actual or expected future performance of any investment strategy, account or individual positions. Accuracy of data is not guaranteed but represents our best judgment and can be derived from a variety of sources.

Past market experience is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Market conditions are extremely fluid and change frequently.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.