We spoke with 12 Loomis Sayles investment experts about the most pressing issues and provocative investment themes for the remainder of 2016. What are they watching? Read on for their insights:

Brexit's impact on Central & Eastern Europe

“Brexit uncertainty is expected to hit EU confidence and growth – with spillover into Central and Eastern Europe (CEE). CEE is vulnerable from Brexit on several fronts:

“Brexit uncertainty is expected to hit EU confidence and growth – with spillover into Central and Eastern Europe (CEE). CEE is vulnerable from Brexit on several fronts:

— Darcie Sunnerberg, senior sovereign analyst |

Stocks choppy with elections on tap

“We expect stock performance to be driven by news headlines during what is likely to be a choppy summer with incremental uncertainty due to Brexit and US elections on tap. I expect new highs in the S&P 500 later this year or the first half of 2017. If we are correct in our assessment that earnings are bottoming, the lows of earlier this year may mark the low point for 2016.”

“We expect stock performance to be driven by news headlines during what is likely to be a choppy summer with incremental uncertainty due to Brexit and US elections on tap. I expect new highs in the S&P 500 later this year or the first half of 2017. If we are correct in our assessment that earnings are bottoming, the lows of earlier this year may mark the low point for 2016.”

— Richard Skaggs, senior equity strategist

Global banks currently offering select opportunities

“The banking sector has underperformed the broader market year-to-date based on four main concerns:

“The banking sector has underperformed the broader market year-to-date based on four main concerns:

|

Despite this, I believe the banking space presently offers attractive relative value over the medium term. Delevered balance sheets, thanks to stricter regulations, tighter underwriting standards and cost reductions have greatly enhanced the capital ratios of the banks. Stronger balance sheets, an emphasis on less risky, fee-based activities (such as wealth management), along with significantly more attractive valuations primarily owing to the disruption caused by Brexit, all indicate that this may be a good time to look at some select opportunities in global banks.”

— Scott Service, portfolio manager

Electric vehicles: ready to take off?

“Although the automotive industry continues to heavily invest in electric vehicles and is introducing new models every year, they are not likely to comprise a meaningful part of the US auto market until well into the next decade. Over the next few years, demand will likely be dampened by high prices (relative to traditional gas-powered engine), low gas prices, a limited number of public and private charging stations - as well as consumers' concerns over the cars’ range capabilities. That said, I believe electric cars sales will accelerate once their prices moderate, the technology improves and a more extensive re-charging infrastructure is readily available.”

— Steve Bocamazo, associate director of credit research

Emerging market consumers drive demand

"As we wait for signs of stabilization in global commodities and manufacturing, we continue to search for good opportunities in the emerging markets consumer space. Robust growth over the last 20 years helped consumers move up the value chain, driving demand for staples and durables, and even changing food preferences and leisure activities. I’ve seen compelling investment ideas in the traditional consumer space including sectors like food & beverage, and brick and mortar retailing, particularly in Mexico where employment trends and consumer sentiment are positive. I’m also excited about the rise of e-commerce across most emerging countries. Mobile penetration is providing a place for consumers to access the online market place (retail, travel, even real estate) while also bringing services to "un-banked" populations (international money transfers, payments, savings products).”

