Trade tensions are rising. The first week of March saw a flurry of trade headlines as the Trump administration imposed and subsequently delayed some tariffs on Canada and Mexico, and increased tariffs on China. These moves are just the beginning of what we expect will be a volatile journey that could ensnare the United States’ other trading partners, including Europe.

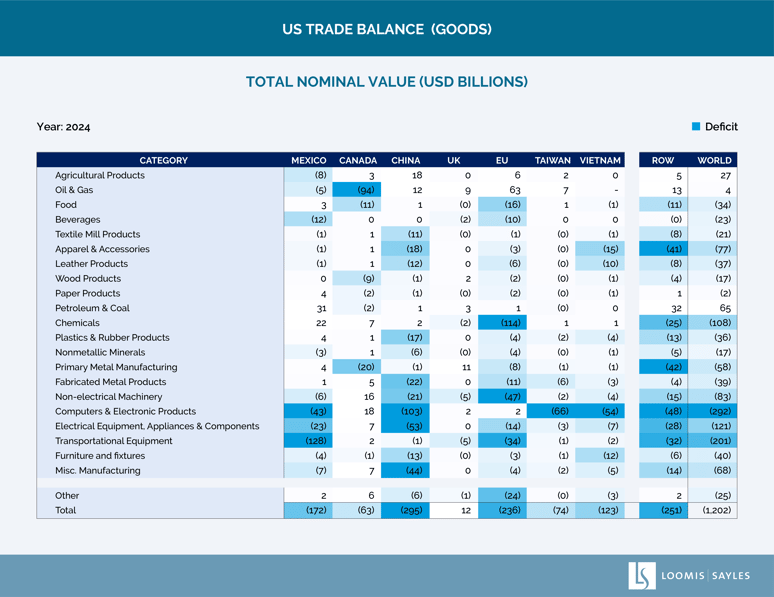

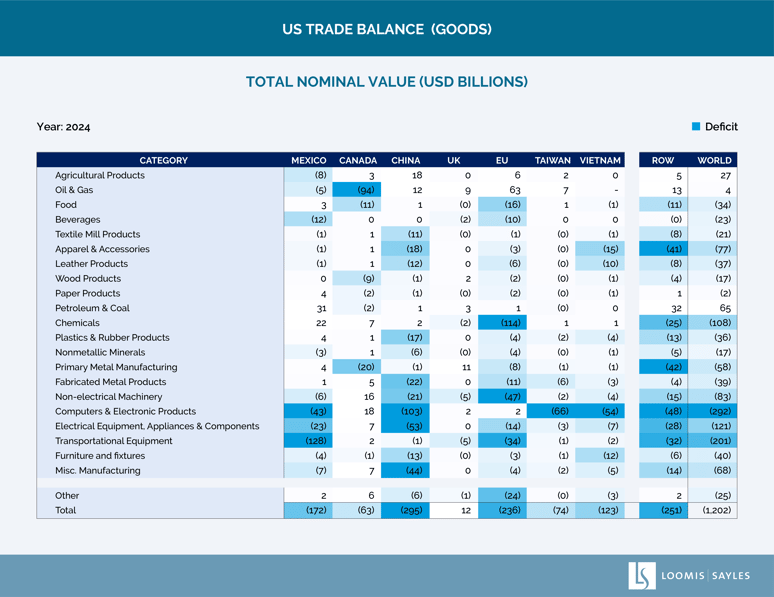

Below, we break down the US trade deficit by sector and country. We think this perspective offers some helpful context as we consider the scope and potential impact of tariffs.

Chart Source: Census Bureau/Haver Analytics. 2024 data as of 5 February 2025. ROW=Rest of World.

Overall: The US runs its largest deficits in computers & electronic products, transportation equipment and electrical products. It runs surpluses in agricultural products, petroleum & coal and oil & gas. The US runs a sizable services surplus with many countries, which could be marked for retaliation in our view. Countries that cannot retaliate much by way of tariffs due to a large trade deficit in goods might use non-tariff barriers, such as restricting certain industries and companies in technology and financial services.

Canada: Oil & gas account for the entire trade deficit. Excluding this sector, the US actually runs a trade surplus with Canada.

China: The largest trade deficit, concentrated in computers & electronic products, electrical products and miscellaneous manufacturing.

Europe: The second-largest trade deficit, driven by chemicals, non-electrical machinery and transportation equipment (including autos). We view Europe as important because it lies at the intersection of trade and security. Key European Union (EU) leaders are weaving US policy actions into their strategic thinking and overhauling fiscal spending in response.

Mexico: The third-largest trade deficit, concentrated in computers & electronic products, electrical products, and transportation equipment.

Key signposts for the road ahead

The tariffs have stoked fears of a trade war that could result in slower growth and higher inflation. We think the extent and severity of a trade war hinges around President Trump’s ultimate goal—is he looking to negotiate deals with our trading partners, or does he want permanent tariffs? Time will tell. Until then, here are the key signposts we’re watching:

- The size and extent of reciprocal tariffs expected on 2 April; we believe Europe will be targeted.

- The magnitude of retaliation by major trading partners, including potential European retaliation on US technology and financial services. Canada, Mexico and the EU are the largest export markets (customers) for the US. We believe retaliation could have a major impact on US growth.

- US dollar moves. In our view, a stronger US dollar would offset some of the tariff impact, while a weaker dollar would worsen the impact.

- Any impact on business investment and hiring.

- Any near-term changes in inflation, as well as long-term inflation expectations.

- Market movements. President Trump has expressed willingness to tolerate some market and economic pain, but it is unclear how far he would be willing to push it if we see significant risk-off market sentiment.

WRITTEN BY:

Tom Fahey, Senior Global Macro Strategist, Co-Director of Macro Strategies

Saurabh Lele, Global Macro Strategist, Commodities

Tyler Silvey, CFA, Global Macro Strategist, Asset Allocation

Trade data sourced from the US Census Bureau/Haver Analytics. The numbers reflect 2024 data as of 5 February 2025. Information is current as of 11:00am ET, 7 March 2025.

SAIFpqa1ddgz