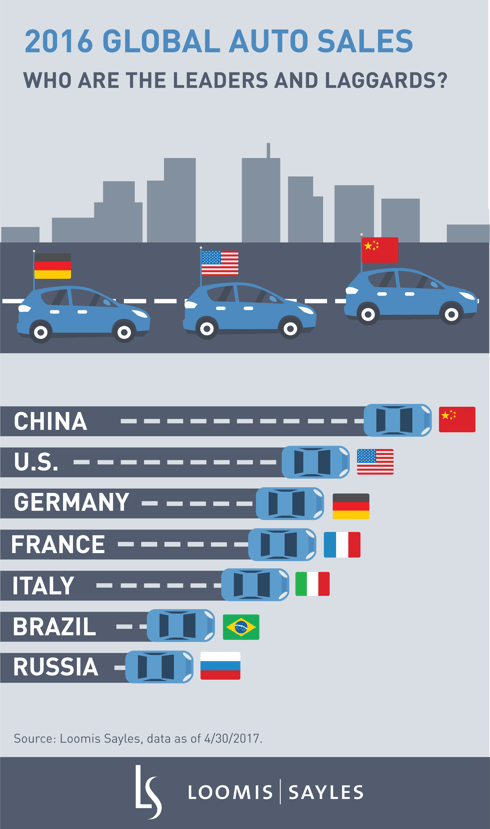

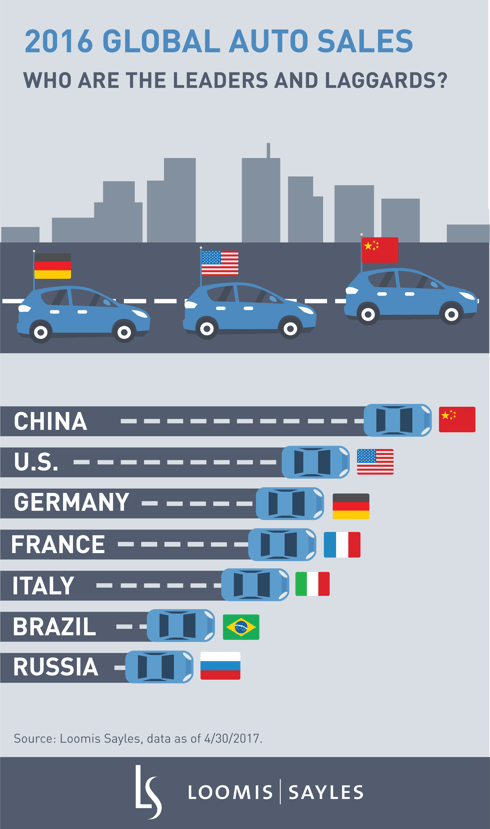

The global auto industry completed a successful year in 2016, driven by solid sales performance in the US, China and Western Europe. However, South America and Russia continued to post weak sales figures due to underlying economic difficulties. While I expect continued growth in global sales in 2017, the underlying fundamentals are weakening in two of the most important markets, the US and China.

A mature market, an affluent customer base and a growing driving population make the US a very desirable market for the auto industry. This was readily apparent from 2010-2016, when auto manufacturers operating in the steadily growing US market generally outperformed peers. US customers have always had a greater affinity for more expensive trucks and sport utility vehicles than their compatriots in other parts of the world. Lower gas prices and easier financing terms in recent years have only accelerated this trend.

That said, I now believe that the US auto market has reached a plateau and that sales are likely to vary by several hundred thousand units (either positive or negative) each year. Aggressive levels of vehicle incentive spending as well as the continued availability of cheap, relatively easy financing may help keep sales elevated over the near and medium term. Rising interest rates, declining used car values and a growing number of off-lease vehicles are likely to present future impediments to volume growth, despite current supportive economic conditions and low gas prices.

That said, I now believe that the US auto market has reached a plateau and that sales are likely to vary by several hundred thousand units (either positive or negative) each year. Aggressive levels of vehicle incentive spending as well as the continued availability of cheap, relatively easy financing may help keep sales elevated over the near and medium term. Rising interest rates, declining used car values and a growing number of off-lease vehicles are likely to present future impediments to volume growth, despite current supportive economic conditions and low gas prices.

The world’s largest auto market, China, continues on an upward growth path, though at a more measured rate than several years ago as unit demand slows in the large Tier 1 cities. Early entrants to China, such as Volkswagen and General Motors, remain market share leaders, but all the largest global original equipment manufacturers (OEMs) now have a presence in this important market. The country’s domestic brands have strengthened their competitive positions, posing a threat to more established automakers and pressuring vehicle pricing.

Entering Era of Massive Technological Change

The global auto industry appears to be on the precipice of its largest technological transformation since its birth more than 100 years ago. Global automakers are making massive investments in the development of electric vehicles (EVs) and autonomous vehicles (AVs). All of the major automakers, as well as the supplier base, are preparing for these innovations. To that end, I have seen automakers acquire companies that possess key technological competencies for these initiatives. Meanwhile, large multi-national firms such as Intel and Samsung, which historically had no major presence in the auto supplier base, have recently acquired or will soon close on acquisitions of previously independent suppliers that are focused on technologies critical for autonomous driving.

While an increasing number of EV models are currently available, their penetration rate among total vehicle sales is quite small, especially in the US, given their higher cost and several years of low gas prices. I expect the EV sales rate to accelerate next decade, especially in China and Europe, given increasingly stringent vehicle tailpipe emission standards. Additionally, the introduction of AVs, most of which are also likely to be EVs, will likely contribute to a global fleet less reliant on the internal combustion engine.

Innovation and Disruption Issues

The rise of vehicle sharing services, such as Uber, may pose future challenges and opportunities for the auto industry. Currently, the rise of ride sharing has negatively impacted demand for traditional taxi and limousine services, but not so much for the automotive industry given continued increases in vehicle sales. Should ride sharing become a ubiquitous service, as expected, it could significantly reduce demand for private vehicles particularly in compact urban areas where the cost of personal vehicle ownership is high. In an effort to be participants in this phenomenon, automakers are entering partnerships with Uber and Lyft on matters such as AV development. General Motors has gone as far as taking an ownership stake in Lyft.

AVs are being tested in controlled areas and on the open road. In addition to testing and refining the technology, some of which is currently available on vehicles (e.g., Advanced Driver Assistance Systems), many hurdles remain involving insurance issues, infrastructure requirements and government regulations. These must be addressed before AVs become commonplace on our local roads and highways. However, there is little doubt that AVs will be on the road over the next three to four years, though I expect the roll out to be slow and deliberate.

MALR017069

That said, I now believe that the US auto market has reached a plateau and that sales are likely to vary by several hundred thousand units (either positive or negative) each year. Aggressive levels of vehicle incentive spending as well as the continued availability of cheap, relatively easy financing may help keep sales elevated over the near and medium term. Rising interest rates, declining used car values and a growing number of off-lease vehicles are likely to present future impediments to volume growth, despite current supportive economic conditions and low gas prices.

That said, I now believe that the US auto market has reached a plateau and that sales are likely to vary by several hundred thousand units (either positive or negative) each year. Aggressive levels of vehicle incentive spending as well as the continued availability of cheap, relatively easy financing may help keep sales elevated over the near and medium term. Rising interest rates, declining used car values and a growing number of off-lease vehicles are likely to present future impediments to volume growth, despite current supportive economic conditions and low gas prices.