— Elisabeth Colleran, portfolio manager

Global GDP and the great sucking sound

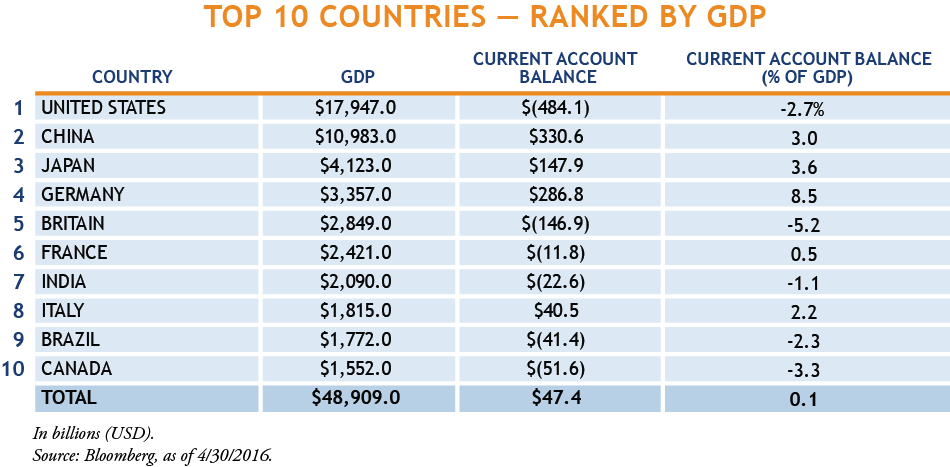

“If the chart below had audio, we’d hear a great sucking sound around China (2nd), Japan (3rd) and Germany (4th) as they suck demand from the global economy by running large current account surpluses. Those surpluses are a reflection of how much these countries have saved. Those savings must be borrowed and spent by another large economy in order to keep global aggregate demand steady. With such low, even negative interest rates around the world, finding someone to borrow and spend those surplus savings is becoming harder and harder. In order to drive global growth, we’d sure like to see more contribution in terms of import demand from the world’s top economies.”

“If the chart below had audio, we’d hear a great sucking sound around China (2nd), Japan (3rd) and Germany (4th) as they suck demand from the global economy by running large current account surpluses. Those surpluses are a reflection of how much these countries have saved. Those savings must be borrowed and spent by another large economy in order to keep global aggregate demand steady. With such low, even negative interest rates around the world, finding someone to borrow and spend those surplus savings is becoming harder and harder. In order to drive global growth, we’d sure like to see more contribution in terms of import demand from the world’s top economies.”

— Tom Fahey, senior global macro strategist

E-Commerce is here

“Brick and mortar retailers have had a tough time competing with online offerings. And the blame cannot be laid at the feet of the economy or the "weather" -- this is a consumer-led shift and in my view it’s permanent. Consumers have spoken and they want attractive pricing, robust offerings, ease of purchase (pictures, accurate description of item, saved profiles, reviews), ability to shop during their commute and downtime, as well as fast and free shipping – all of which are increasingly being met via online shopping. We expect the trend to accelerate.”

— Rob Forker, senior global specialist

The future belongs to renewable energy

“A number of major European utilities recently unveiled their strategic plans for the next 3-4 years, confirming that the future belongs to renewable energy. Our research shows that most companies will be allocating the bulk of their capital expenditure budgets for power generation to renewable projects, primarily wind. Moreover, larger and smarter grid infrastructure will be required to support renewable energy development. The International Energy Agency expects renewables to account for 80% of the electricity sector's global investments over the next 25 years.”

— Spyros Katsaros, senior credit research analyst

The life insurance dilemma

“How are life insurance companies going to meet the guarantees on their life and income products in the face of perpetually low interest rates and the resulting pressure on investment income? Over the past few years, alternative and hedge fund investments have provided some welcome relief and have been a boost to overall investment income. Given a recent reversal of performance, several life insurer management teams have announced plans to dramatically reduce their allocations to alternatives. Most are looking to reallocate back into more traditional investments for life insurers (corporate bonds or commercial real estate loans) although lower yields on these traditionally lower risk assets could squeeze life insurance margins even further. This may prompt them to hunt for other riskier assets or sacrifice credit quality as the outlook for higher rates continues to get pushed out further given volatility in the macro outlook.”

“How are life insurance companies going to meet the guarantees on their life and income products in the face of perpetually low interest rates and the resulting pressure on investment income? Over the past few years, alternative and hedge fund investments have provided some welcome relief and have been a boost to overall investment income. Given a recent reversal of performance, several life insurer management teams have announced plans to dramatically reduce their allocations to alternatives. Most are looking to reallocate back into more traditional investments for life insurers (corporate bonds or commercial real estate loans) although lower yields on these traditionally lower risk assets could squeeze life insurance margins even further. This may prompt them to hunt for other riskier assets or sacrifice credit quality as the outlook for higher rates continues to get pushed out further given volatility in the macro outlook.”

