By 2020 it is projected that 70% of the world’s population will own a smartphone - 1.2 billion smartphones were sold worldwide last year alone. Users increasingly rely on their smartphones for conducting a variety of daily activities including banking transactions[i]. As retail banks respond to this shift toward mobile reliance, winners and losers are quickly emerging in the internet and app-based banking space.

Who are the winners?

1. Early adopters

The banks that invested early in internet and smartphone banking are leading the pack today.They are typically the largest and most profitable banks, which could afford to invest in high-quality technology for both their core banking systems and for new products. For example, Bank of America[ii] and Wells Fargo[iii] each have more than 16 million active smartphone banking customers.

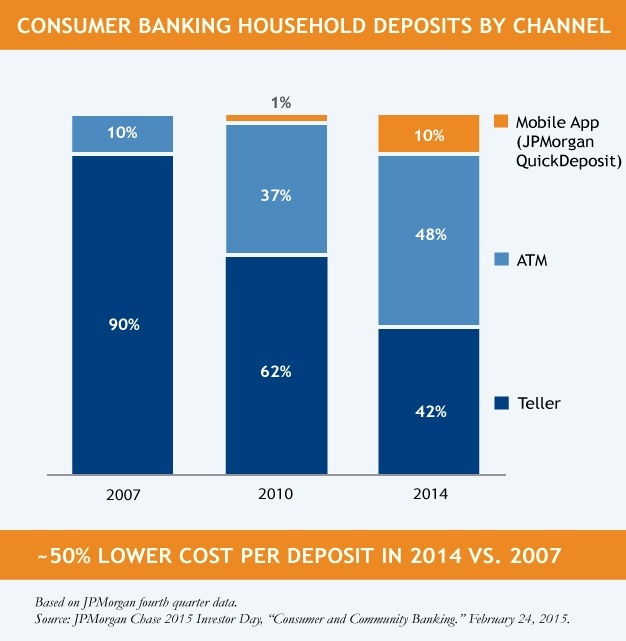

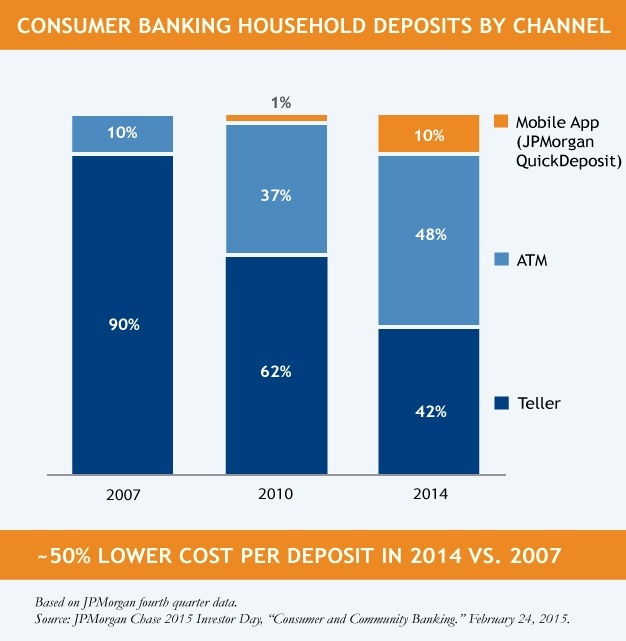

For the forward-thinking banks that embraced this trend early, smartphone account access has surpassed personal computer access. These early adopters are currently benefiting from lower costs, increased customer loyalty and growing market share. Smartphone banking customers are typically young, well-educated and tend to interact with their bank frequently via their mobile device.

2. Scandinavian banks

Scandinavian countries boast some of the highest levels of smartphone penetration in the world, which positions them to also be at the forefront of digital banking.

Scandanavian banks are able to greatly decrease overhead and overall operations as customers make key transactions through the mobile interface. In Norway, DNB Group reports that 42% of their customer traffic comes from mobile banking, while only 1% of transactions are completed in a branch office.[iv]

Mobile customers engage with their bank more frequently. Swedbank customers access the mobile bank 24 times per month on average, compared to 9 times per month for the internet bank.[v] This customer behavior allows banks to shrink their branch networks and make most of their remaining branches cashless.

3. Banks that leverage big data capabilities

We are also seeing signs that some of the largest banks in the world, like BBVA, CBA, Lloyds, and Wells Fargo, are starting to use big data to make customer app-based offers and to provide services that increase customer loyalty.

For example, if a customer makes a car payment using a bank app, it may immediately trigger a text from the bank offering car insurance at the click of a button. Some banks are developing the financial equivalent of the popular fitness apps which track monthly spending and saving patterns to show customers’ “financial fitness.”

4. Smaller banks face challenges

The losers in this category tend to be smaller banks with weaker and under-developed technology systems. The biggest challenge for these laggards is not the look and functionality of an app, which are relatively easy to copy, but the quality of the bank’s core operating system. It’s generally easier to upgrade than replace a bank’s operating system.

As a result, the banks that have been slow to replace their outdated core technology systems over the last decade will likely struggle to find solutions that work well with mobile and internet services.

MALR013771

[i] Pew Research Center, American Trends Panel Survey, October 2014

[ii] Bank of America, “Trends in Consumer Mobility Report”, 2015

[iii] Wells Fargo, “Wells Fargo Reports $5.7 Billion In Net Income,” July 14, 2015.

[iv] DNB Group, Morgan Stanley European Financials Conference, “Digital, Regulation and Macro Challenges,” March 26, 2015.

[v] Swedbank, Bank of America Merrill Lynch Digital Banking Revolution Conference, “Our Digitalization Journey,” May 2015.