— David Lapierre, senior credit research analyst

Agency MBS: May perform in line with US Treasurys

“Our outlook has changed from the beginning of the year: the current spread does compensate for the callability of agency MBS. Even though agency MBS spreads are at historically tight levels, we observe a remarkably low level of spread volatility given the Federal Reserve's continued re-investment of MBS paydowns in agency MBS. Post Brexit, we see the Federal Reserve maintaining an accommodating agency MBS stance through 2017. A combination of both burnout and capacity constraints have kept prepayments in check despite the significant proportion of borrowers with both ability and incentive to refinance. Our view is that agency MBS performs in line with US Treasurys for the remainder of this year.”

“Our outlook has changed from the beginning of the year: the current spread does compensate for the callability of agency MBS. Even though agency MBS spreads are at historically tight levels, we observe a remarkably low level of spread volatility given the Federal Reserve's continued re-investment of MBS paydowns in agency MBS. Post Brexit, we see the Federal Reserve maintaining an accommodating agency MBS stance through 2017. A combination of both burnout and capacity constraints have kept prepayments in check despite the significant proportion of borrowers with both ability and incentive to refinance. Our view is that agency MBS performs in line with US Treasurys for the remainder of this year.”

— Barath Sankaran, senior securitized asset analyst

Oil & gas loans: US bank losses remain manageable

"The pace of deterioration in oil and gas loans accelerated during the first quarter just as regulators were completing a review of their status. However, losses appear manageable given the relatively low exposure the banks have to the oil/gas sector. We are watching closely for the possibility of contagion to retail loans in oil-dependent regions like Texas. Fortunately, despite the deterioration in oil and gas loans, overall loan quality remains at very strong levels.”

"The pace of deterioration in oil and gas loans accelerated during the first quarter just as regulators were completing a review of their status. However, losses appear manageable given the relatively low exposure the banks have to the oil/gas sector. We are watching closely for the possibility of contagion to retail loans in oil-dependent regions like Texas. Fortunately, despite the deterioration in oil and gas loans, overall loan quality remains at very strong levels.”

— Elizabeth Schroeder, senior credit research analyst

The weird world of negative rates

"Welcome to the weird world of negative interest rates. They already exist in Japan and most of Europe and they may visit us in the US next time we experience a recession. Recently, the Federal Reserve asked large US banks to prepare for interest rates that are below zero. In the future, you may have to pay interest on your deposit account. In May, the European Central Bank announced that it will phase out €500 bank notes. A Harvard study found that criminals refer to the €500 note as a "Bin Laden," popular for use in money laundering, drug trafficking and financing terrorism. By phasing it out, the ECB is also making it more difficult for law-abiding people to avoid negative interest rates by storing their cash under the mattress. Discontinuing the €500 note may even be the first step towards phasing out physical cash altogether to keep people from hoarding it. These are strange times."

"Welcome to the weird world of negative interest rates. They already exist in Japan and most of Europe and they may visit us in the US next time we experience a recession. Recently, the Federal Reserve asked large US banks to prepare for interest rates that are below zero. In the future, you may have to pay interest on your deposit account. In May, the European Central Bank announced that it will phase out €500 bank notes. A Harvard study found that criminals refer to the €500 note as a "Bin Laden," popular for use in money laundering, drug trafficking and financing terrorism. By phasing it out, the ECB is also making it more difficult for law-abiding people to avoid negative interest rates by storing their cash under the mattress. Discontinuing the €500 note may even be the first step towards phasing out physical cash altogether to keep people from hoarding it. These are strange times."

— Julian Wellesley, senior analyst, global equity

MALR015241

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.